Question: Problem 9-02A al-a2, b (Video) (Part Level Submission) In recent years, Oriole Transportation purchased three used buses. Because of frequent turnover in the accounting department,

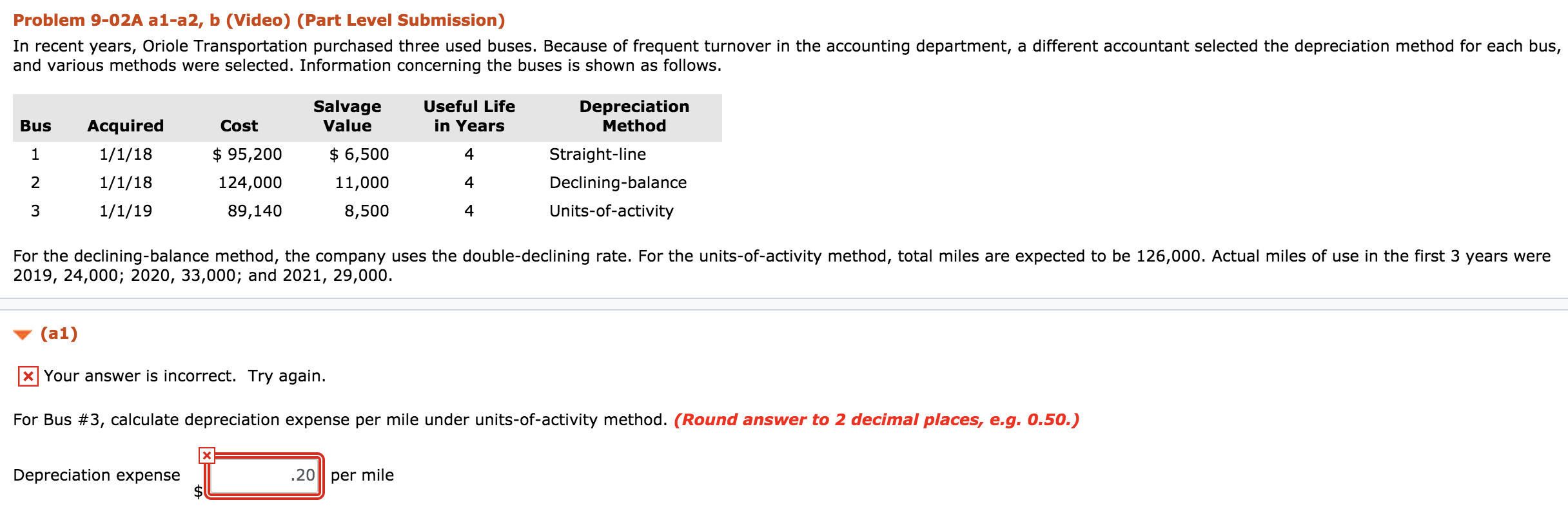

Problem 9-02A al-a2, b (Video) (Part Level Submission) In recent years, Oriole Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depreciation method for each bus, and various methods were selected. Information concerning the buses is shown as follows. Salvage Value Useful Life in Years Depreciation Method Bus Acquired Cost Straight-line 1/1/18 1/1/18 1/1/19 $ 95,200 124,000 89,140 $ 6,500 11,000 8,500 Declining-balance Units-of-activity For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 126,000. Actual miles of use in the first 3 years were 2019, 24,000; 2020, 33,000; and 2021, 29,000. (al) x Your answer is incorrect. Try again. For Bus #3, calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) x Depreciation expense per mile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts