Question: Problem 9.33 Unit Costs, Multiple Products, Variance Analysis, Journal Entries Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor

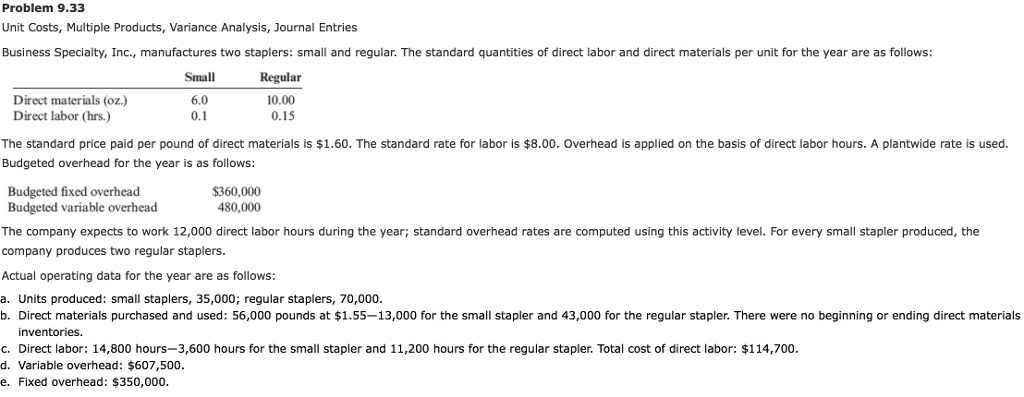

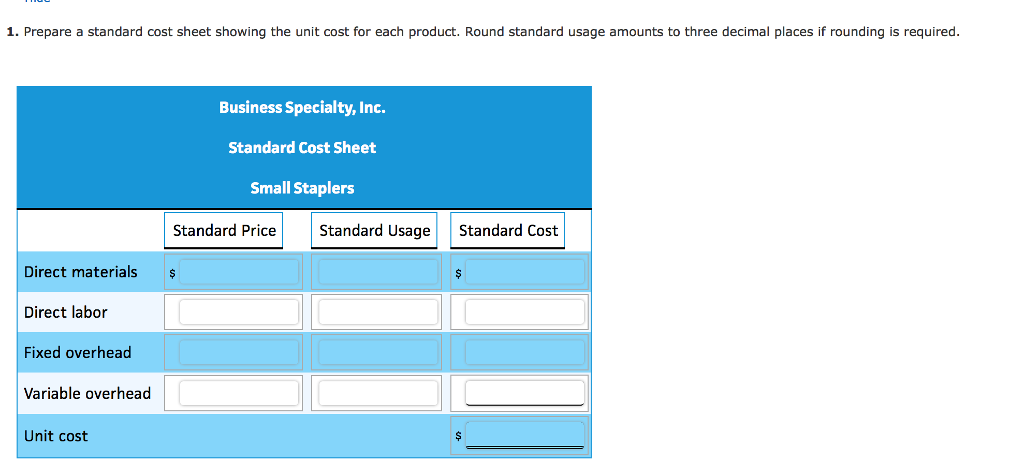

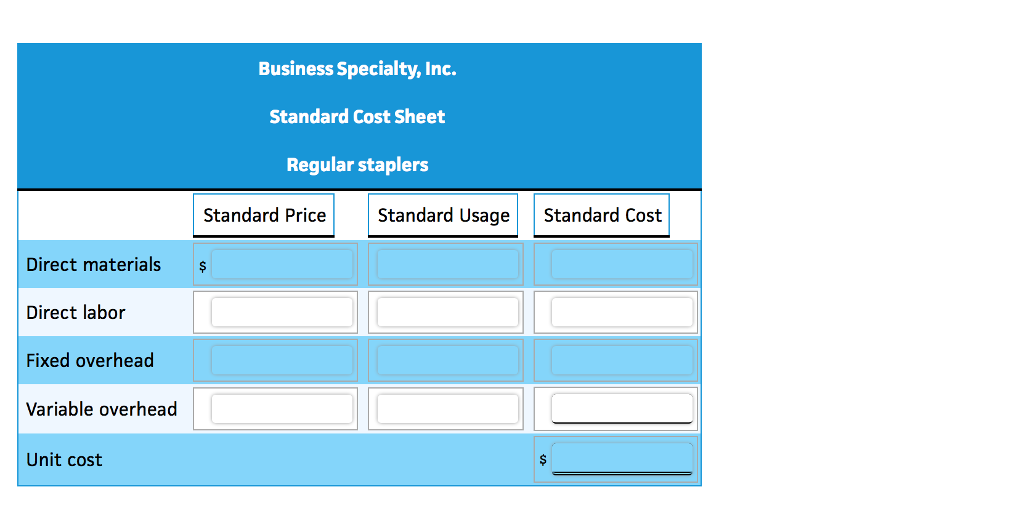

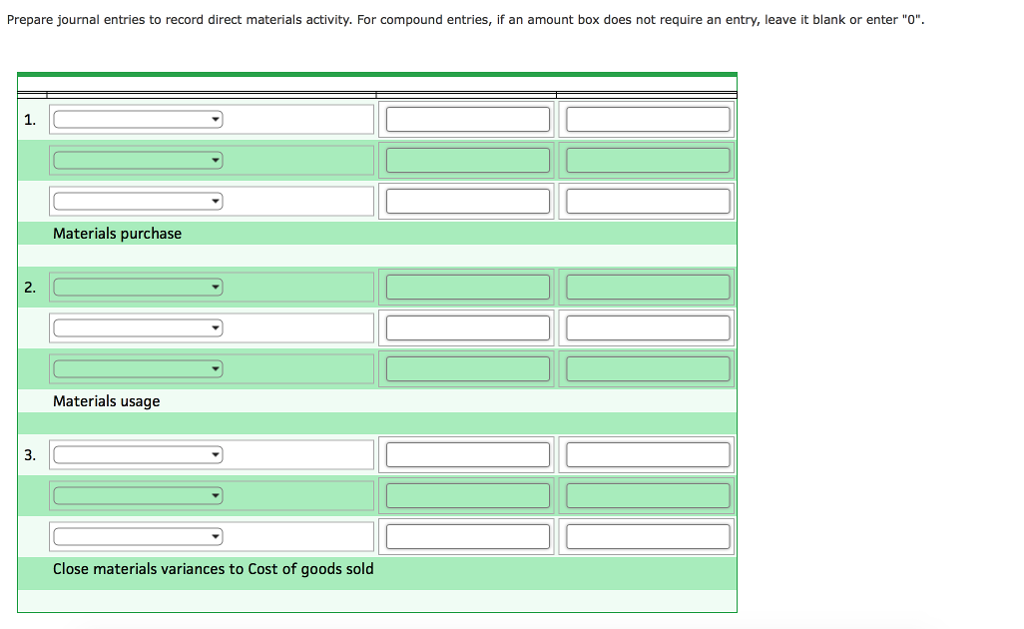

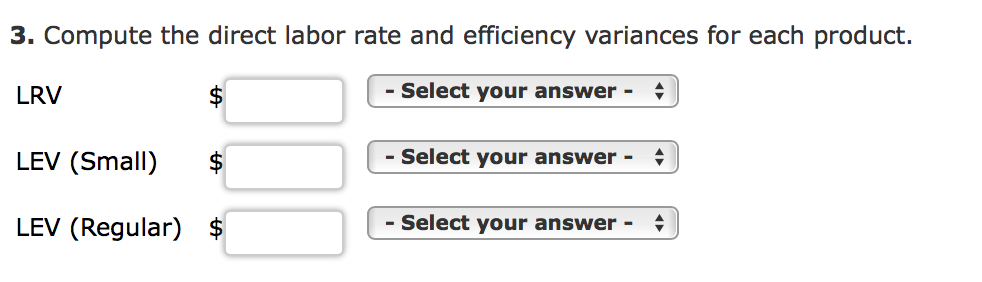

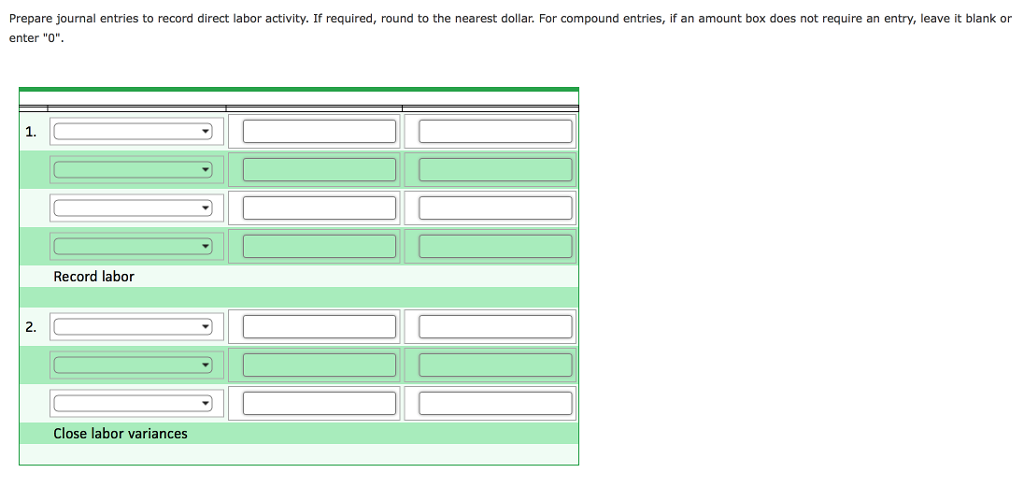

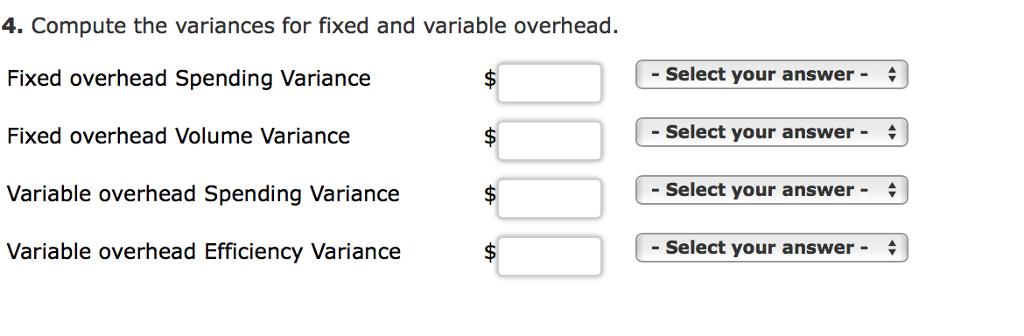

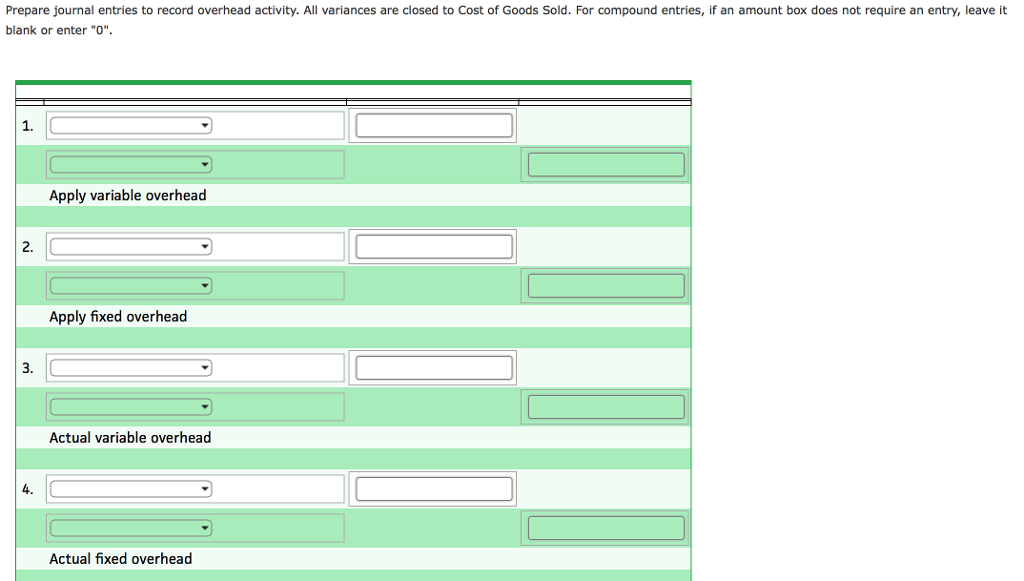

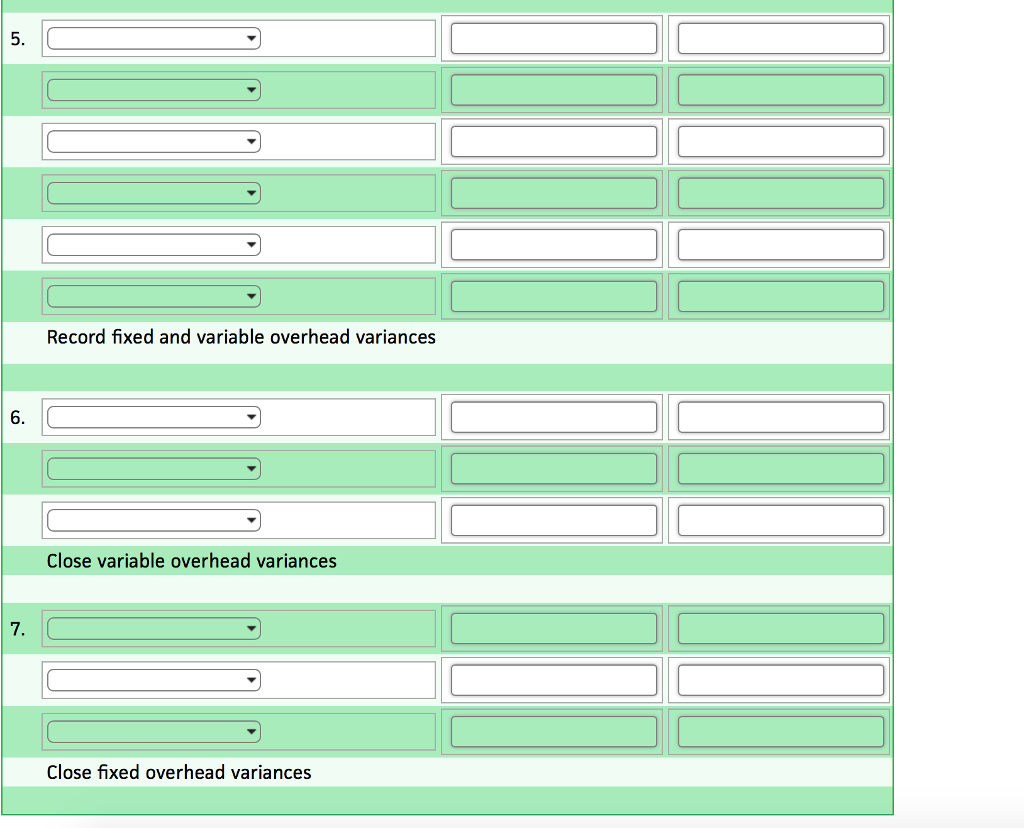

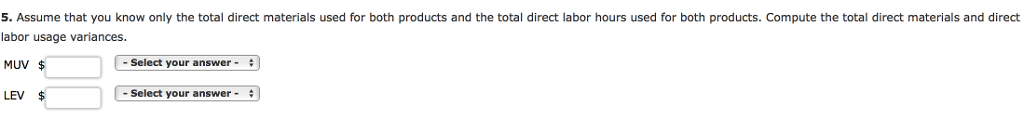

Problem 9.33 Unit Costs, Multiple Products, Variance Analysis, Journal Entries Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: Small Regular Direct materials (oz) 6.0 10.00 Direct labor (hrs) 0.1 0.15 The standard price paid per pound of direct materials is $1.60. The standard rate for labor is $8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: Budgeted fixed overhead $360,000 Budgeted variable overhead 480,000 The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at $1.55-13,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials nventories. c. Direct labor: 14,800 hours-3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: $114,700. d. Variable overhead: $607,500. e. Fixed overhead: $350,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts