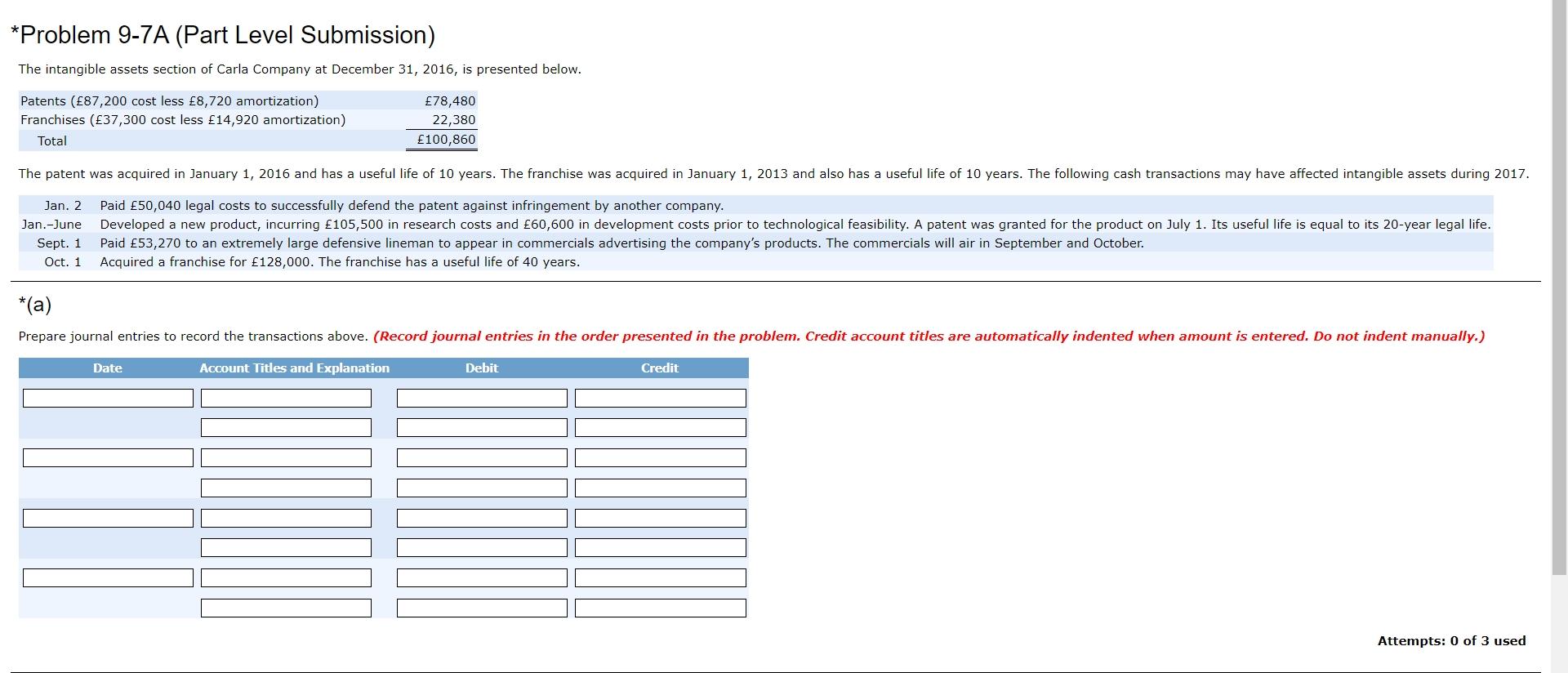

Question: * Problem 9-7A (Part Level Submission) The intangible assets section of Carla Company at December 31, 2016, is presented below. Patents (87,200 cost less 8,720

* Problem 9-7A (Part Level Submission) The intangible assets section of Carla Company at December 31, 2016, is presented below. Patents (87,200 cost less 8,720 amortization) Franchises (37,300 cost less 14,920 amortization) Total 78,480 22,380 100,860 The patent was acquired in January 1, 2016 and has a useful life of 10 years. The franchise was acquired in January 1, 2013 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2017. Jan. 2 Jan.- June Sept. 1 Oct. 1 Paid 50,040 legal costs to successfully defend the patent against infringement by another company. Developed a new product, incurring 105,500 in research costs and 60,600 in development costs prior to technological feasibility. A patent was granted for the product on July 1. Its useful life is equal to its 20-year legal life. Paid 53,270 to an extremely large defensive lineman to appear in commercials advertising the company's products. The commercials will air in September and October. Acquired a franchise for 128,000. The franchise has a useful life of 40 years. *(a) Prepare journal entries to record the transactions above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts