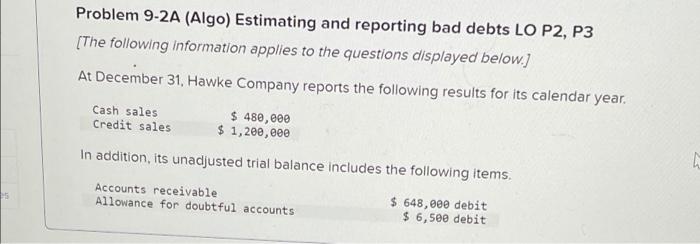

Question: Problem 9-2A (Algo) Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below. At December 31, Hawke Company

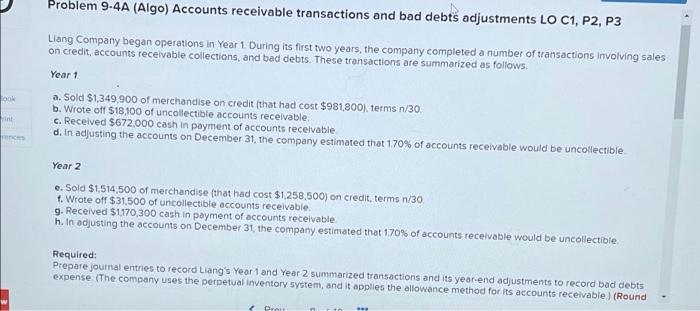

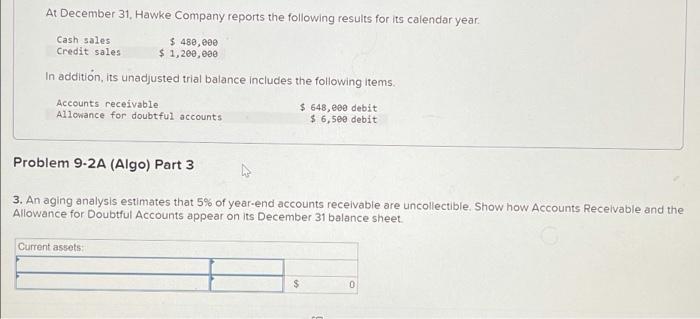

Problem 9-2A (Algo) Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below. At December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 480,000 Credit sales $ 1,200, eee In addition, its unadjusted trial balance includes the following items, Accounts receivable Allowance for doubtful accounts $ 648,000 debit $ 6,50e debit Problem 9-4A (Algo) Accounts receivable transactions and bad debts adjustments LO C1, P2, P3 Liang Company began operations In Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1.349,900 of merchandise on credit (that had cost $981800), terms n/30. b. Wrote off $18,100 of uncollectible accounts receivable c. Received $672,000 cash in payment of accounts receivable d. In adjusting the accounts on December 31, the company estimated that 1 70% of accounts receivable would be uncollectible Ook rint Year 2 e. Sold $1.514.500 of merchandise (that had cost $1.258,500) on credit, terms n/30 1. Wrote off $31.500 of uncollectible accounts receivable 9. Received $1170,300 cash in payment of accounts receivable h. In adjusting the accounts on December 31, the company estimated that 170% of accounts receivable would be uncollectible Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized transactions and its year-end adjustments to record bad debts expense (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable) (Round Dr At December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 480,eee Credit sales $ 1,200,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable $ 648,eee debit Allowance for doubtful accounts $ 6,50e debit Problem 9-2A (Algo) Part 3 3. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet Current assets S 0 Problem 9-2A (Algo) Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below. At December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 480,000 Credit sales $ 1,200, eee In addition, its unadjusted trial balance includes the following items, Accounts receivable Allowance for doubtful accounts $ 648,000 debit $ 6,50e debit Problem 9-4A (Algo) Accounts receivable transactions and bad debts adjustments LO C1, P2, P3 Liang Company began operations In Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1.349,900 of merchandise on credit (that had cost $981800), terms n/30. b. Wrote off $18,100 of uncollectible accounts receivable c. Received $672,000 cash in payment of accounts receivable d. In adjusting the accounts on December 31, the company estimated that 1 70% of accounts receivable would be uncollectible Ook rint Year 2 e. Sold $1.514.500 of merchandise (that had cost $1.258,500) on credit, terms n/30 1. Wrote off $31.500 of uncollectible accounts receivable 9. Received $1170,300 cash in payment of accounts receivable h. In adjusting the accounts on December 31, the company estimated that 170% of accounts receivable would be uncollectible Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized transactions and its year-end adjustments to record bad debts expense (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable) (Round Dr At December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 480,eee Credit sales $ 1,200,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable $ 648,eee debit Allowance for doubtful accounts $ 6,50e debit Problem 9-2A (Algo) Part 3 3. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet Current assets S 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts