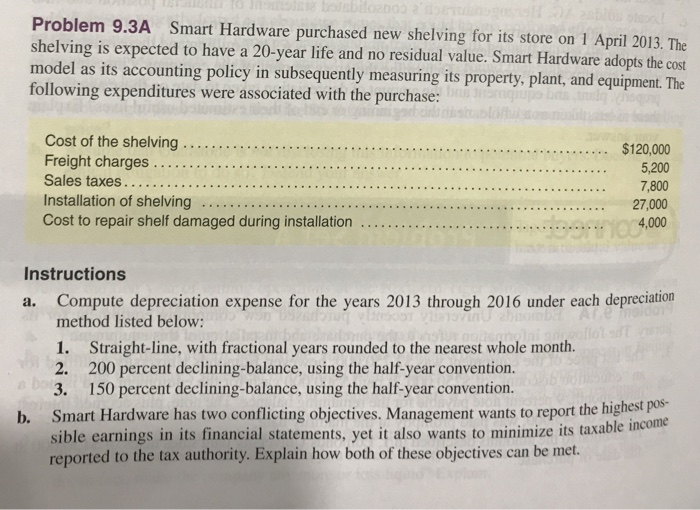

Question: Problem 9.3A Smart Hardware purchased new shelving for its store on 1 April 2013. The shelving is expected to have model as its accounting policy

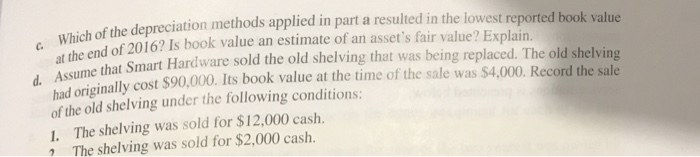

Problem 9.3A Smart Hardware purchased new shelving for its store on 1 April 2013. The shelving is expected to have model as its accounting policy in subsequently following expenditures were associated with the purchase: a 20-year life and no residual value . Smart Hardware adopts the cost measuring its property, plant, and equipment. The Cost of the shelving... $120,000 5,200 7,800 27,000 4,000 Installation of shelving . Cost to repair shelf damaged during installation . .. Instructions Compute depreciation expense for the years 2013 through 2016 under each depreciation method listed below 1. Straight-line, with fractional years rounded to the nearest whole month. 2. 200 percent declining-balance, using the half-year convention. 3. 150 percent declining-balance, using the half-year convention. Smart Hardware has two conflicting objectives. Management wants to report the high sible earnings in its financial statements, yet it also wants reported to the tax authority. Explain how both of these objectives can be met. a. est pos- b. to minimize its taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts