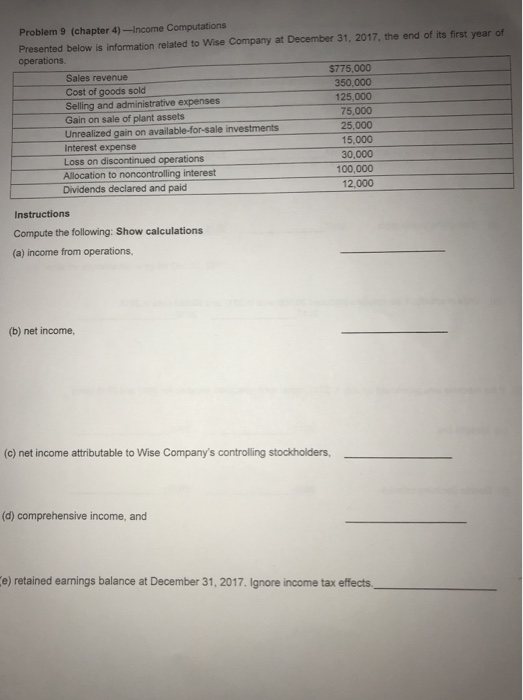

Question: Problem 9 (chapter 4)-Income Computations Presented below is information related to Wise Company at December 31, 2017, the end of its first year of operations

Problem 9 (chapter 4)-Income Computations Presented below is information related to Wise Company at December 31, 2017, the end of its first year of operations $775,000 350,000 125,000 75,000 25,000 15,000 30,000 100,000 12,000 Sales revenue Cost of goods sold Selling and administrative expenses Gain on sale of plant assets Unrealized gain on available-for-sale investments Interest expense Loss on discontinued operations Allocation to noncontrolling interest Dividends declared and paid Instructions Compute the following: Show calculations (a) income from operations, (b) net income, (c) net income attributable to Wise Company's controlling stockholders, (d) comprehensive income, and e) retained earnings balance at December 31, 2017. Ignore income tax effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts