Question: Problem 9-18cd Question Help Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight

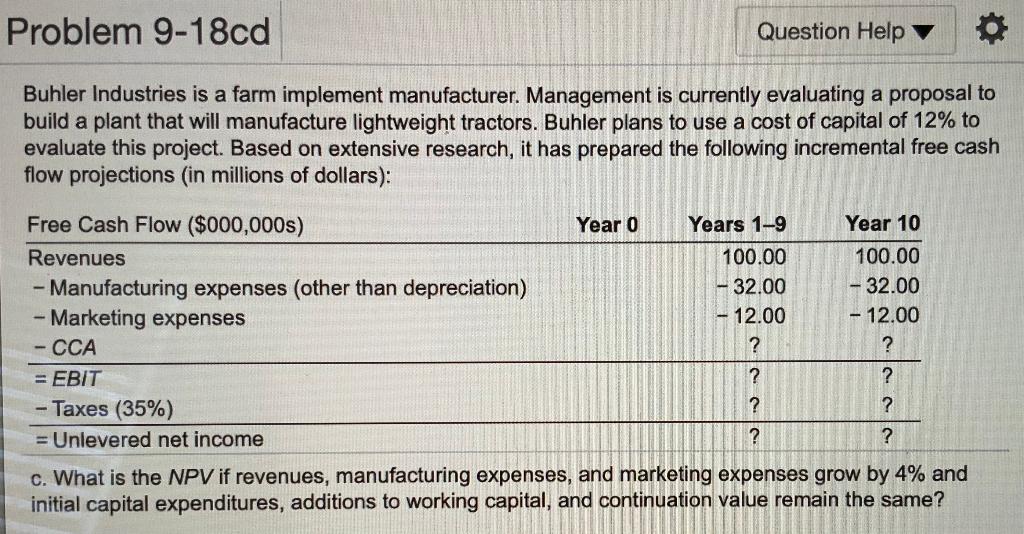

Problem 9-18cd Question Help Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight tractors. Buhler plans to use a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental free cash flow projections (in millions of dollars): Free Cash Flow ($000,000s) Year 0 Years 1-9 Year 10 Revenues 100.00 100.00 - Manufacturing expenses (other than depreciation) -32.00 - 32.00 - Marketing expenses 12.00 - 12.00 - CCA ? ? = EBIT ? ? - Taxes (35%) ? ? = Unlevered net income ? ? c. What is the NPV if revenues, manufacturing expenses, and marketing expenses grow by 4% and initial capital expenditures, additions to working capital, and continuation value remain the same? Problem 9-18cd Question Help Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight tractors. Buhler plans to use a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental free cash flow projections (in millions of dollars): Free Cash Flow ($000,000s) Year 0 Years 1-9 Year 10 Revenues 100.00 100.00 - Manufacturing expenses (other than depreciation) -32.00 - 32.00 - Marketing expenses 12.00 - 12.00 - CCA ? ? = EBIT ? ? - Taxes (35%) ? ? = Unlevered net income ? ? c. What is the NPV if revenues, manufacturing expenses, and marketing expenses grow by 4% and initial capital expenditures, additions to working capital, and continuation value remain the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts