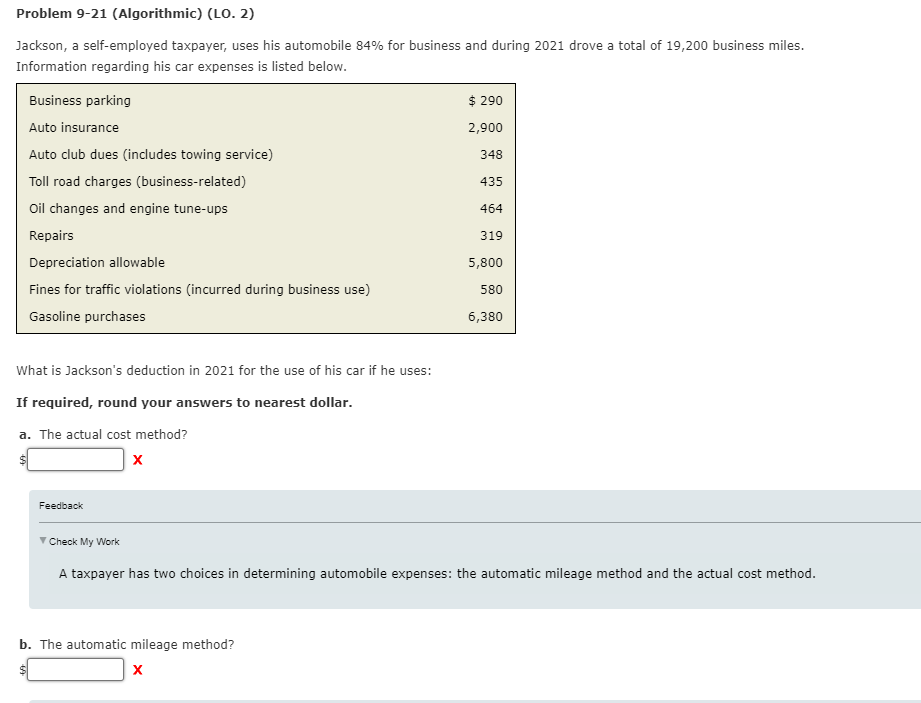

Question: Problem 9-21 (Algorithmic) (LO. 2) Jackson, a self-employed taxpayer, uses his automobile 84% for business and during 2021 drove a total of 19,200 business miles.

Problem 9-21 (Algorithmic) (LO. 2) Jackson, a self-employed taxpayer, uses his automobile 84% for business and during 2021 drove a total of 19,200 business miles. Information regarding his car expenses is listed below. $ 290 2,900 348 435 Business parking Auto insurance Auto club dues (includes towing service) Toll road charges (business-related) Oil changes and engine tune-ups Repairs Depreciation allowable Fines for traffic violations incurred during business use) Gasoline purchases 464 319 5,800 580 6,380 What is Jackson's deduction in 2021 for the use of his car if he uses: If required, round your answers to nearest dollar. a. The actual cost method? S Feedback Check My Work A taxpayer has two choices in determining automobile expenses: the automatic mileage method and the actual cost method. b. The automatic mileage method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts