Question: Problem 9-59 (Static) Adopting an Activity-Based Costing System ( LO 93,5,6) Elifs Equipment (EE), manufactures three models of lawn tractor: EE-1000, EE-1800, and EE-2800. Because

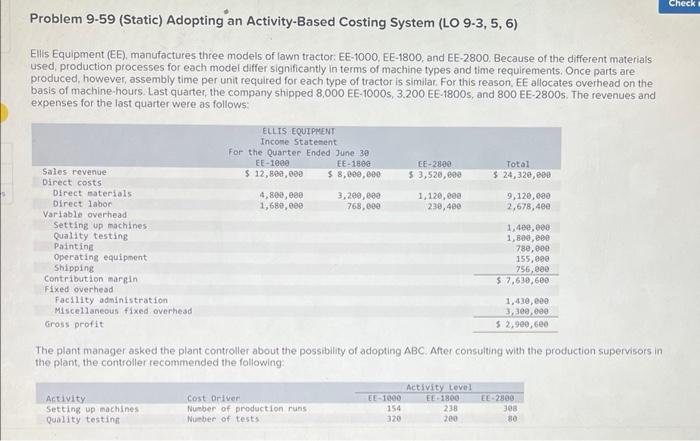

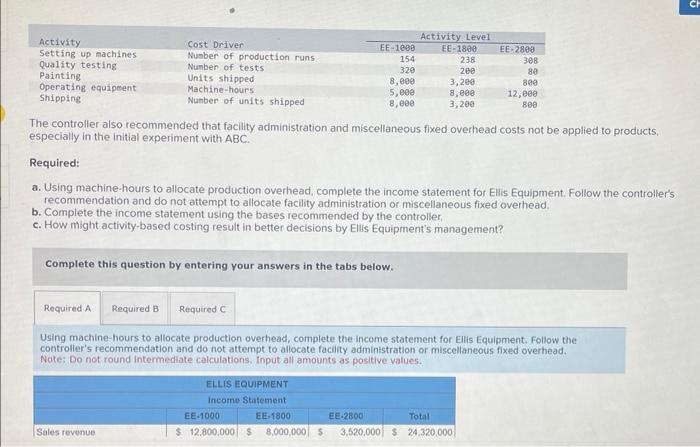

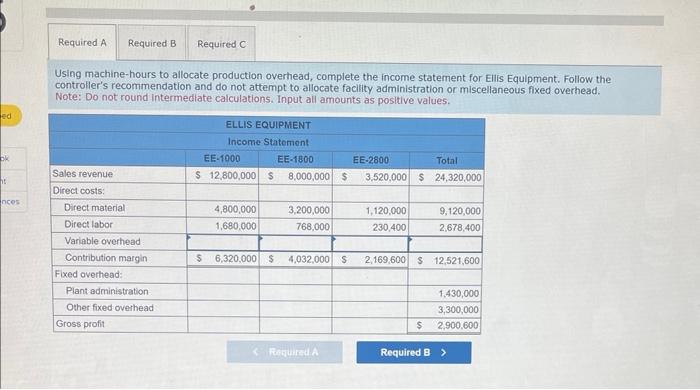

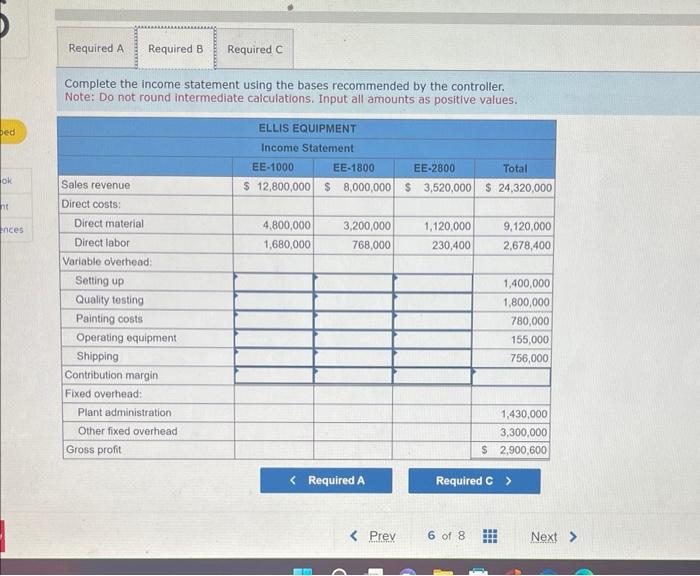

Problem 9-59 (Static) Adopting an Activity-Based Costing System ( LO 93,5,6) Elifs Equipment (EE), manufactures three models of lawn tractor: EE-1000, EE-1800, and EE-2800. Because of the different materials used, production processes for each model differ significantly in terms of machine types and time requirements. Once parts are produced, however, assembly time per unit required for each type of tractor is similar. For this reason, EE allocates overhead on the basis of machine-hours. Last quarter, the company shipped 8,000 EE-1000s, 3.200 EE-1800s, and 800EE2800 s. The revenues and expenses for the last quarter were as follows: The plant manager asked the plant controller about the possibility of adopting ABC. After consulting with the production supervisors in the plant, the controller recommended the following: The controller also recommended that facility administration and miscellaneous fixed overhead costs not be applied to products, especially in the initial experiment with ABC. Required: a. Using machine-hours to allocate production overhead, complete the income statement for Elis Equipment. Follow the controller's recommendation and do not attempt to allocate facility administration or miscellaneous fixed overhead. b. Complete the income statement using the bases recommended by the controller, c. How might activity-based costing result in better decisions by Elils Equipment's management? Complete this question by entering your answers in the tabs below. Using machine-hours to allocate production overhead, complete the income statement for Ellis Equipment. Follow the controller's recommendation and do not attempt to allocate facility administration or miscellaneous fixed overhead. Note: Do not round intermediate calculations, Input all amounts as positive values. Using machine-hours to allocate production overhead, complete the income statement for Elils Equipment. Follow the controller's recommendation and do not attempt to allocate facility administration or miscellaneous fixed overhead. Note: Do not round intermedate calculations. Input all amounts as positive values. Complete the income statement using the bases recommended by the controller. Note: Do not round intermediate calculations. Input all amounts as positive values. especially in the initial experiment with ABC. Required: a. Using machine-hours to allocate production overhead, complete the income statement for Elilis Equipment. Follow the controller's recommendation and do not attempt to allocate facility administration or miscellaneous fixed overhead, b. Complete the income statement using the bases recommended by the controlles. c. How might activity-based costing result in better decisions by Ellis Equipment's management? Complete this question by entering your answers in the tabs below. How might activity-based costing result in better decistons by Ellis Equipment's management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts