Question: problem 9-14 can you please show me how to do? Thank you nachiRe that costs 598,000. It is expected that the machine will generate after-tax

problem 9-14 can you please show me how to do? Thank you

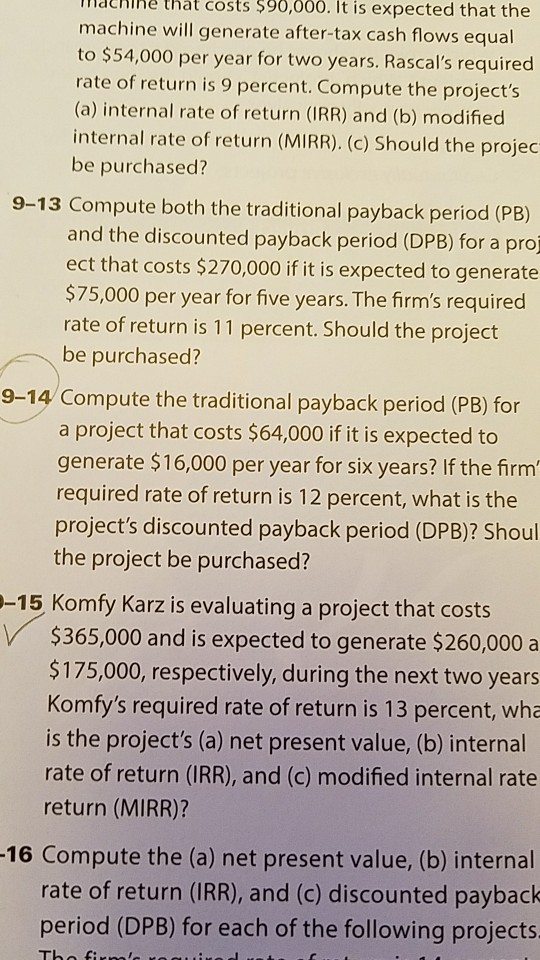

nachiRe that costs 598,000. It is expected that the machine will generate after-tax cash flows equal to $54,000 per year for two years. Rascal's required rate of return is 9 percent. Compute the project's (a) internal rate of return (IRR) and (b) modified internal rate of return (MIRR). (c) Should the projec be purchased? 9-13 Compute both the traditional payback period (PB) and the discounted payback period (DPB) for a proj ect that costs $270,000 if it is expected to generate $75,000 per year for five years. The frm's required rate of return is 11 percent. Should the project be purchased? 9-14 Compute the traditional payback period (PB) for a project that costs $64,000 if it is expected to generate $16,000 per year for six years? If the firm required rate of return is 12 percent, what is the project's discounted payback period (DPB)? Shoul the project be purchased? -15 Komfy Karz is evaluating a project that costs $365,000 and is expected to generate $260,000 a $175,000, respectively, during the next two years Komfy's required rate of return is 13 percent, wha is the project's (a) net present value, (b) internal rate of return (IRR), and (c) modified internal rate return (MIRR)? 16 Compute the (e) net present value, (b) internal rate of return (IRR), and (c) discounted payback period (DPB) for each of the following projects Tho fi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts