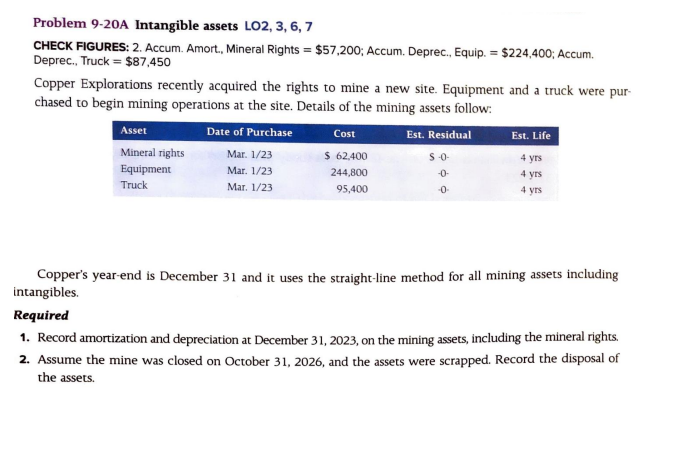

Question: Problem 9-20A Intangible assets LO2, 3, 6, 7 CHECK FIGURES: 2 . Accum. Amort., Mineral Rights =$57,200; Accum. Deprec.., Equip. =$224,400; Accum. Deprec., Truck =$87,450

Problem 9-20A Intangible assets LO2, 3, 6, 7 CHECK FIGURES: 2 . Accum. Amort., Mineral Rights =$57,200; Accum. Deprec.., Equip. =$224,400; Accum. Deprec., Truck =$87,450 Copper Explorations recently acquired the rights to mine a new site. Equipment and a truck were purchased to begin mining operations at the site. Details of the mining assets follow: Copper's year-end is December 31 and it uses the straight-line method for all mining assets including intangibles. Required 1. Record amortization and depreciation at December 31,2023 , on the mining assets, including the mineral rights. 2. Assume the mine was closed on October 31,2026 , and the assets were scrapped. Record the disposal of the assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts