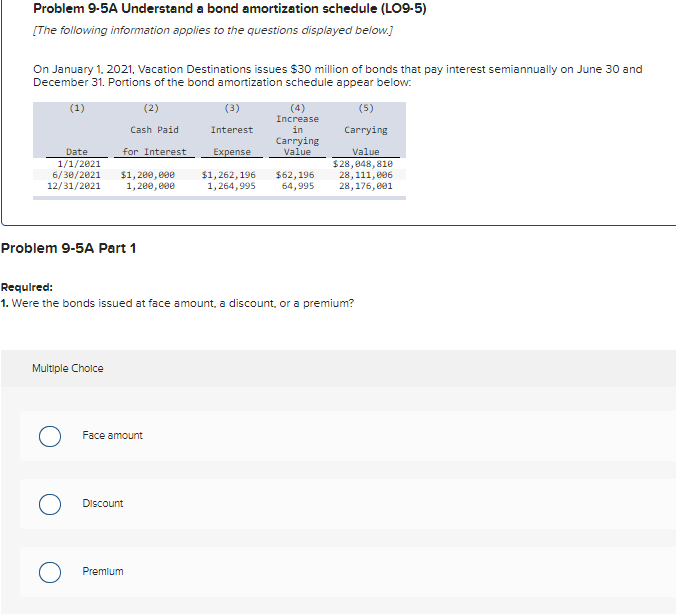

Question: Problem 9-5A Understand a bond amortization schedule (LO9-5) [The following information applies to the questions displayed below.] (4) On January 1, 2021, Vacation Destinations issues

![applies to the questions displayed below.] (4) On January 1, 2021, Vacation](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f787488535a_05666f7874839f47.jpg)

Problem 9-5A Understand a bond amortization schedule (LO9-5) [The following information applies to the questions displayed below.] (4) On January 1, 2021, Vacation Destinations issues $30 million of bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below. (1) (2) (3) (5) Increase Cash Paid Interest in Carrying Carrying for Interest Expense Value Value 1/1/2021 $28,848,810 6/30/2021 $1,200,000 $1,262, 196 $62, 196 28,111,826 12/31/2021 1,2ee, eee 1,264,995 64,995 28,176,891 Date Problem 9-5A Part 1 Required: 1. Were the bonds issued at face amount, a discount, or a premium? Multiple Choice O Face amount Discount Premium 2. What is the original issue price of the bonds? (Enter your answer In dollars, not millions. (I.e., $5.5 million should be entered as 3,500,000).) Issue price 3. What is the face amount of the bonds? (Enter your answer In dollars, not millions. (I.e., $5.5 million should be entered as 5,500,000).) Face amount 4. What is the stated annual interest rate? Stated annual interest rate 5. What is the market annual interest rate? (Round your answer to the nearest whole percent.) Market annual interest rate 6. What is the total cash paid for interest assuming the bonds mature in 10 years? (Enter your answer In dollars, not millions. (l.e., $5.5 million should be entered as 5,500,000).) Total cash interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts