Question: Problem #9: Suppose a bond with face and redemption value of $33040 matures in 39 years and has a nominal annual coupon [7 marks] rate

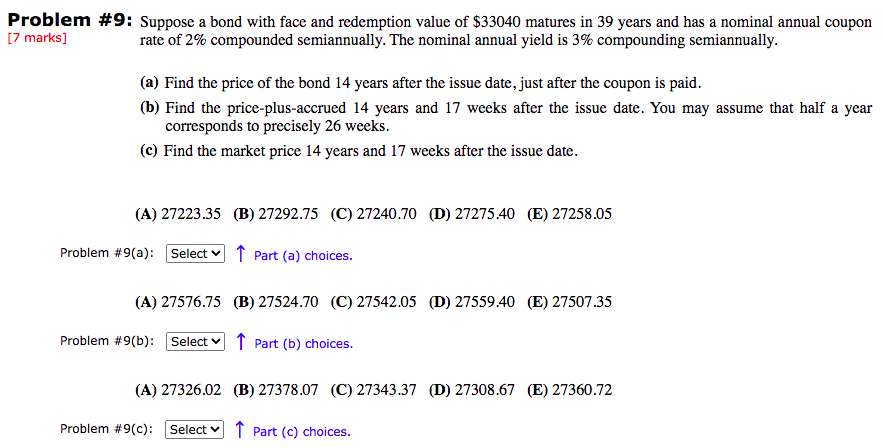

Problem #9: Suppose a bond with face and redemption value of $33040 matures in 39 years and has a nominal annual coupon [7 marks] rate of 2% compounded semiannually. The nominal annual yield is 3% compounding semiannually. (a) Find the price of the bond 14 years after the issue date, just after the coupon is paid. (b) Find the price-plus-accrued 14 years and 17 weeks after the issue date. You may assume that half a year corresponds to precisely 26 weeks. (e) Find the market price 14 years and 17 weeks after the issue date. (A) 27223.35 (B) 27292.75 (C) 27240.70 (D) 27275.40 (E) 27258.05 Problem #9(a): Select 1 Part (a) choices. (A) 27576.75 (B) 27524.70 (c)27542.05 (D) 27559.40 (E) 27507.35 Problem #9(b): Select 1 Part (b) choices. (A) 27326.02 (B) 27378.07 (C) 27343.37 (D) 27308.67 (E) 27360.72 Problem #9(c): Select 1 Part (c) choices. Problem #9: Suppose a bond with face and redemption value of $33040 matures in 39 years and has a nominal annual coupon [7 marks] rate of 2% compounded semiannually. The nominal annual yield is 3% compounding semiannually. (a) Find the price of the bond 14 years after the issue date, just after the coupon is paid. (b) Find the price-plus-accrued 14 years and 17 weeks after the issue date. You may assume that half a year corresponds to precisely 26 weeks. (e) Find the market price 14 years and 17 weeks after the issue date. (A) 27223.35 (B) 27292.75 (C) 27240.70 (D) 27275.40 (E) 27258.05 Problem #9(a): Select 1 Part (a) choices. (A) 27576.75 (B) 27524.70 (c)27542.05 (D) 27559.40 (E) 27507.35 Problem #9(b): Select 1 Part (b) choices. (A) 27326.02 (B) 27378.07 (C) 27343.37 (D) 27308.67 (E) 27360.72 Problem #9(c): Select 1 Part (c) choices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts