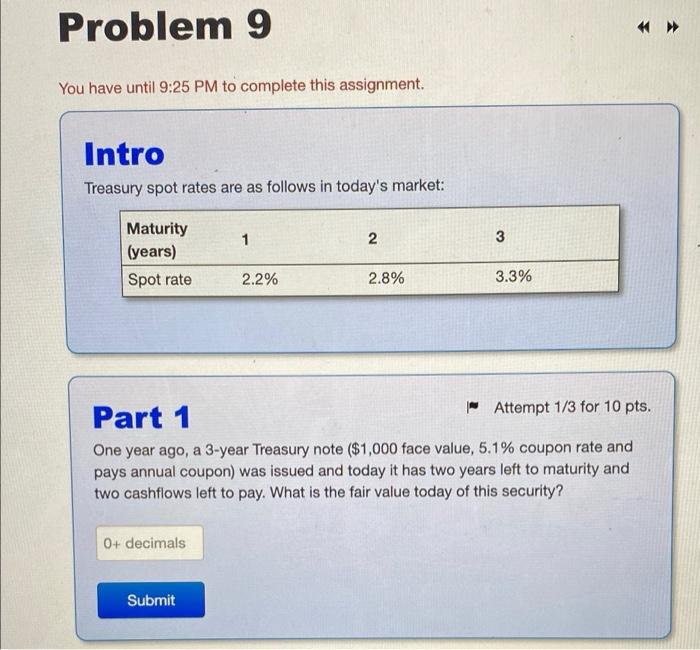

Question: Problem 9 You have until 9:25 PM to complete this assignment. Intro Treasury spot rates are as follows in today's market: 1 2 3 Maturity

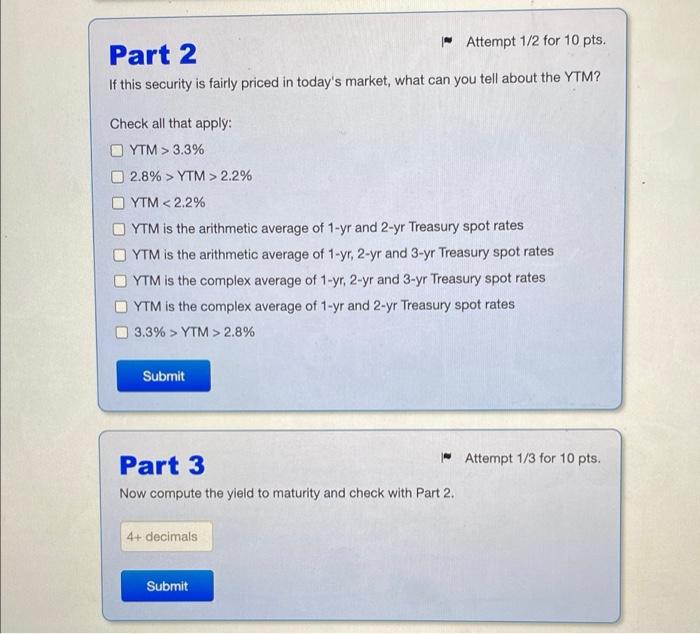

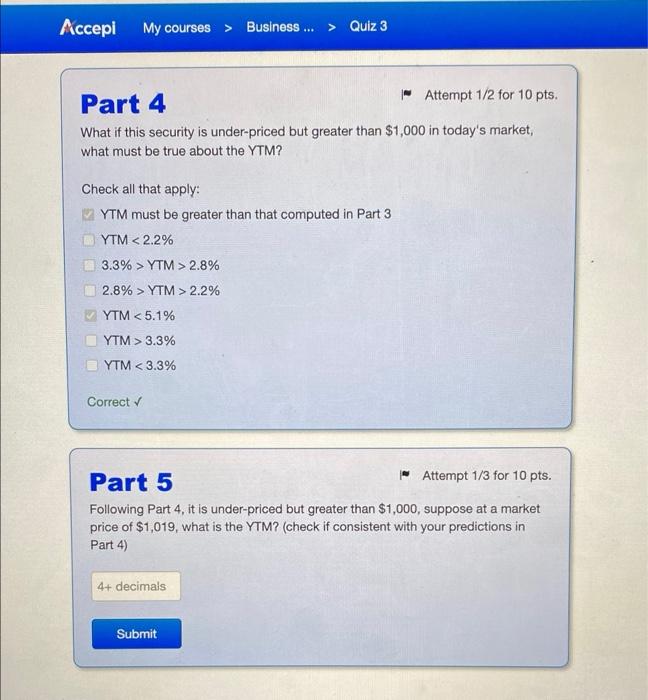

Problem 9 You have until 9:25 PM to complete this assignment. Intro Treasury spot rates are as follows in today's market: 1 2 3 Maturity (years) Spot rate 2.2% 2.8% 3.3% Part 1 * Attempt 1/3 for 10 pts. One year ago, a 3-year Treasury note ($1,000 face value, 5.1% coupon rate and pays annual coupon) was issued and today it has two years left to maturity and two cashflows left to pay. What is the fair value today of this security? 0+ decimals Submit Part 2 - Attempt 1/2 for 10 pts. If this security is fairly priced in today's market, what can you tell about the YTM? Check all that apply: YTM > 3.3% 2.8% > YTM > 2.2% YTM YTM > 2.8% Submit Attempt 1/3 for 10 pts. Part 3 Now compute the yield to maturity and check with Part 2 4+ decimals Submit Accepi My courses > Business ... > Quiz 3 Part 4 | Attempt 1/2 for 10 pts. What if this security is under-priced but greater than $1,000 in today's market, what must be true about the YTM? Check all that apply: VYTM must be greater than that computed in Part 3 YTM 3.3% > YTM > 2.8% 2.8% > YTM > 2.2% YTM 3.3% YTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts