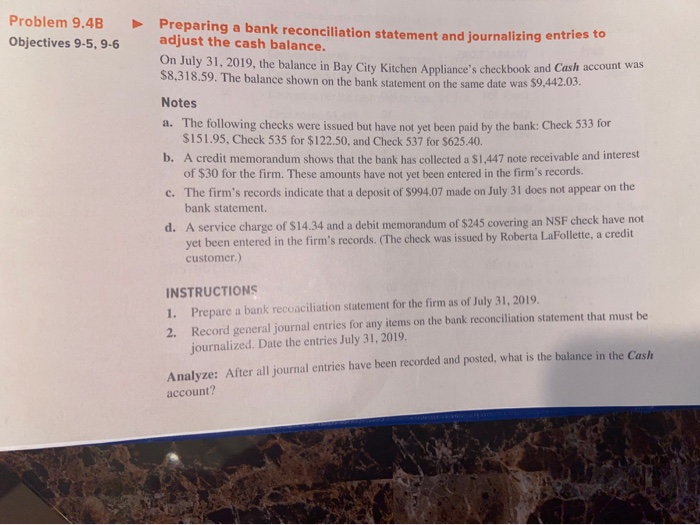

Question: Problem 9.4B Objectives 9-5, 9-6 Preparing a bank reconciliation statement and journalizing entries adjust the cash balance. On July 31, 2019, the balance in Bay

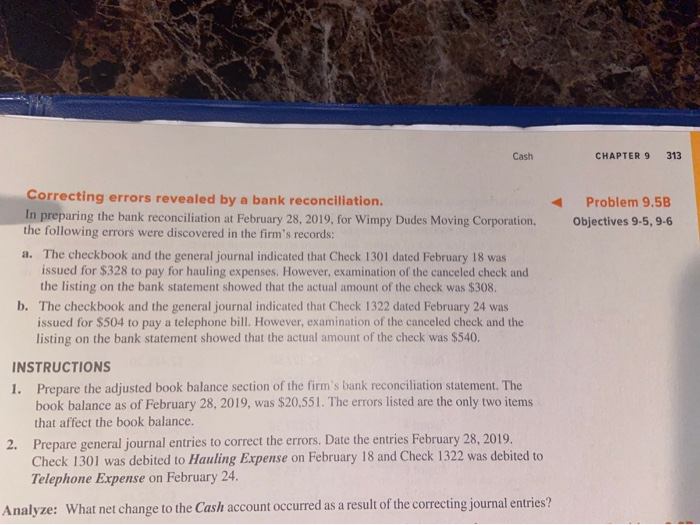

Problem 9.4B Objectives 9-5, 9-6 Preparing a bank reconciliation statement and journalizing entries adjust the cash balance. On July 31, 2019, the balance in Bay City Kitchen Appliance's checkbook and Cash acco 58,318.59. The balance shown on the bank statement on the same date was $9.442.03. Notes a. The following checks were issued but have not yet been paid by the bank: Check 533 for $151.95, Check 535 for $122.50, and Check 537 for $625.40. b. Acredit memorandum shows that the bank has collected a $1,447 note receivable and interest of $30 for the firm. These amounts have not yet been entered in the firm's records.. c. The firm's records indicate that a deposit of $994.07 made on July 31 does not appear on the bank statement. d. A service charge of $14.34 and a debit memorandum of $245 covering an NSF check have not yet been entered in the firm's records. (The check was issued by Roberta LaFollette, a credit customer.) INSTRUCTIONS 1. Prepare a bank reconciliation statement for the firm as of July 31, 2019. 2. Record general journal entries for any items on the bank reconciliation statement that must be journalized. Date the entries July 31, 2019. Analyze: After all journal entries have been recorded and posted, what is the balance in the Cash account? Cash CHAPTER 9 313 Problem 9.5B Objectives 9-5, 9-6 Correcting errors revealed by a bank reconciliation. In preparing the bank reconciliation at February 28, 2019. for Wimpy Dudes Moving Corporation, the following errors were discovered in the firm's records: a. The checkbook and the general journal indicated that Check 1301 dated February 18 was issued for $328 to pay for hauling expenses. However, examination of the canceled check and the listing on the bank statement showed that the actual amount of the check was $308. b. The checkbook and the general journal indicated that Check 1322 dated February 24 was issued for $504 to pay a telephone bill. However, examination of the canceled check and the listing on the bank statement showed that the actual amount of the check was $540. INSTRUCTIONS 1. Prepare the adjusted book balance section of the firm's bank reconciliation statement. The book balance as of February 28, 2019, was $20,551. The errors listed are the only two items that affect the book balance. 2. Prepare general journal entries to correct the errors. Date the entries February 28, 2019, Check 1301 was debited to Hauling Expense on February 18 and Check 1322 was debited to Telephone Expense on February 24. Analyze: What net change to the Cash account occurred as a result of the correcting journal entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts