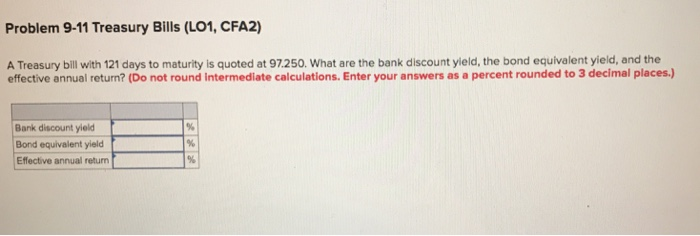

Question: Problem 9-11 Treasury Bills (LO1, CFA2) A Treasury bill with 121 days to maturity is quoted at 97.250. What are the bank discount yield, the

Problem 9-11 Treasury Bills (LO1, CFA2) A Treasury bill with 121 days to maturity is quoted at 97.250. What are the bank discount yield, the bond equivalent yield, and the effective annual return? (Do not round intermediate calculations. Enter your answers as a percent rounded to 3 decimal places.) Bank discount yield Bond equivalent yield Effective annual retum

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock