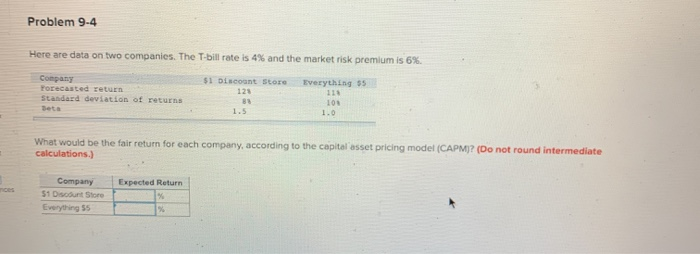

Question: Problem 9-4 Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. $1 Discount Store Everything 35

Problem 9-4 Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. $1 Discount Store Everything 35 Company Forecasted return Standard deviation of returns Beta What would be the fair return for each company, according to the capital asset pricing model (CAPM)? (Do not round intermediate calculations.) Company 51 Discount Store Everything 55 Expected Return % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts