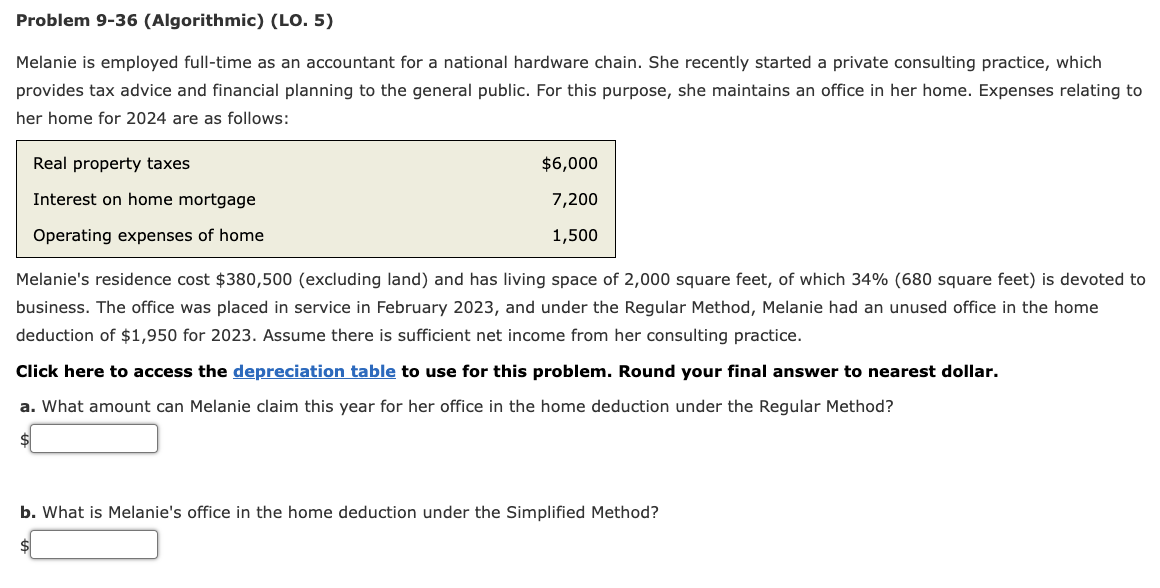

Question: Problem 9-36 (Algorithmic) (LO. 5) Melanie is employed full-time as an accountant for a national hardware chain. She recently started a private consulting practice, which

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock