Question: Problem 9-16A Partial year's depreciation; exchanging PPE LO2, 3, 6 In 2017, Staged Home Ltd. completed the following transactions involving delivery trucks: July 5 Traded-in

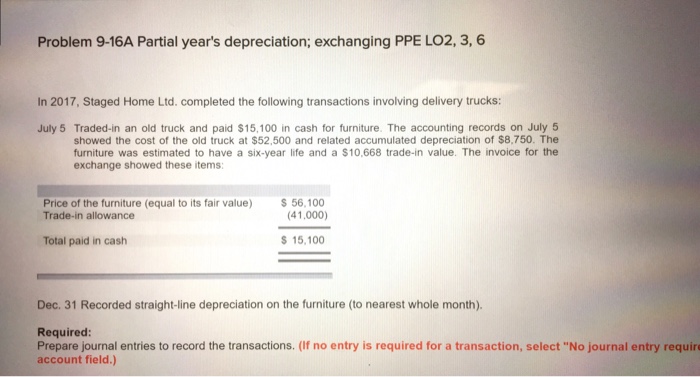

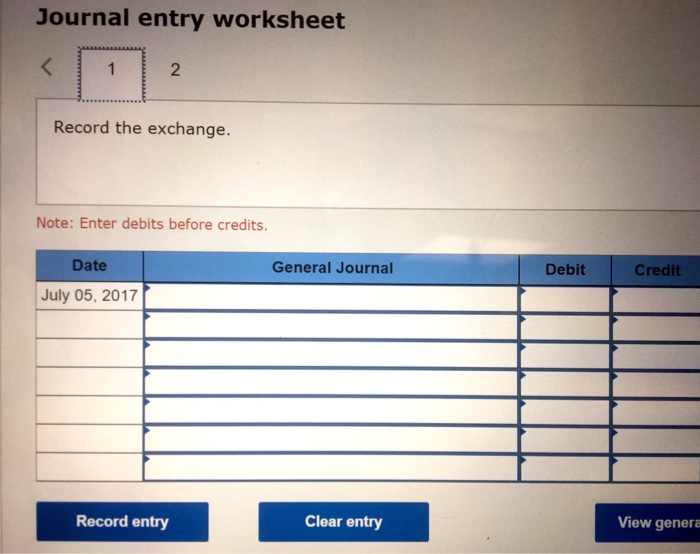

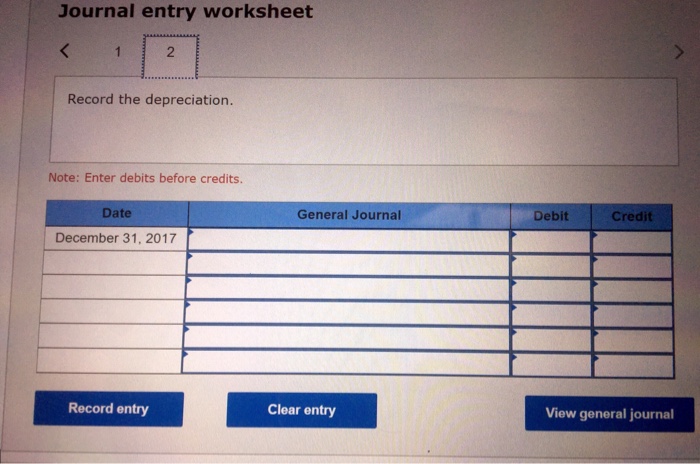

Problem 9-16A Partial year's depreciation; exchanging PPE LO2, 3, 6 In 2017, Staged Home Ltd. completed the following transactions involving delivery trucks: July 5 Traded-in an old truck and paid $15,100 in cash for furniture. The accounting records on July 5 showed the cost of the old truck at $52,500 and related accumulated depreciation of $8,750. The furniture was estimated to have a six-year life and a $10,668 trade-in value. The invoice for the exchange showed these items: Price of the furniture (equal to its fair value) Trade-in allowance 56,100 (41,000) Total paid in cash 15,100 Dec. 31 Recorded straight-line depreciation on the furniture (to nearest whole month). Required Prepare journal entries to record the transactions. (If no entry is required for a transaction, select "No journal entry require account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts