Question: Problem A mining firm estimates that it needs to make an initial investment of 0.5 million in order to employ a new mining method. Geologists

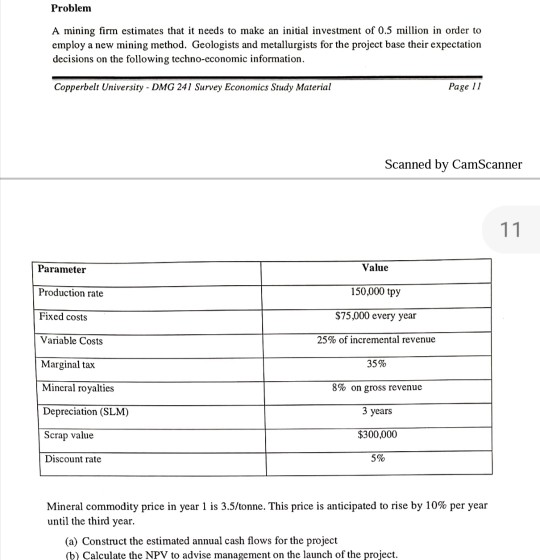

Problem A mining firm estimates that it needs to make an initial investment of 0.5 million in order to employ a new mining method. Geologists and metallurgists for the project base their expectation decisions on the following techno-economic information. Copperbelt University- DMG 241 Survey Economics Study Material Page 11 Scanned by CamScanner 11 Value Parameter 150,000 tpy Production rate Fixed costs $75,000 every year 25% of incremental revenue Variable Costs Marginal tax 35% Mineral royalties 8% on gross revenue Depreciation (SLM) 3 years $300,000 Scrap value Discount rate Mineral commodity price in year 1 is 3.5/tonne. This price is anticipated to rise by 10% per year until the third ycar. (a) Construct the estimated annual cash flows for the project (b) Calculate the NPV to advise management on the launch of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts