Question: Problem 9-10 Present value LO3] How much would you have to invest today to receive: Use Appendix B and Appendix D for an approximate answer,

![Problem 9-10 Present value LO3] How much would you have to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffb3762bf8b_65366ffb375b38a0.jpg)

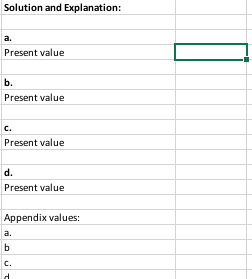

Problem 9-10 Present value LO3] How much would you have to invest today to receive: Use Appendix B and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. $15,000 in 8 years at 10 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) b. $20,000 in 12 years at 13 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) c. $6,000 each year for 10 years at 9 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) d. $50,000 each year for 50 years at 7 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Input variables: $15,000 a. Future value a. Number of years a. Interest rate b. Future value b. Number of years b. Interest rate c. Annuity payment c. Number of years c. Interest rate d. Annuity payment d. Number of years d. Interest rate a. Appendix factor b. Appendix factor c. Appendix factor d. Appendix factor 8 years 0.10 $20,000 12 years 0.13 $6,000 10 years 0.09 $50,000 50 years 0.07 467 231 6.418 13.801

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts