Question: Problem: a pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the

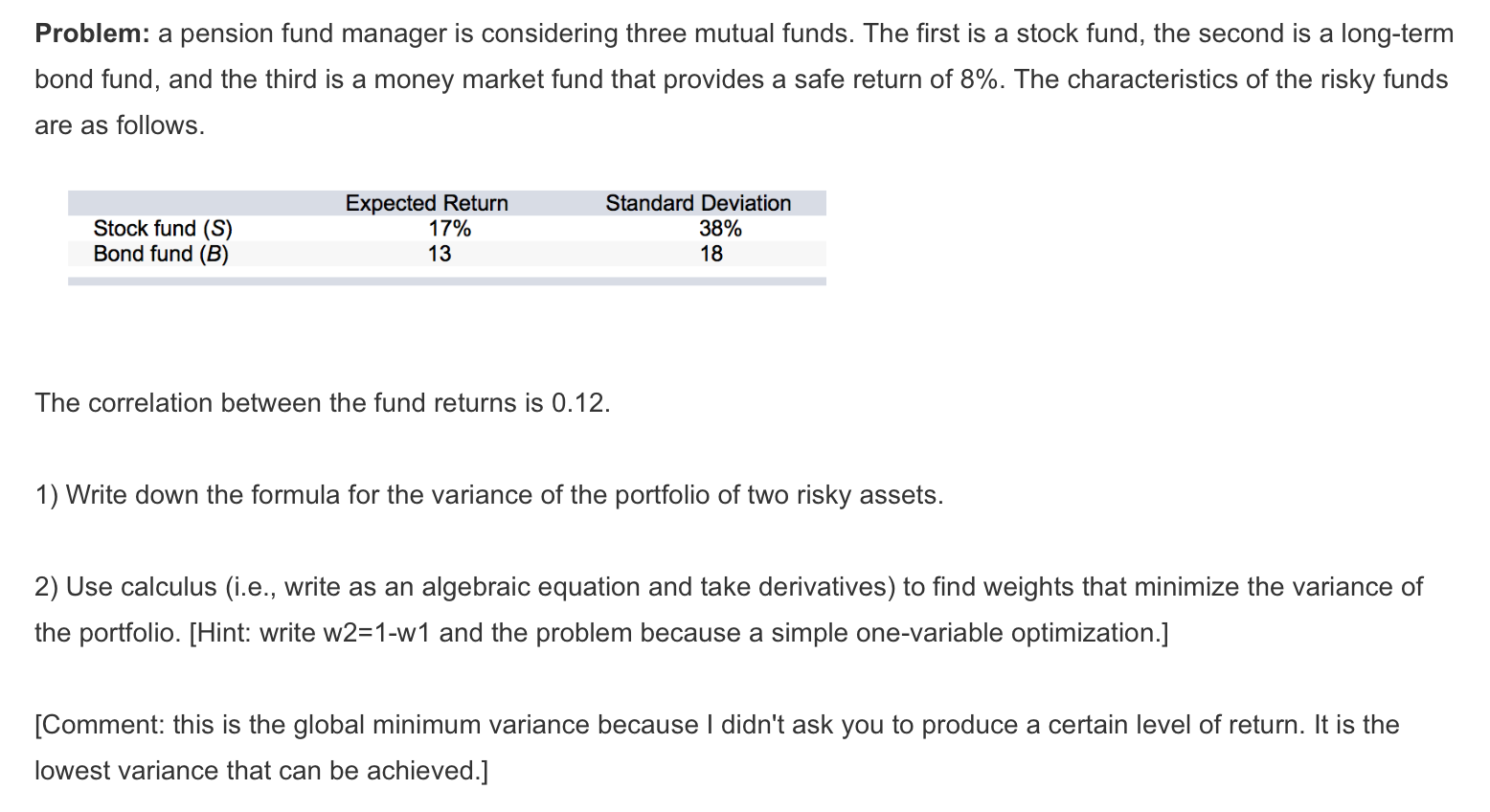

Problem: a pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows. Stock fund (S) Bond fund (B) Expected Return 17% 13 Standard Deviation 38% 18 The correlation between the fund returns is 0.12. 1) Write down the formula for the variance of the portfolio of two risky assets. 2) Use calculus (i.e., write as an algebraic equation and take derivatives) to find weights that minimize the variance of the portfolio. [Hint: write w2=1-w1 and the problem because a simple one-variable optimization.] [Comment: this is the global minimum variance because I didn't ask you to produce a certain level of return. It is the lowest variance that can be achieved.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts