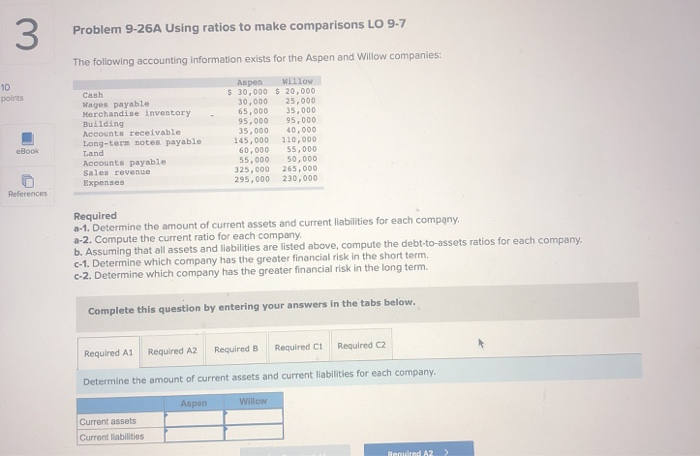

Question: Problem 9-26A Using ratios to make comparisons LO 9-7 The following accounting information exists for the Aspen and Willow companies: points Cash Wages payable Merchandise

Problem 9-26A Using ratios to make comparisons LO 9-7 The following accounting information exists for the Aspen and Willow companies: points Cash Wages payable Merchandise inventory Building Accounts receivable Long-term notes payable Tand Accounts payable Sales revenue Expenses Aspen $ 30,000 30,000 65,000 95, 000 35,000 145,000 60,000 55.000 325,000 295,000 Willow $20,000 25,000 35,000 95.000 40,000 110,000 55,000 50.000 265,000 230.000 eBook References Required -1. Determine the amount of current assets and current liabilities for each company a-2. Compute the current ratio for each company. b. Assuming that all assets and liabilities are listed above, compute the debt-to-assets ratios for each company. C-1. Determine which company has the greater financial risk in the short term. c-2. Determine which company has the greater financial risk in the long term. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B Required C2 Required C Determine the amount of current assets and current liabilities for each company. Aspon Willow Current assets Current liabilities Renud A2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts