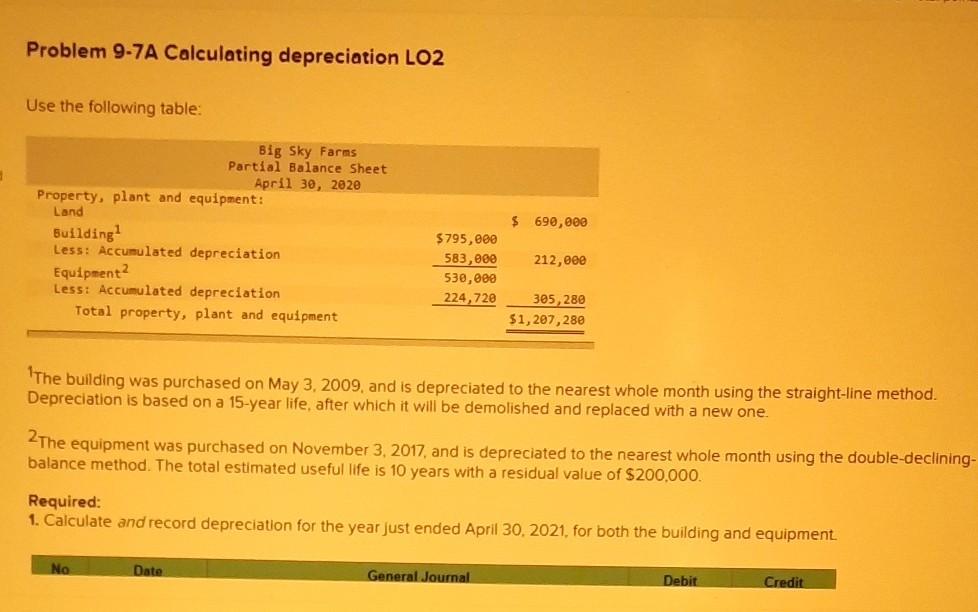

Question: Problem 9-7A Calculating depreciation LO2 Use the following table: Big Sky Farms Partial Balance Sheet April 30, 2020 Property, plant and equipment: Land Building

Problem 9-7A Calculating depreciation LO2 Use the following table: Big Sky Farms Partial Balance Sheet April 30, 2020 Property, plant and equipment: Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Total property, plant and equipment $ 690,000 $795,000 583,000 212,000 530,000 224,728 305,280 $1,207,280 The building was purchased on May 3, 2009, and is depreciated to the nearest whole month using the straight-line method. Depreciation is based on a 15-year life, after which it will be demolished and replaced with a new one. 2The equipment was purchased on November 3, 2017, and is depreciated to the nearest whole month using the double-declining- balance method. The total estimated useful life is 10 years with a residual value of $200,000. Required: 1. Calculate and record depreciation for the year just ended April 30, 2021, for both the building and equipment. No Date General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts