Question: Problem 9-37 CVP Analysis; Strategy [LO 9-1, 9-2, 9-3] Bubbas Western Wear is a western hat retailer in Lubbock, Texas. Although Bubbas carries numerous styles

Problem 9-37 CVP Analysis; Strategy [LO 9-1, 9-2, 9-3]

Bubbas Western Wear is a western hat retailer in Lubbock, Texas. Although Bubbas carries numerous styles of western hats, each hat has approximately the same price and invoice (purchase) cost, as shown in the following table. Sales personnel receive a commission to encourage them to be more aggressive in their sales efforts. Currently, the Lubbock economy is really humming, and sales growth at Bubbas has been great. The business is very competitive, however, and Bubba, the owner, has relied on his knowledgeable and courteous staff to attract and retain customers who otherwise might go to other western wear stores. Because of the rapid growth in sales, Bubba is also finding the management of certain aspects of the business more difficult, such as restocking inventory and hiring and training new salespeople.

| Sales price | $ | 80.00 | |

| Per unit variable expenses | |||

| Purchase cost | 23.50 | ||

| Sales commissions | 31.50 | ||

| Total per unit variable costs | $ | 55.00 | |

| Total annual fixed expenses | |||

| Advertising | $ | 297,500 | |

| Rent | 248,000 | ||

| Salaries | 397,000 | ||

| Total fixed expenses | $ | 942,500 | |

Required:

1. Calculate the annual breakeven point, both in terms of units and in terms of sales dollars.

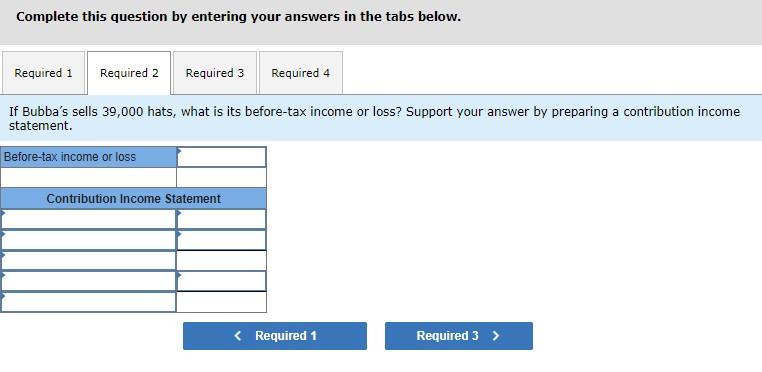

2. If Bubbas sells 39,000 hats, what is its before-tax income or loss? Support your answer by preparing a contribution income statement.

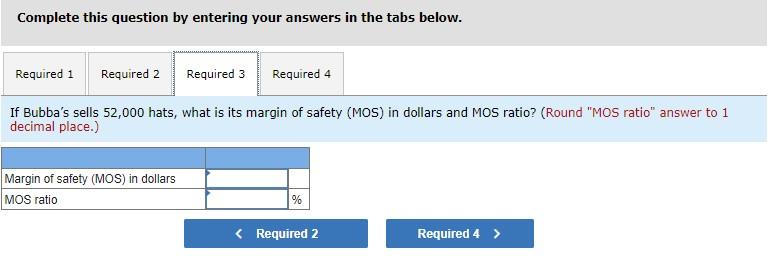

3. If Bubbas sells 52,000 hats, what is its margin of safety (MOS) in dollars and MOS ratio?

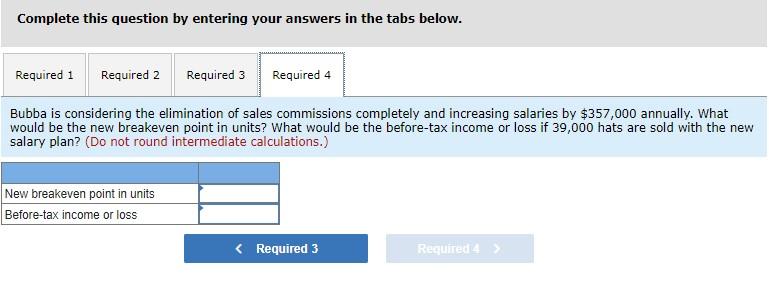

4. Bubba is considering the elimination of sales commissions completely and increasing salaries by $357,000 annually. What would be the new breakeven point in units? What would be the before-tax income or loss if 39,000 hats are sold with the new salary plan?

![Problem 9-37 CVP Analysis; Strategy [LO 9-1, 9-2, 9-3] Bubbas Western Wear](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66a0381323650_14666a03812b81d6.jpg)

Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the annual breakeven point, both in terms of units and in terms of sales dollars. (Do not round intermediate calculations.) Breakeven Point In units In sales dollars Required Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 If Bubba's sells 39,000 hats, what is its before-tax income or loss? Support your answer by preparing a contribution income statement. Before-tax income or loss Contribution Income Statement Required 1 Required 3 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 If Bubba's sells 52,000 hats, what is its margin of safety (MOS) in dollars and MOS ratio? (Round "MOS ratio" answer to 1 decimal place.) Margin of safety (MOS) in dollars MOS ratio % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Bubba is considering the elimination of sales commissions completely and increasing salaries by $357,000 annually. What would be the new breakeven point in units? What would be the before-tax income or loss if 39,000 hats are sold with the new salary plan? (Do not round intermediate calculations.) New breakeven point in units Before-tax income or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts