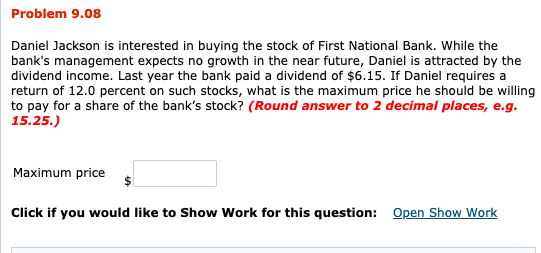

Question: Problem 9.08 Daniel Jackson is interested in buying the stock of First National Bank. While the bank's management expects no growth in the near future,

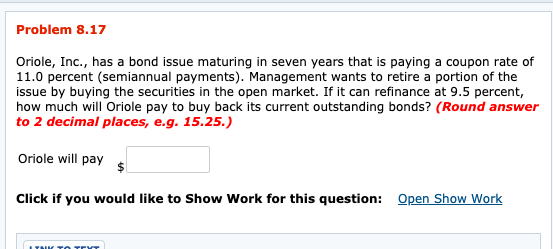

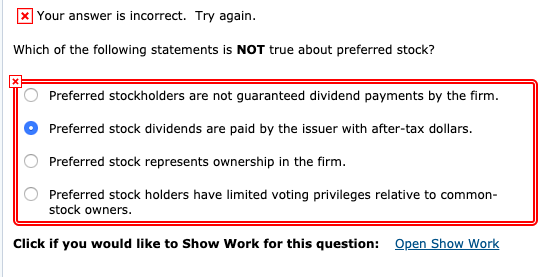

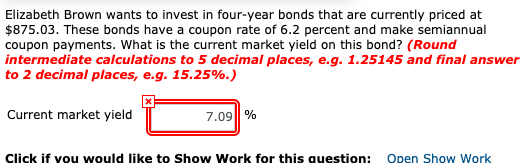

Problem 9.08 Daniel Jackson is interested in buying the stock of First National Bank. While the bank's management expects no growth in the near future, Daniel is attracted by the dividend income. Last year the bank paid a dividend of $6.15. If Daniel requires a return of 12.0 percent on such stocks, what is the maximum price he should be willing to pay for a share of the bank's stock? (Round answer to 2 decimal places, e.g. 15.25.) Maximum price Click if you would like to Show Work for this question: Open Show Work Problem 8.17 Oriole, Inc., has a bond issue maturing in seven years that is paying a coupon rate of 11.0 percent (semiannual payments). Management wants to retire a portion of the issue by buying the securities in the open market. If it can refinance at 9.5 percent, how much will Oriole pay to buy back its current outstanding bonds? (Round answer to 2 decimal places, e.g. 15.25.) Oriole will pay s Click if you would like to Show Work for this question: Open Show Work Your answer is incorrect. Try again. Which of the following statements is NOT true about preferred stock? Preferred stockholders are not guaranteed dividend payments by the firm Preferred stock dividends are paid by the issuer with after-tax dollars. O Preferred stock represents ownership in the firm. Preferred stock holders have limited voting privileges relative to common- stock owners. Click if you would like to Show Work for this question: Open Show Work Elizabeth Brown wants to invest in four-year bonds that are currently priced at $875.03. These bonds have a coupon rate of 6.2 percent and make semiannual coupon payments. What is the current market yield on this bond? (Round intermediate calculations to 5 decimal places, e.g. 1.25145 and final answer to 2 decimal places, eg. 15.25%.) Current market yield 7.0911 % Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts