Question: Problem A 1. A credit card statement for July showed these transactions: July 1 Previous balance $ 2000.00 July 6 Purchase $ 500.00 July 14

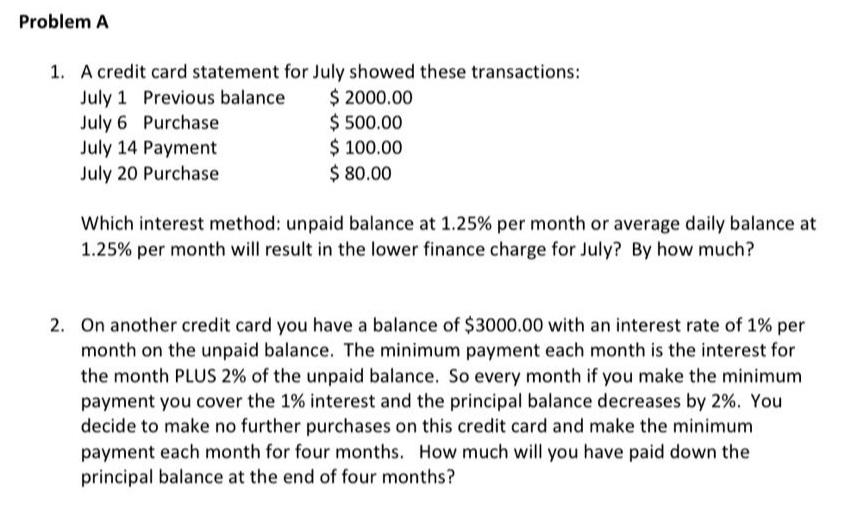

Problem A 1. A credit card statement for July showed these transactions: July 1 Previous balance $ 2000.00 July 6 Purchase $ 500.00 July 14 Payment $ 100.00 July 20 Purchase $ 80.00 Which interest method: unpaid balance at 1.25% per month or average daily balance at 1.25% per month will result in the lower finance charge for July? By how much? 2. On another credit card you have a balance of $3000.00 with an interest rate of 1% per month on the unpaid balance. The minimum payment each month is the interest for the month PLUS 2% of the unpaid balance. So every month if you make the minimum payment you cover the 1% interest and the principal balance decreases by 2%. You decide to make no further purchases on this credit card and make the minimum payment each month for four months. How much will you have paid down the principal balance at the end of four months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts