Question: Problem 9-92A (Algorithmic) Entries for and Financial Statement Presentation of a Note Perez Company borrowed $54,000 from the First National Bank on June 1, 2019,

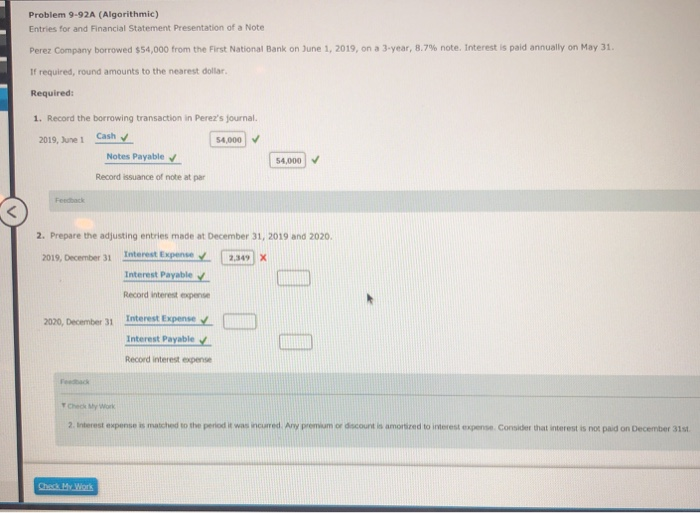

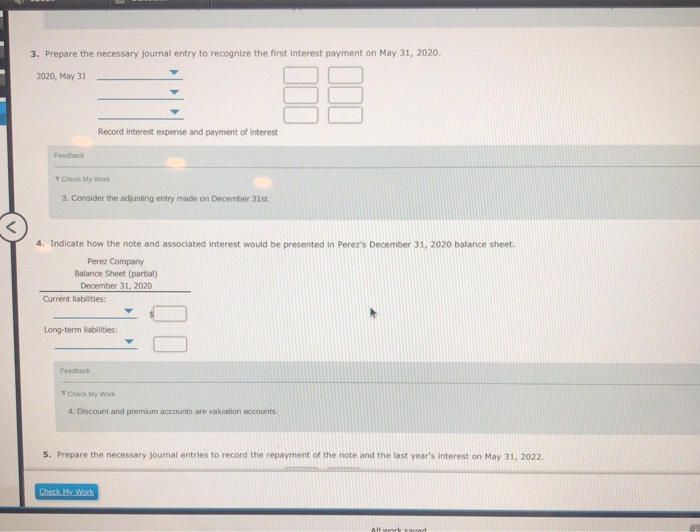

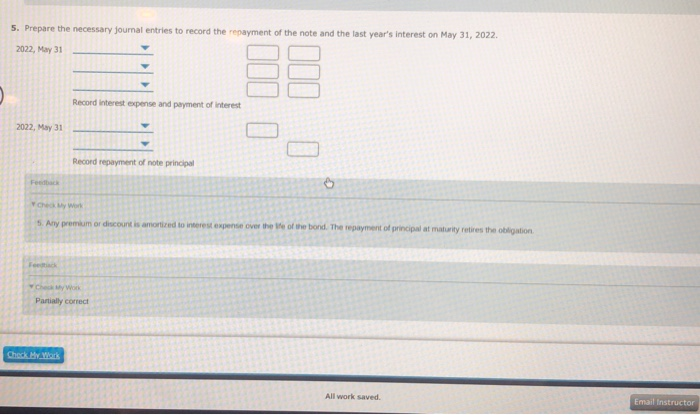

Problem 9-92A (Algorithmic) Entries for and Financial Statement Presentation of a Note Perez Company borrowed $54,000 from the First National Bank on June 1, 2019, on a 3-year, 8.7% note. Interest is paid annually on May 31. If required, round amounts to the nearest dollar. Required: 1. Record the borrowing transaction in Perez's journal. 54,000 2019, June 1 Cash Notes Payable 54,000 Record issuance of note at par Feedback 2. Prepare the adjusting entries made at December 31, 2019 and 2020. 2019, December 31 Interest Exponse2.349x Interest Payable Record interest expense 2020, December 31 Interest Expense Interest Payable Record interest expensae Feedback Check My work expense is matched to the period it was incured Any premium or dscount is amortized to interest expense. Consider that interest is not paid on December 31st 3. Prepare the necessary journal entry to recognize the first interest payment on May 31, 2020 2020, May 31 Record interest expense and payment of interest Check My Work 3. Consider the adjusting entry made on December 31st 4. Indicate how the note and associated interest would be presented in Perez's December 31, 2020 balance sheet. Perez Company Balance Sheet (partial) December 31, 2020 Currnt liabilities: Long-term liabilities: Check My Work 4. Discount and premium accounts are valuation accounts s. Prepare the necessary journal entries to record the repayment of the note and the last year's interest on May 31, 2022. Check My Work 5. Prepare the necessary journal entries to record the repayment of the note and the last year's interest on May 31, 2022 2022, May 3 Record interest expense and payment of interest 2022, May 31 Record repayment of note principal S Any premium or discount is amortized to inerest expense over the te of the bond. The repayment of principal at maturity retires the obligation Partially correct All work saved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts