Question: Problem 9-32 (Algorithmic) (LO. 1, 3, 5) Kim works for a clothing manufacturer as a dress designer. During 2020, she travels to New York City

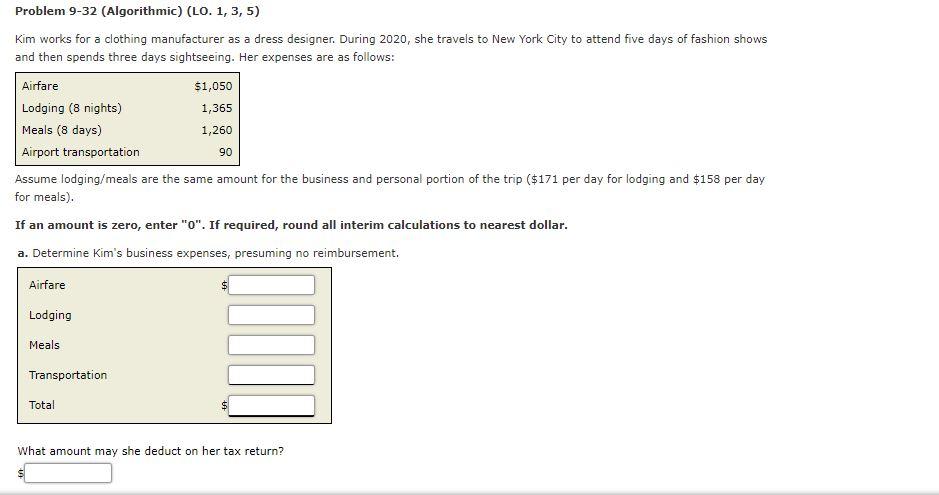

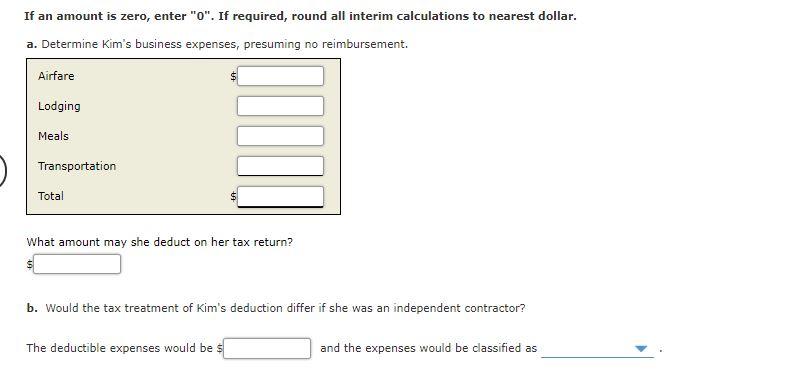

Problem 9-32 (Algorithmic) (LO. 1, 3, 5) Kim works for a clothing manufacturer as a dress designer. During 2020, she travels to New York City to attend five days of fashion shows and then spends three days sightseeing. Her expenses are as follows: Airfare $1,050 Lodging (8 nights) 1,365 Meals (8 days) 1,260 Airport transportation Assume lodging/meals are the same amount for the business and personal portion of the trip ($171 per day for lodging and $158 per day for meals). If an amount is zero, enter "0". If required, round all interim calculations to nearest dollar. a. Determine Kim's business expenses, presuming no reimbursement. 90 Airfare $ Lodging Meals Transportation Total What amount may she deduct on her tax return? If an amount is zero, enter "0". If required, round all interim calculations to nearest dollar. a. Determine Kim's business expenses, presuming no reimbursement. Airfare Lodging Meals Transportation Total What amount may she deduct on her tax return? b. Would the tax treatment of Kim's deduction differ if she was an independent contractor? The deductible expenses would be s and the expenses would be classified as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts