Question: Problem 9-8A Calculate and analyze ratios (L09-8) Selected financial data for Bahama Bay and Caribbean Key are as follows: ($ in millions) Bahama Bay Caribbean

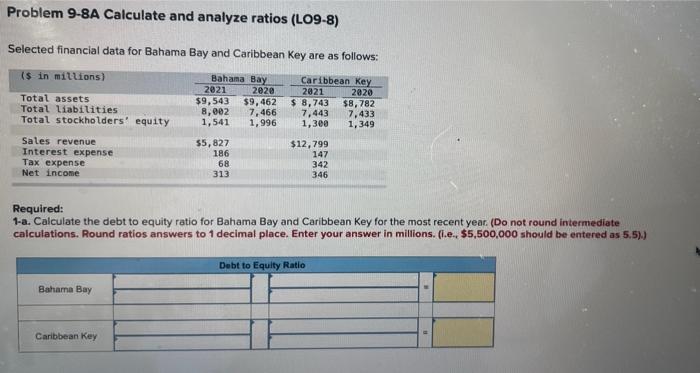

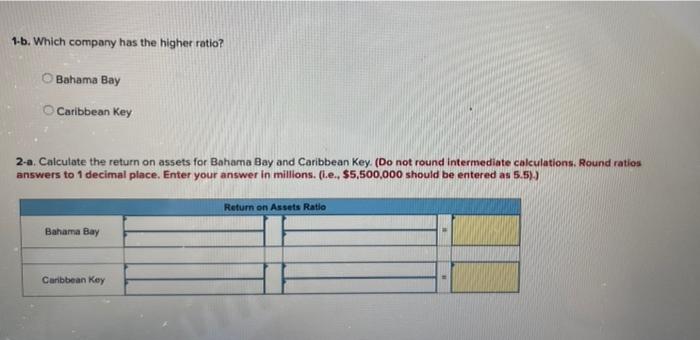

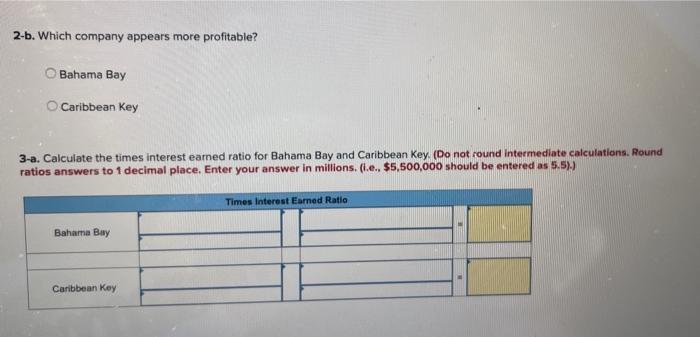

Problem 9-8A Calculate and analyze ratios (L09-8) Selected financial data for Bahama Bay and Caribbean Key are as follows: ($ in millions) Bahama Bay Caribbean Key 2021 2020 2821 2020 Total assets $9,543 $9,462 $ 8,743 $8,782 Total liabilities 8,002 7,466 7,443 7.433 Total stockholders' equity 1,541 1,996 1,300 1,349 Sales revenue Interest expense Tax expense Net income 55,827 186 68 313 $12,799 147 342 346 Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. (Do not round intermediate calculations. Round ratios answers to 1 decimal place. Enter your answer in millions. (i.e., $5,500,000 should be entered as 5.5)) Debt to Equity Ratio Bahama Bay Caribbean Key 1-b. Which company has the higher ratio? Bahama Bay Caribbean Key 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key. (Do not round intermediate calculations. Round ratios answers to 1 decimal place. Enter your answer in millions. (l.e., $5,500,000 should be entered as 5.5).) Return on Assets Ratio Bahama Bay Caribbean Key 2-b. Which company appears more profitable? Bahama Bay Caribbean Key 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key (Do not round Intermediate calculations. Round ratios answers to 1 decimal place. Enter your answer in millions. (i.e., $5,500,000 should be entered as 5.5).) Times Interest Earned Ratio Bahama Bay Caribbean Koy 3-b. Which company is better able to meet interest payments as they become due? Bahama Bay Caribbean Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts