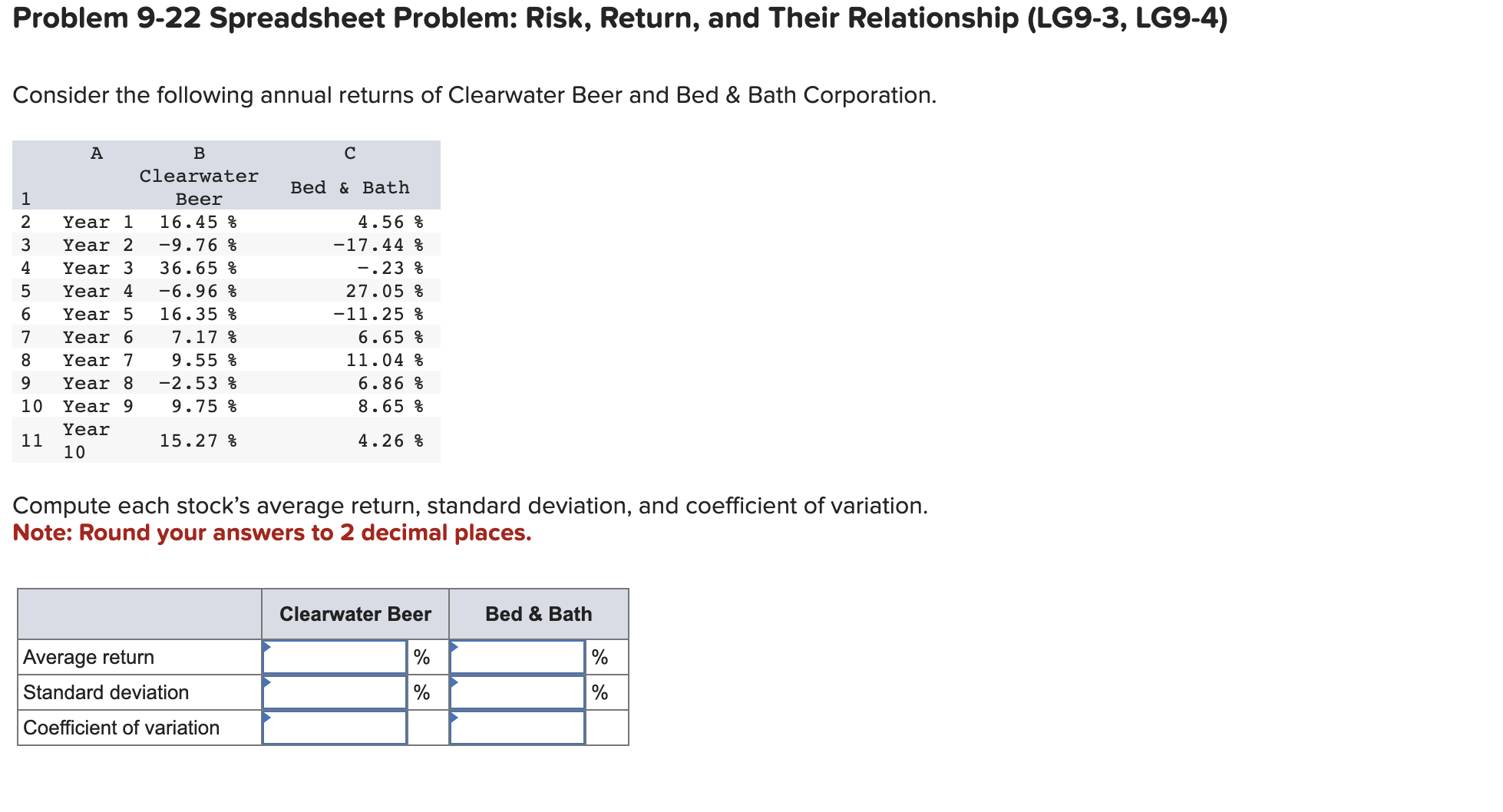

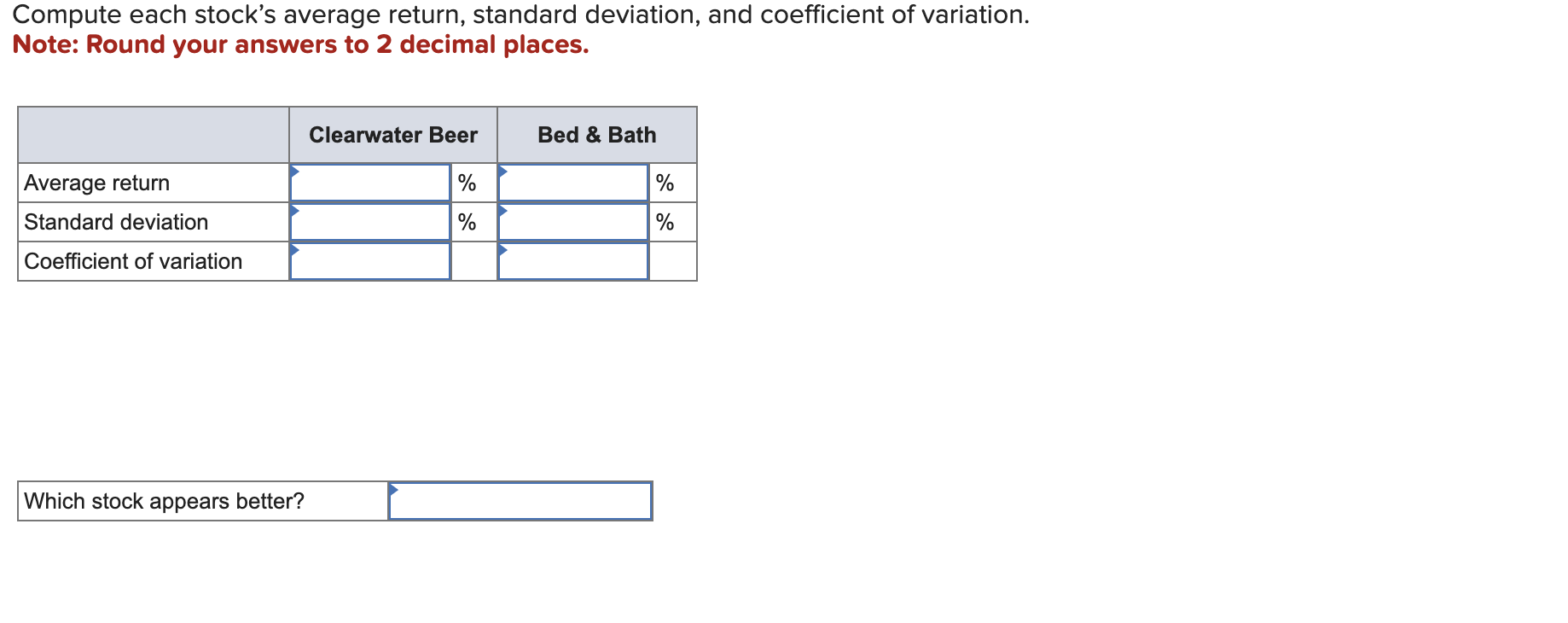

Question: Problem 9-22 Spreadsheet Problem: Risk, Return, and Their Relationship (LG9-3, LG9-4) Consider the following annual returns of Clearwater Beer and Bed & Bath Corporation. Compute

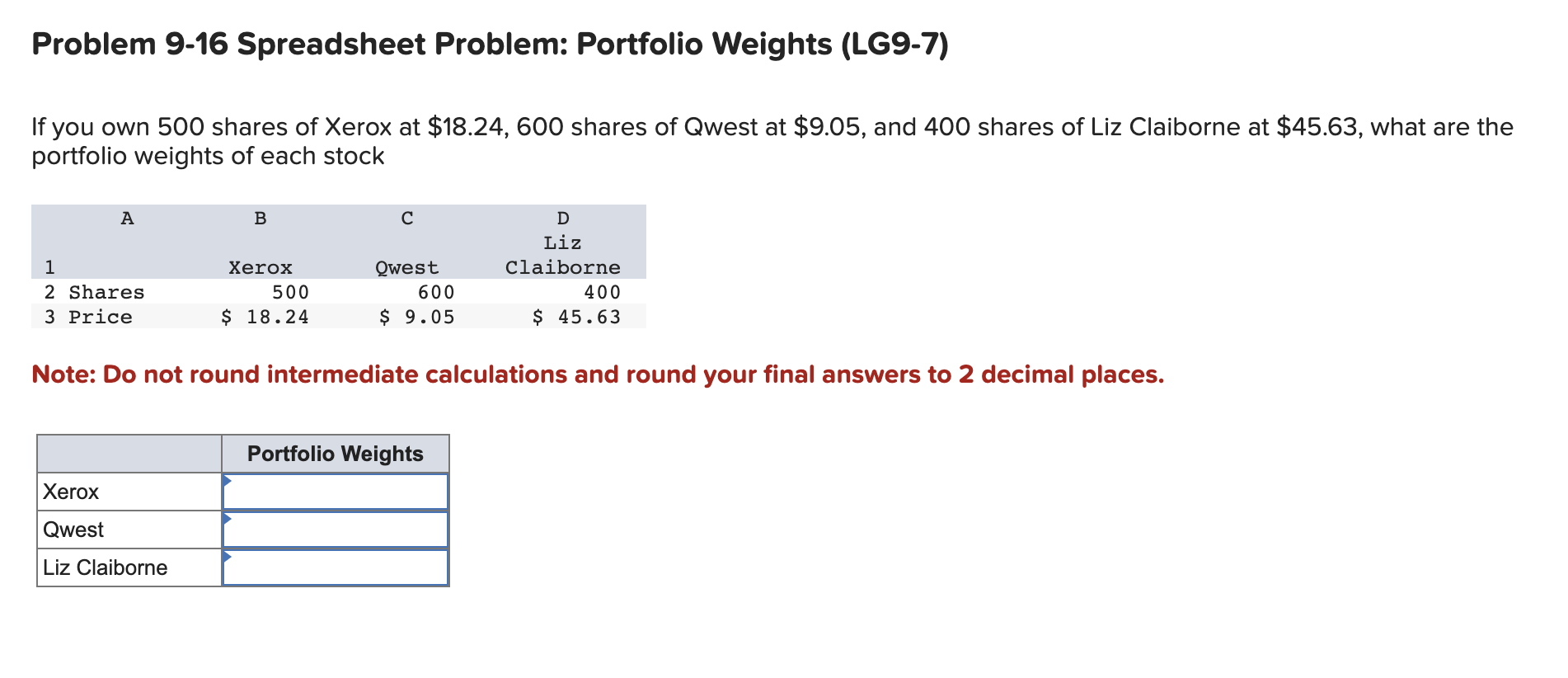

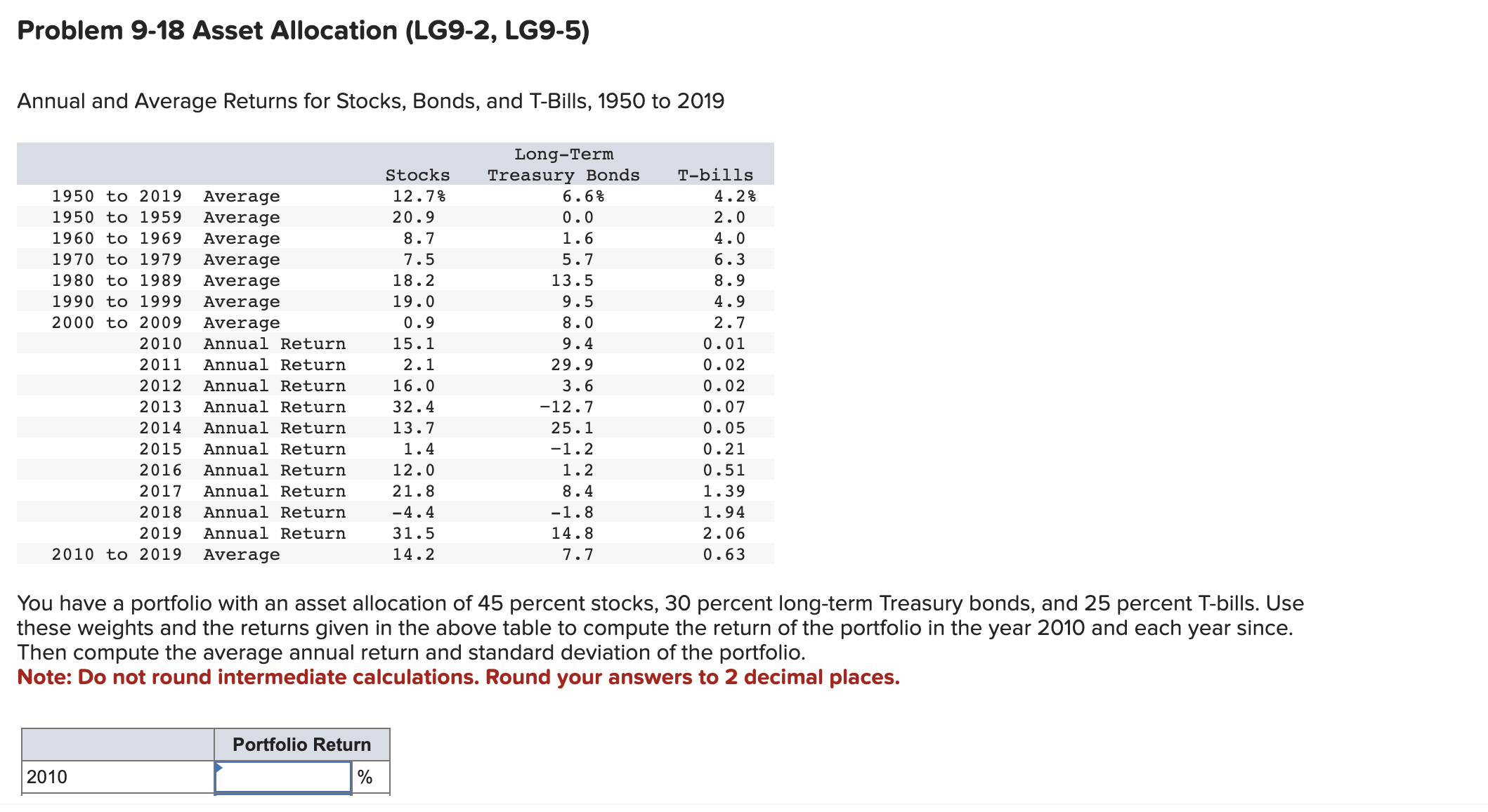

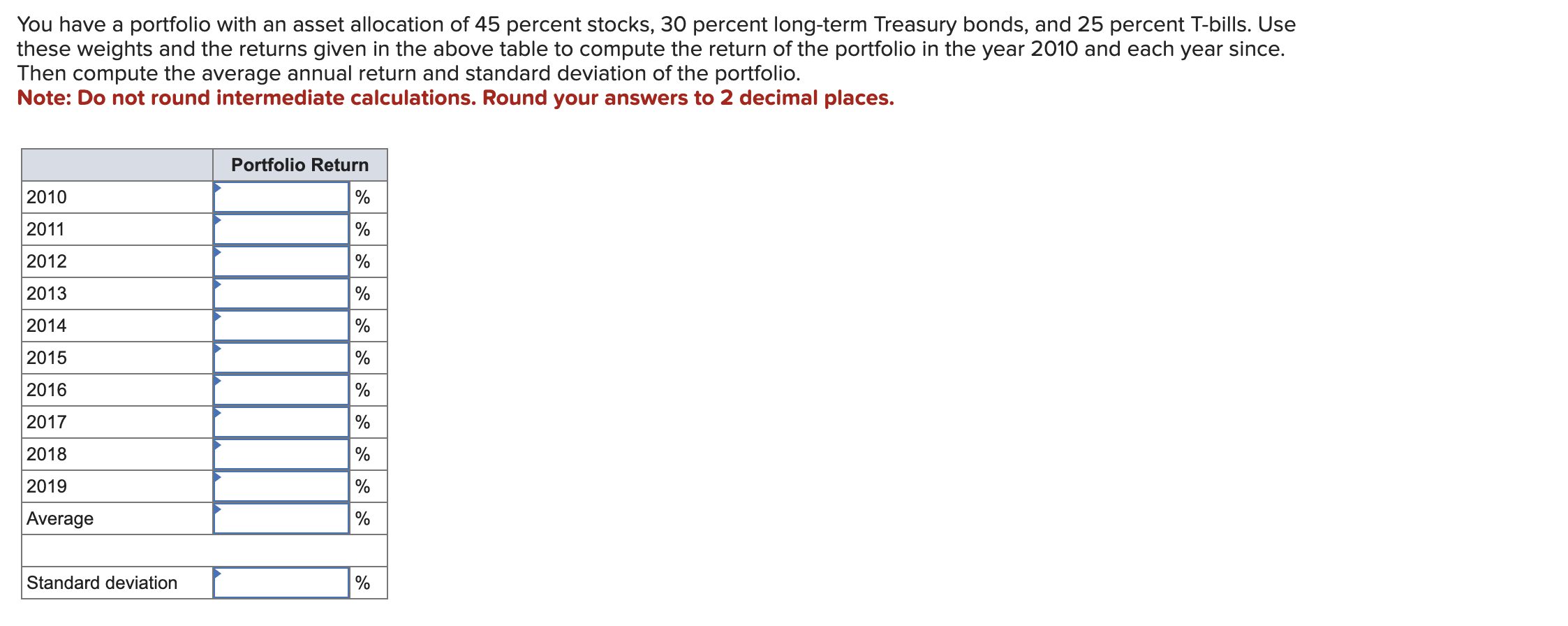

Problem 9-22 Spreadsheet Problem: Risk, Return, and Their Relationship (LG9-3, LG9-4) Consider the following annual returns of Clearwater Beer and Bed \& Bath Corporation. Compute each stock's average return, standard deviation, and coefficient of variation. Note: Round your answers to 2 decimal places. You have a portfolio with an asset allocation of 45 percent stocks, 30 percent long-term Treasury bonds, and 25 percent T-bills. Use these weights and the returns given in the above table to compute the return of the portfolio in the year 2010 and each year since. Then compute the average annual return and standard deviation of the portfolio. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Compute each stock's average return, standard deviation, and coefficient of variation. Note: Round your answers to 2 decimal places. Annual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2019 You have a portfolio with an asset allocation of 45 percent stocks, 30 percent long-term Treasury bonds, and 25 percent T-bills. Use these weights and the returns given in the above table to compute the return of the portfolio in the year 2010 and each year since. Then compute the average annual return and standard deviation of the portfolio. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Problem 9-16 Spreadsheet Problem: Portfolio Weights (LG9-7) If you own 500 shares of Xerox at $18.24,600 shares of Qwest at $9.05, and 400 shares of Liz Claiborne at $45.63, what are the portfolio weights of each stock Note: Do not round intermediate calculations and round your final answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts