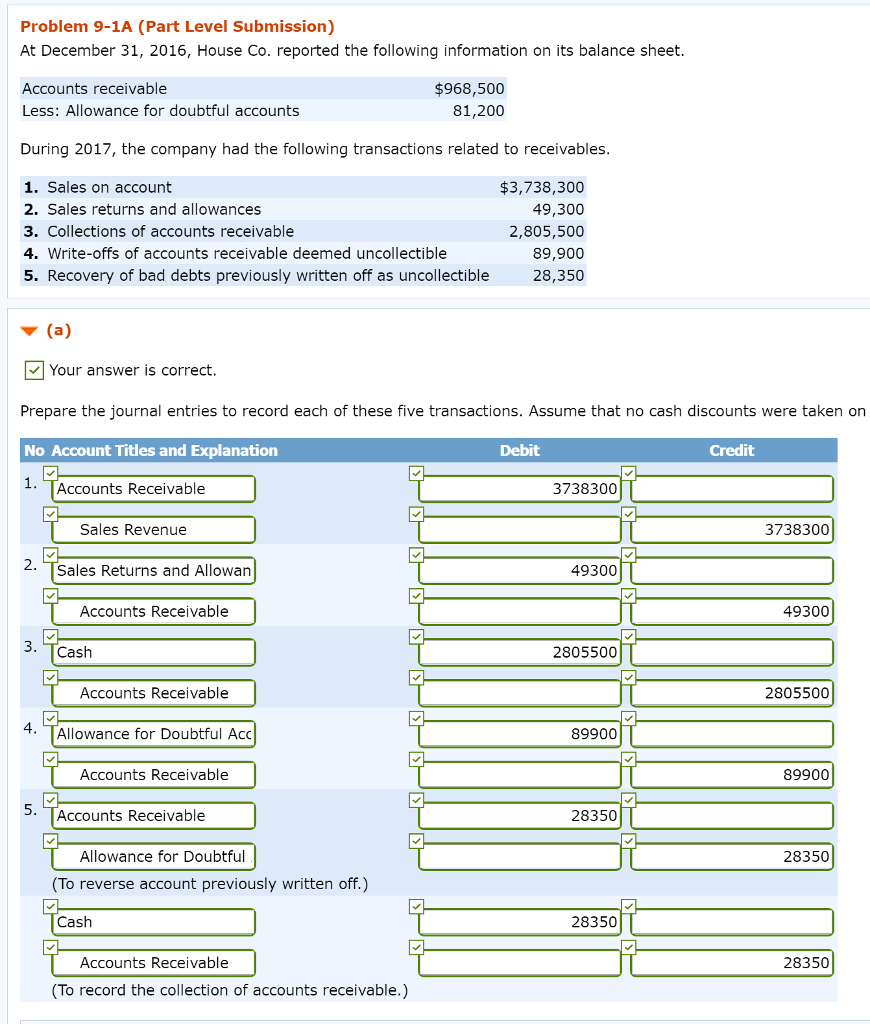

Question: Problem 9-1A (Part Level Submission) At December 31, 2016, House Co. reported the following information on its balance sheet. Accounts receivable $968,500 Less: Allowance for

Problem 9-1A (Part Level Submission)

At December 31, 2016, House Co. reported the following information on its balance sheet.

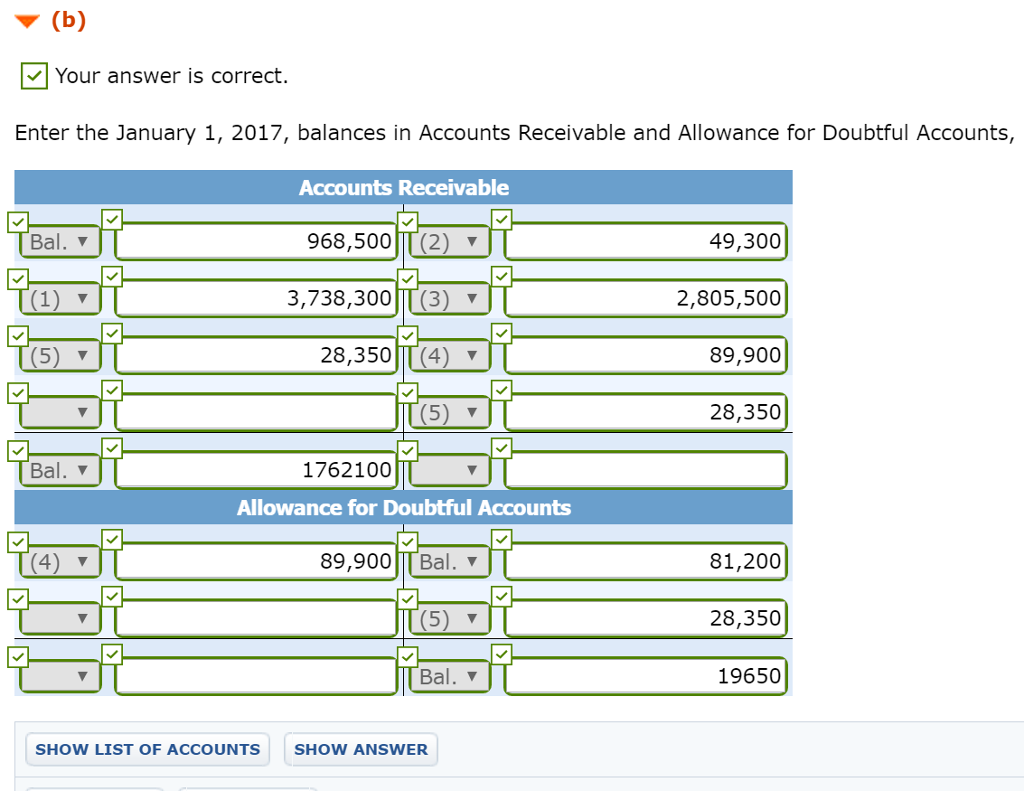

| Accounts receivable | $968,500 | |

| Less: Allowance for doubtful accounts | 81,200 |

During 2017, the company had the following transactions related to receivables.

| 1. | Sales on account | $3,738,300 | ||

| 2. | Sales returns and allowances | 49,300 | ||

| 3. | Collections of accounts receivable | 2,805,500 | ||

| 4. | Write-offs of accounts receivable deemed uncollectible | 89,900 | ||

| 5. | Recovery of bad debts previously written off as uncollectible | 28,350 |

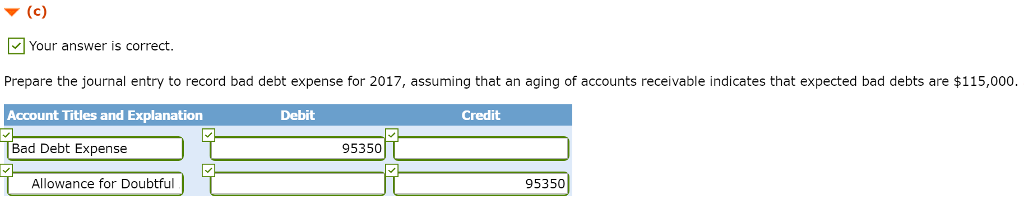

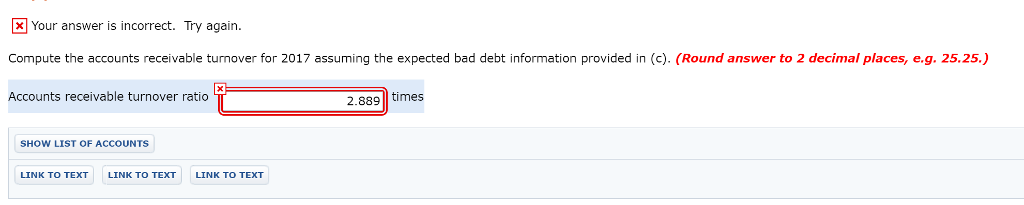

The problem is alomst complete all I need is the Accounts receivable turnover ratio. I am getting it wrong. I do not know why but please double check before submition! I only have 2 tries left!

The problem is alomst complete all I need is the Accounts receivable turnover ratio. I am getting it wrong. I do not know why but please double check before submition! I only have 2 tries left!

Problem 9-1A (Part Level Submission) At December 31, 2016, House Co. reported the following information on its balance sheet. Accounts receivable $968,500 Less: Allowance for doubtful accounts 81,200 During 2017, the company had the following transactions related to receivables. $3,738,300 1. Sales on account 2. Sales returns and allowances 49,300 3. Collections of accounts receivable 2,805,500 89,900 4. Write-offs of accounts receivable deemed uncollectible 5. Recovery of bad debts previously written off as uncollectible 28,350 (a) Your answer is correct Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on No Account Titles and Explanation Debit Credit 1. Accounts Receivable 3738300 Sales Revenue 3738300 2. Sales Returns and Allowan 49300 Accounts Receivable 49300 2805500 Cash 2805500 Accounts Receivable 89900 f. Allowance for Doubtful Acc Accounts Receivable 89900 5. Accounts Receivable 28350 T 28350 Allowance for Doubtful (To reverse account previously written off. Cash 28350 Accounts Receivable 28350 (To record the collection of accounts receivable.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts