Question: Problem A - 2 2 ( Static ) Compute Net Present Value Lodi Fabrication is evaluating a proposal to purchase a new turbine to replace

Problem AStatic Compute Net Present Value

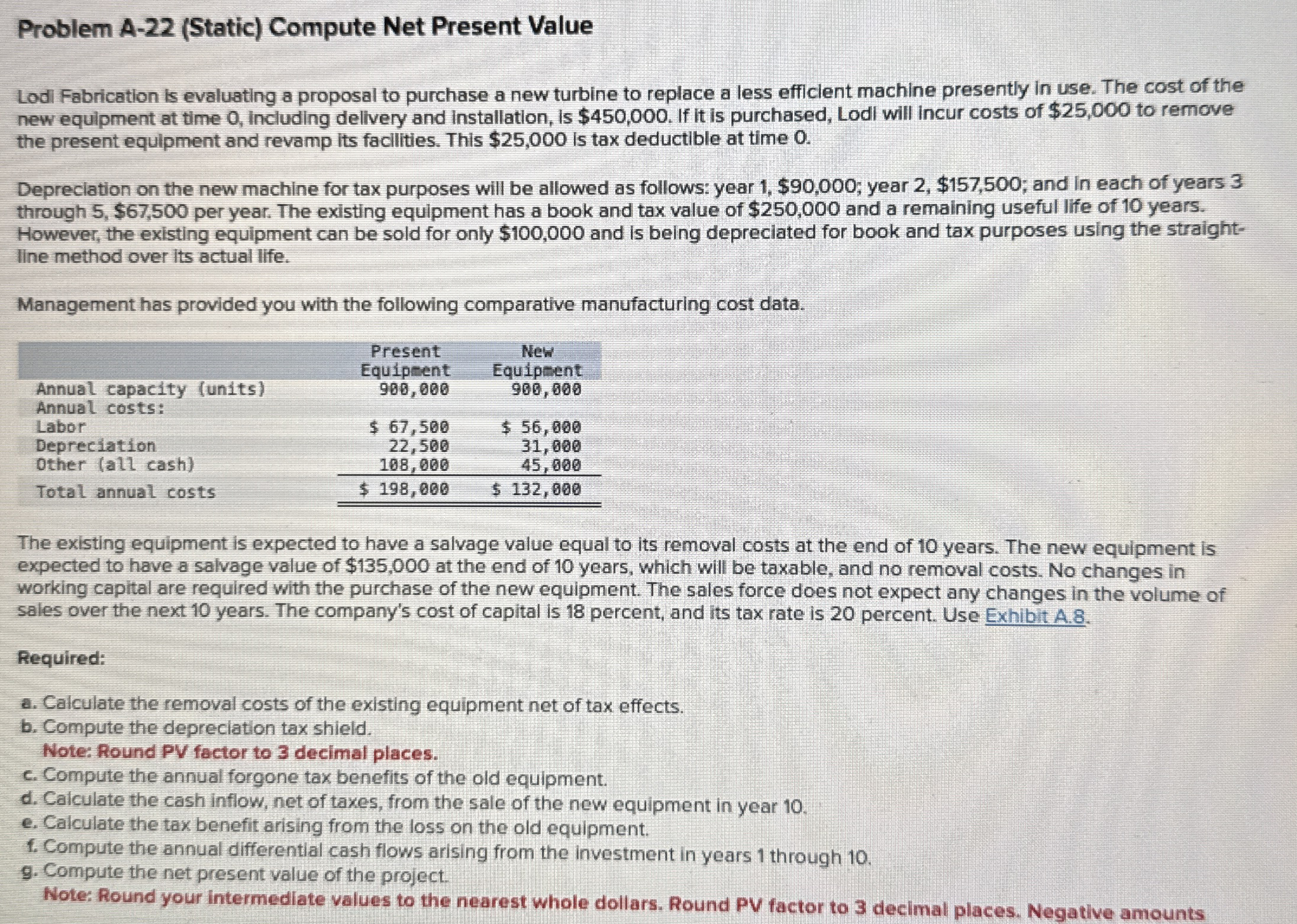

Lodi Fabrication is evaluating a proposal to purchase a new turbine to replace a less efficlent machine presently in use. The cost of the new equipment at time Including dellvery and installation, is $ If it is purchased, Lodi will incur costs of $ to remove the present equipment and revamp its facilities. This $ is tax deductible at time

Depreclation on the new machine for tax purposes will be allowed as follows: year $; year $; and in each of years through $ per year. The existing equipment has a book and tax value of $ and a remaining useful life of years. However, the existing equipment can be sold for only $ and is being depreciated for book and tax purposes using the straightline method over its actual life.

Management has provided you with the following comparative manufacturing cost data.

tablePresent Equipment,tableNeVEquipinentAnnual capacity unitsAnnual costs:,,Labor$ $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock