Question: Problem: a . Last January there were 7 , 0 0 0 sales at $ 4 5 each. This year the company expects to sell

Problem:

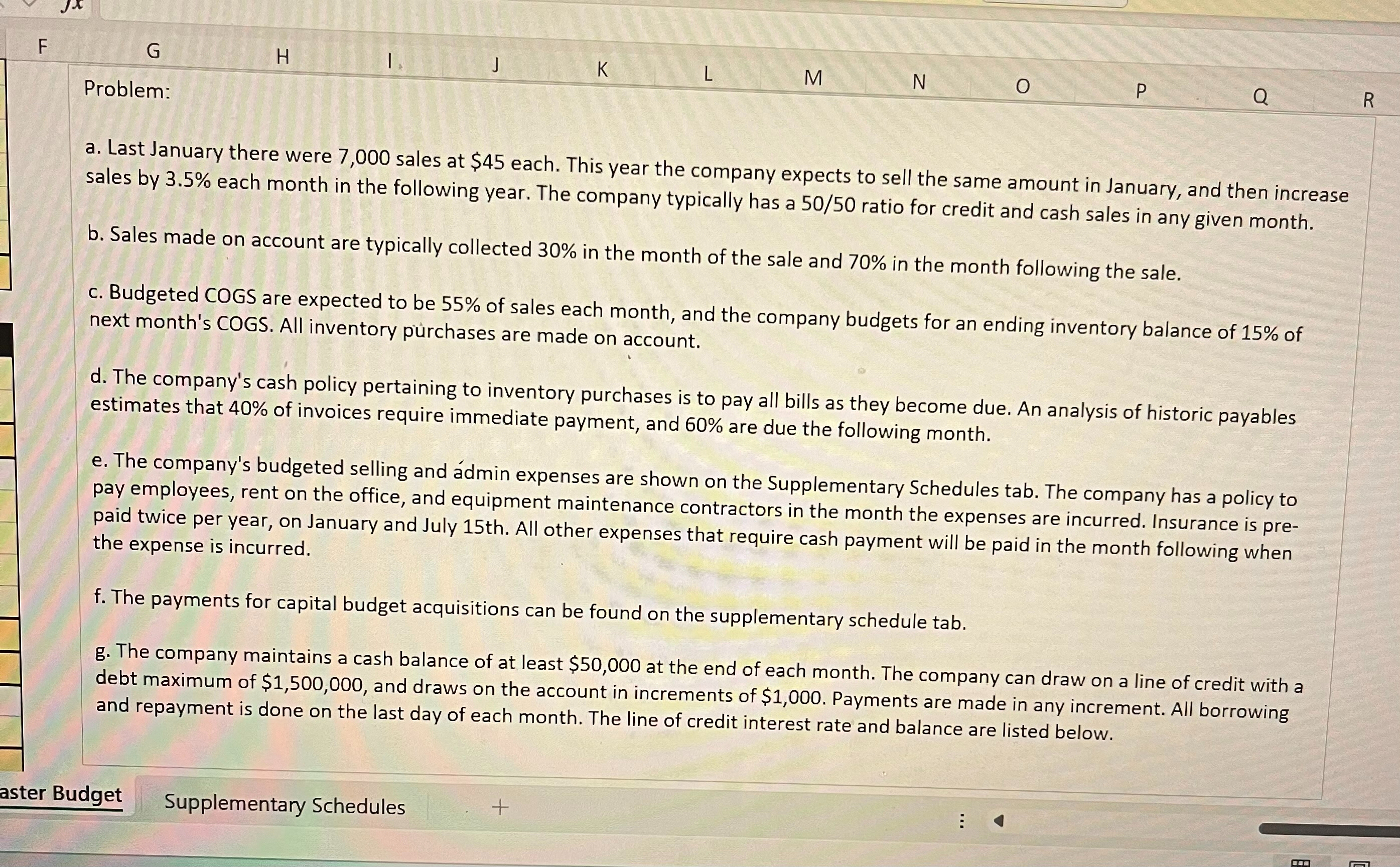

a Last January there were sales at $ each. This year the company expects to sell the same amount in January, and then increase

sales by each month in the following year. The company typically has a ratio for credit and cash sales in any given month.

b Sales made on account are typically collected in the month of the sale and in the month following the sale.

c Budgeted COGS are expected to be of sales each month, and the company budgets for an ending inventory balance of of

next month's COGS. All inventory prchases are made on account.

d The company's cash policy pertaining to inventory purchases is to pay all bills as they become due. An analysis of historic payables

estimates that of invoices require immediate payment, and are due the following month.

e The company's budgeted selling and dmin expenses are shown on the Supplementary Schedules tab. The company has a policy to

pay employees, rent on the office, and equipment maintenance contractors in the month the expenses are incurred. Insurance is pre

paid twice per year, on January and July th All other expenses that require cash payment will be paid in the month following when

the expense is incurred.

f The payments for capital budget acquisitions can be found on the supplementary schedule tab.

g The company maintains a cash balance of at least $ at the end of each month. The company can draw on a line of credit with a

debt maximum of $ and draws on the account in increments of $ Payments are made in any increment. All borrowing

and repayment is done on the last day of each month. The line of credit interest rate and balance are listed below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock