Question: Problem A (2 points) On October 1, 20x1, ABC Company settled an amount of P48,000 for the renewal of its insurance policy for three years.

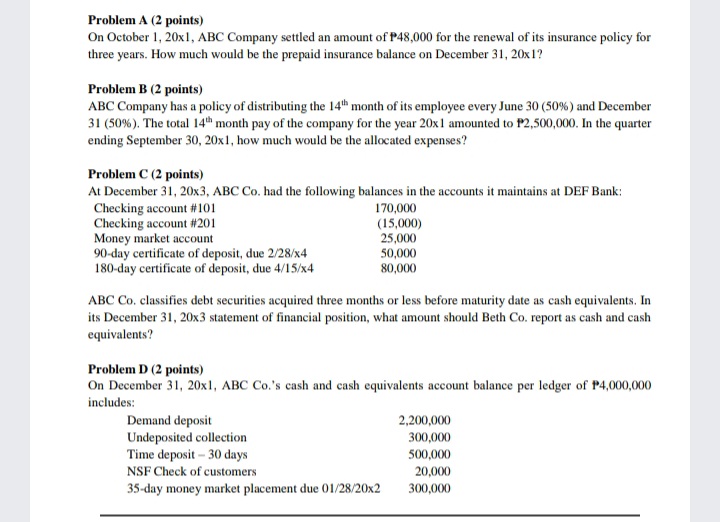

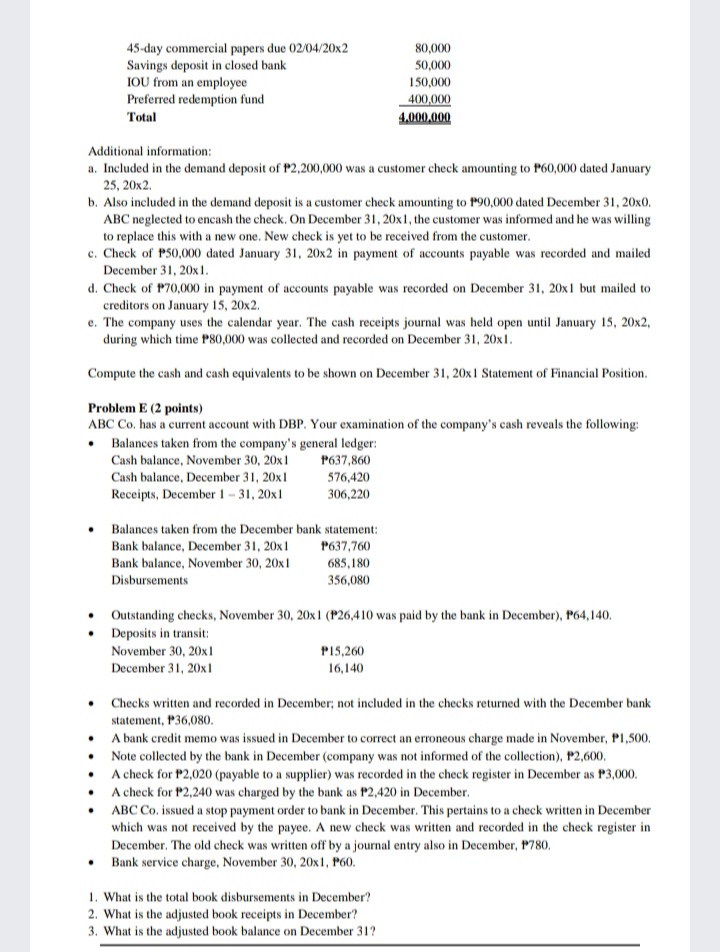

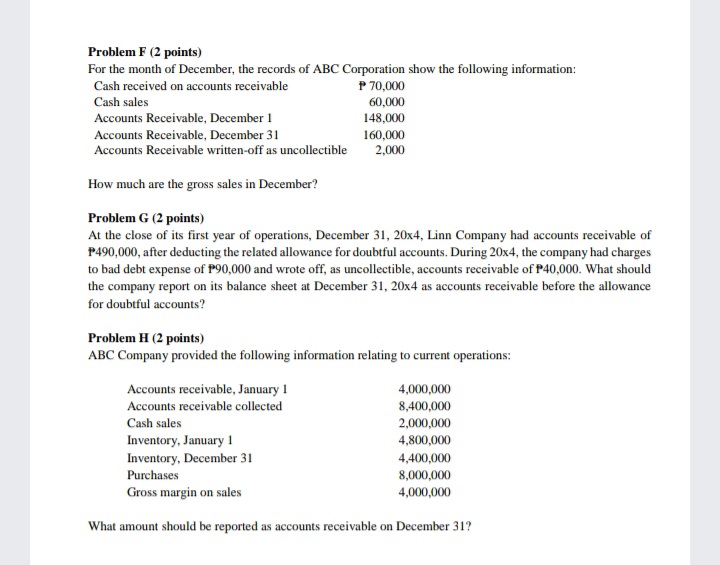

Problem A (2 points) On October 1, 20x1, ABC Company settled an amount of P48,000 for the renewal of its insurance policy for three years. How much would be the prepaid insurance balance on December 31, 20x 1? Problem B (2 points) ABC Company has a policy of distributing the 14" month of its employee every June 30 (50% ) and December 31 (50%). The total 14" month pay of the company for the year 20x 1 amounted to P2,500,000. In the quarter ending September 30, 20x1, how much would be the allocated expenses? Problem C (2 points) At December 31, 20x3, ABC Co. had the following balances in the accounts it maintains at DEF Bank: Checking account #101 170,000 Checking account #201 (15,000) Money market account 25,000 90-day certificate of deposit, due 2/28/x4 50,000 180-day certificate of deposit, due 4/15/x4 80,000 ABC Co. classifies debt securities acquired three months or less before maturity date as cash equivalents. In its December 31, 20x3 statement of financial position, what amount should Beth Co. report as cash and cash equivalents? Problem D (2 points) On December 31, 20x1, ABC Co.'s cash and cash equivalents account balance per ledger of P4,000,000 includes: Demand deposit 2,200,000 Undeposited collection 300,000 Time deposit - 30 days 500,000 NSF Check of customers 20,000 35-day money market placement due 01/28/20x2 300,00045-day commercial papers due 02/04/20x2 80,000 Savings deposit in closed bank 50,000 IOU from an employee 150,000 Preferred redemption fund 400,000 Total 4,000.000 Additional information: a. Included in the demand deposit of P2,200,000 was a customer check amounting to P60,000 dated January 25, 20x2. b. Also included in the demand deposit is a customer check amounting to P90,000 dated December 31, 20x0. ABC neglected to encash the check. On December 31, 20x1, the customer was informed and he was willing to replace this with a new one. New check is yet to be received from the customer. c. Check of P50,000 dated January 31. 20x2 in payment of accounts payable was recorded and mailed December 31, 20x1. d. Check of P70,000 in payment of accounts payable was recorded on December 31, 20x1 but mailed to creditors on January 15, 20x2. e. The company uses the calendar year. The cash receipts journal was held open until January 15, 20x2, during which time P80,000 was collected and recorded on December 31, 20x1. Compute the cash and cash equivalents to be shown on December 31, 20x 1 Statement of Financial Position. Problem E (2 points) ABC Co. has a current account with DBP. Your examination of the company's cash reveals the following: Balances taken from the company's general ledger: Cash balance, November 30, 20x 1 P637,860 Cash balance, December 31, 20x1 576,420 Receipts, December 1 - 31, 20x1 306,220 Balances taken from the December bank statement: Bank balance, December 31, 20x 1 P637,760 Bank balance, November 30, 20x1 685,180 Disbursements 356.080 Outstanding checks, November 30, 20x1 (P26,410 was paid by the bank in December), P64,140. . Deposits in transit: November 30, 20x1 P15,260 December 31, 20x1 16,140 Checks written and recorded in December, not included in the checks returned with the December bank statement, P36,080. A bank credit memo was issued in December to correct an erroneous charge made in November, PI,500. Note collected by the bank in December (company was not informed of the collection), P2,600. . . A check for P2,020 (payable to a supplier) was recorded in the check register in December as P3,000. A check for P2,240 was charged by the bank as P2,420 in December. ABC Co, issued a stop payment order to bank in December. This pertains to a check written in December which was not received by the payee. A new check was written and recorded in the check register in December. The old check was written off by a journal entry also in December, P780. Bank service charge, November 30, 20x1, P60. 1. What is the total book disbursements in December? 2. What is the adjusted book receipts in December? 3. What is the adjusted book balance on December 31?Problem F (2 points) For the month of December, the records of ABC Corporation show the following information: Cash received on accounts receivable P 70,000 Cash sales 60,000 Accounts Receivable, December 1 148.000 Accounts Receivable, December 31 160,000 Accounts Receivable written-off as uncollectible 2,000 How much are the gross sales in December? Problem G (2 points) At the close of its first year of operations, December 31, 20x4, Linn Company had accounts receivable of P490,000, after deducting the related allowance for doubtful accounts. During 20x4, the company had charges to bad debt expense of P90,000 and wrote off, as uncollectible, accounts receivable of P40,000. What should the company report on its balance sheet at December 31, 20x4 as accounts receivable before the allowance for doubtful accounts? Problem H (2 points) ABC Company provided the following information relating to current operations: Accounts receivable, January 1 4,000,000 Accounts receivable collected 8,400,000 Cash sales 2,000,000 Inventory, January 1 4,800,000 Inventory, December 31 4,400,000 Purchases 8,000,000 Gross margin on sales 4,000,000 What amount should be reported as accounts receivable on December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts