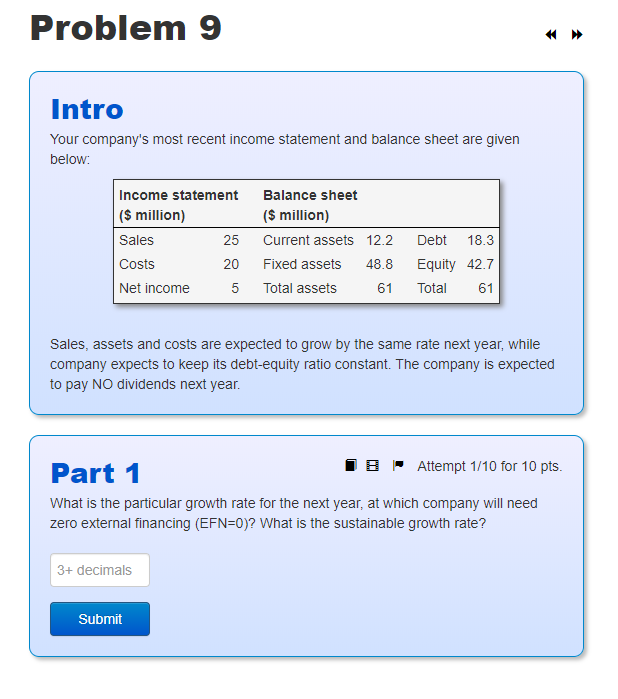

Question: Problem 9 Intro Your company's most recent income statement and balance sheet are given below: Income statement ($ million) Sales 25 20 Net income 5

Problem 9 Intro Your company's most recent income statement and balance sheet are given below: Income statement ($ million) Sales 25 20 Net income 5 Balance sheet ($ million) Current assets 12.2 Fixed assets 48.8 Total assets 61 Costs Debt 18.3 Equity 42.7 Total 61 Sales, assets and costs are expected to grow by the same rate next year, while company expects to keep its debt-equity ratio constant. The company is expected to pay NO dividends next year. Part 1 1B Attempt 1/10 for 10 pts. What is the particular growth rate for the next year, at which company will need zero external financing (EFN=0)? What is the sustainable growth rate? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts