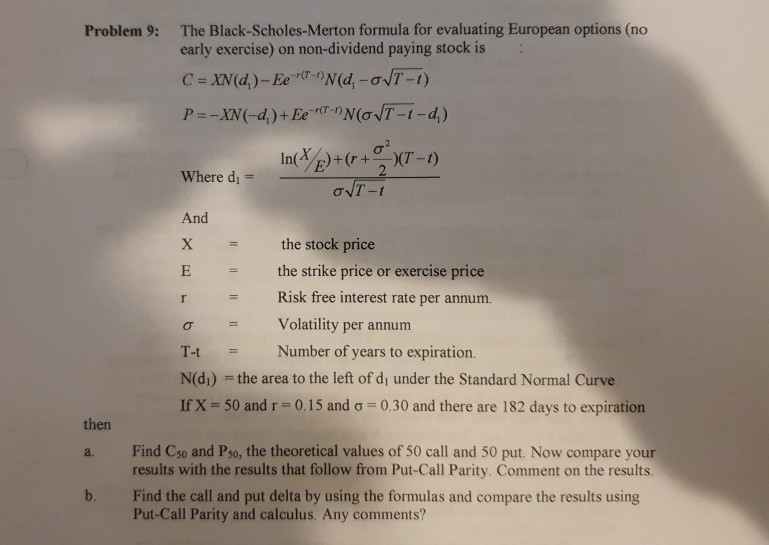

Question: Problem 9: The Black-Scholes Merton formula for evaluating European options (no early exercise) on non-dividend paying stock is : C = XN(d)- Ee(T-N(d, -01T-1) P=-XN(-d.)+

Problem 9: The Black-Scholes Merton formula for evaluating European options (no early exercise) on non-dividend paying stock is : C = XN(d)- Ee(T-N(d, -01T-1) P=-XN(-d.)+ Ee (oT-1-d) In(*/p)+(+ XT-1) Where di = ONT-1 And the stock price E = the strike price or exercise price T = Risk free interest rate per annum. o = Volatility per annum Number of years to expiration Ndi) the area to the left of d, under the Standard Normal Curve If X = 50 and 0.15 and o=0.30 and there are 182 days to expiration then a. Find Cso and Pso, the theoretical values of 50 call and 50 put. Now compare your results with the results that follow from Put-Call Parity. Comment on the results. Find the call and put delta by using the formulas and compare the results using Put-Call Parity and calculus. Any comments? b. Problem 9: The Black-Scholes Merton formula for evaluating European options (no early exercise) on non-dividend paying stock is : C = XN(d)- Ee(T-N(d, -01T-1) P=-XN(-d.)+ Ee (oT-1-d) In(*/p)+(+ XT-1) Where di = ONT-1 And the stock price E = the strike price or exercise price T = Risk free interest rate per annum. o = Volatility per annum Number of years to expiration Ndi) the area to the left of d, under the Standard Normal Curve If X = 50 and 0.15 and o=0.30 and there are 182 days to expiration then a. Find Cso and Pso, the theoretical values of 50 call and 50 put. Now compare your results with the results that follow from Put-Call Parity. Comment on the results. Find the call and put delta by using the formulas and compare the results using Put-Call Parity and calculus. Any comments? b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts