Question: Problem 9. A loan is to be repaid with $1,000,$2,000, and $3,000 at the end of the first, second, and third year. Interest is payable

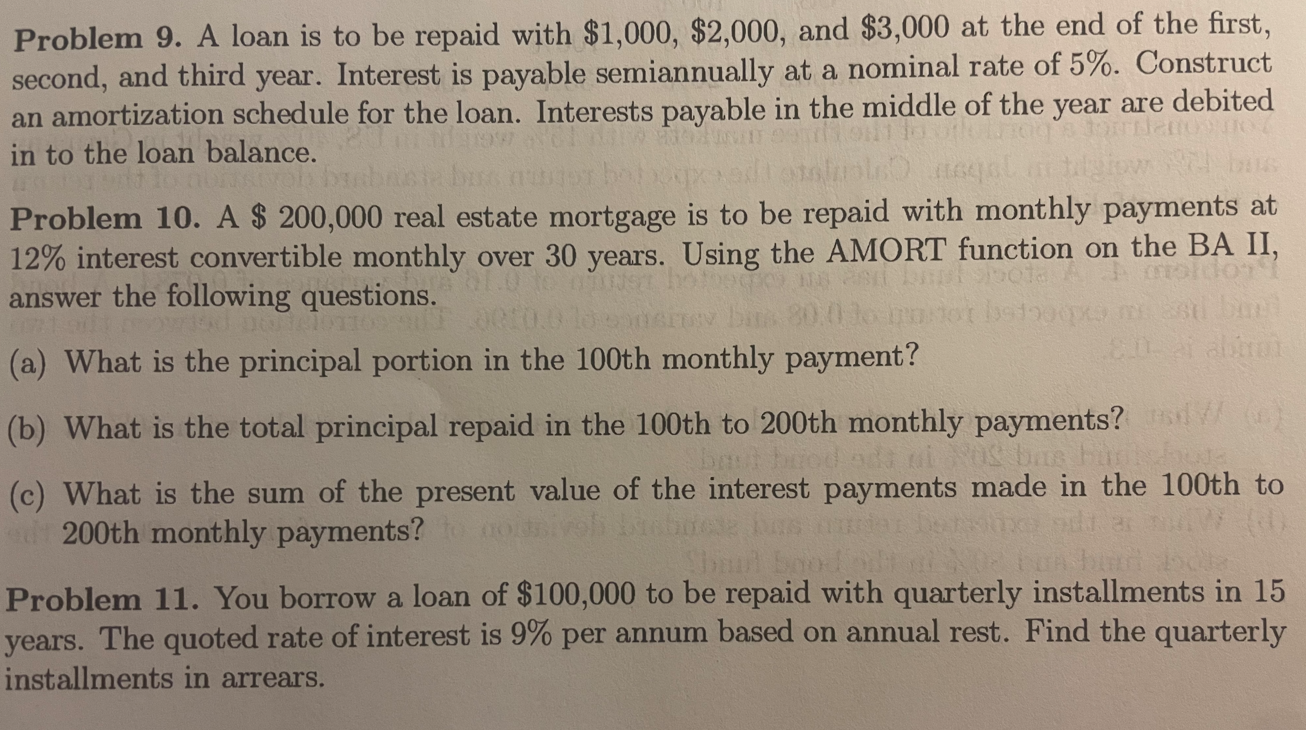

Problem 9. A loan is to be repaid with $1,000,$2,000, and $3,000 at the end of the first, second, and third year. Interest is payable semiannually at a nominal rate of 5%. Construct an amortization schedule for the loan. Interests payable in the middle of the year are debited in to the loan balance. Problem 10. A $200,000 real estate mortgage is to be repaid with monthly payments at 12% interest convertible monthly over 30 years. Using the AMORT function on the BA II, answer the following questions. (a) What is the principal portion in the 100th monthly payment? (b) What is the total principal repaid in the 100th to 200th monthly payments? (c) What is the sum of the present value of the interest payments made in the 100th to 200th monthly payments? Problem 11. You borrow a loan of $100,000 to be repaid with quarterly installments in 15 years. The quoted rate of interest is 9% per annum based on annual rest. Find the quarterly installments in arrears

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts