Question: Problem 9. Interest rate risks (20 points) (To do in class on May 5) You manage a pension fund, and your liabilities consist of two

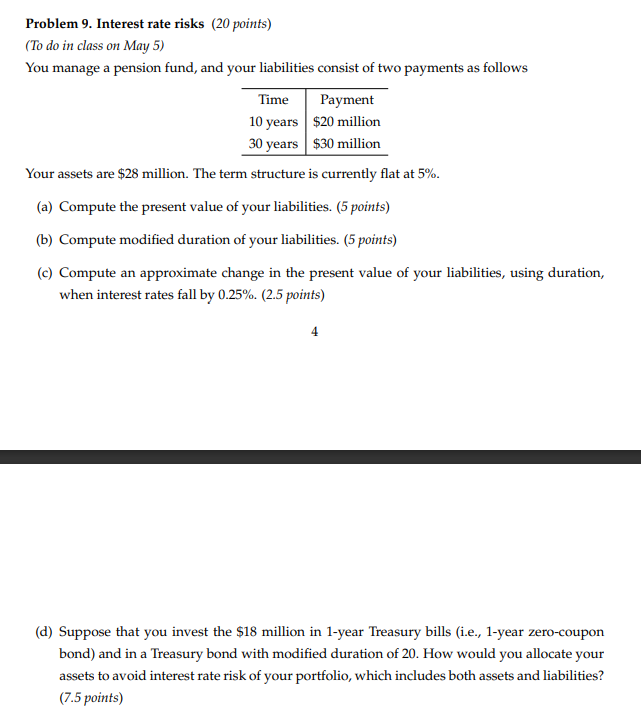

Problem 9. Interest rate risks (20 points) (To do in class on May 5) You manage a pension fund, and your liabilities consist of two payments as follows Time Payment 10 years $20 million 30 years $30 million Your assets are $28 million. The term structure is currently flat at 5%. (a) Compute the present value of your liabilities. (5 points) (b) Compute modified duration of your liabilities. (5 points) (c) Compute an approximate change in the present value of your liabilities, using duration, when interest rates fall by 0.25%. (2.5 points) 4 (d) Suppose that you invest the $18 million in 1-year Treasury bills (i.e., 1-year zero-coupon bond) and in a Treasury bond with modified duration of 20. How would you allocate your assets to avoid interest rate risk of your portfolio, which includes both assets and liabilities? (7.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts