Question: Problem 9-17a Question Help You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into

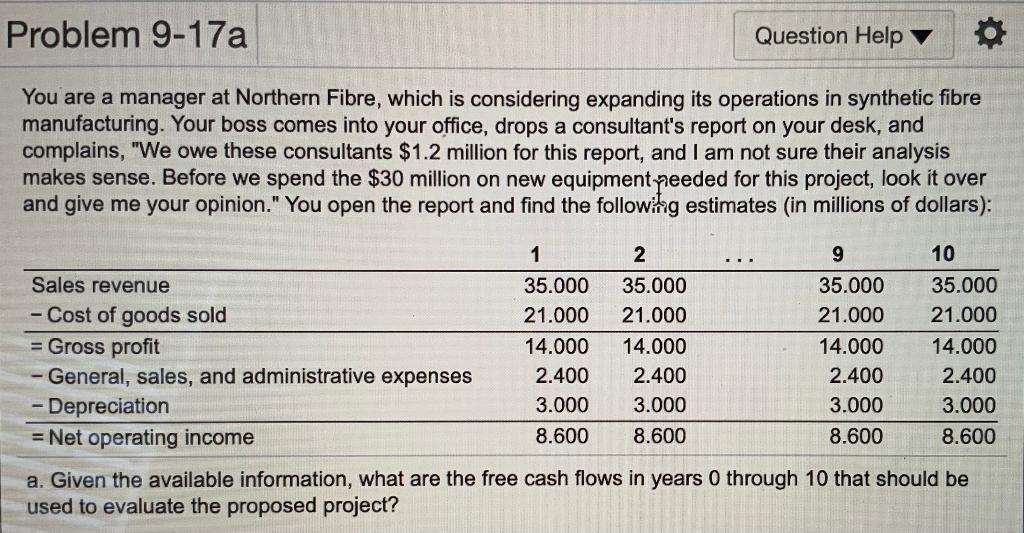

Problem 9-17a Question Help You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.2 million for this report, and I am not sure their analysis makes sense. Before we spend the $30 million on new equipment peeded for this project, look it over and give me your opinion." You open the report and find the followitig estimates (in millions of dollars): 1 2 9 10 Sales revenue 35.000 35.000 35.000 35.000 - Cost of goods sold 21.000 21.000 21.000 21.000 = Gross profit 14.000 14.000 14.000 14.000 - General, sales, and administrative expenses 2.400 2.400 2.400 2.400 - Depreciation 3.000 3.000 3.000 3.000 = Net operating income 8.600 8.600 8.600 8.600 a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts