Question: problem ACCT 2301 - SU2020 Homework: Comprehensive Problem 2 Score: 0 of 10 pts 1 of 1 (0 complete) Comp6-1 (similar to) The Harris Lamp

problem

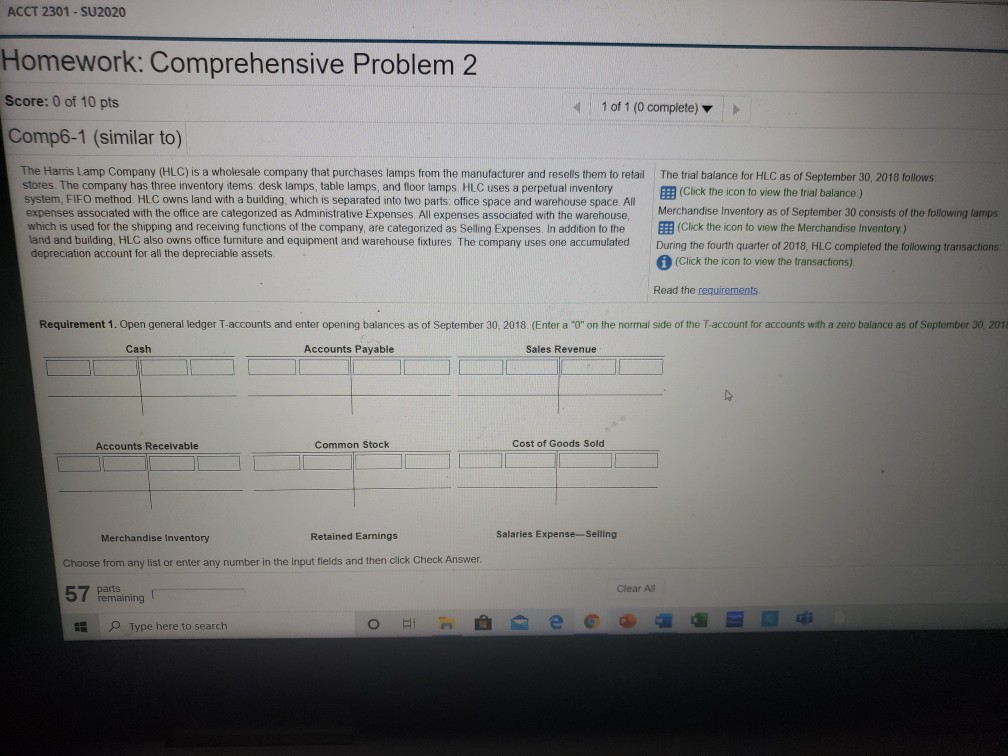

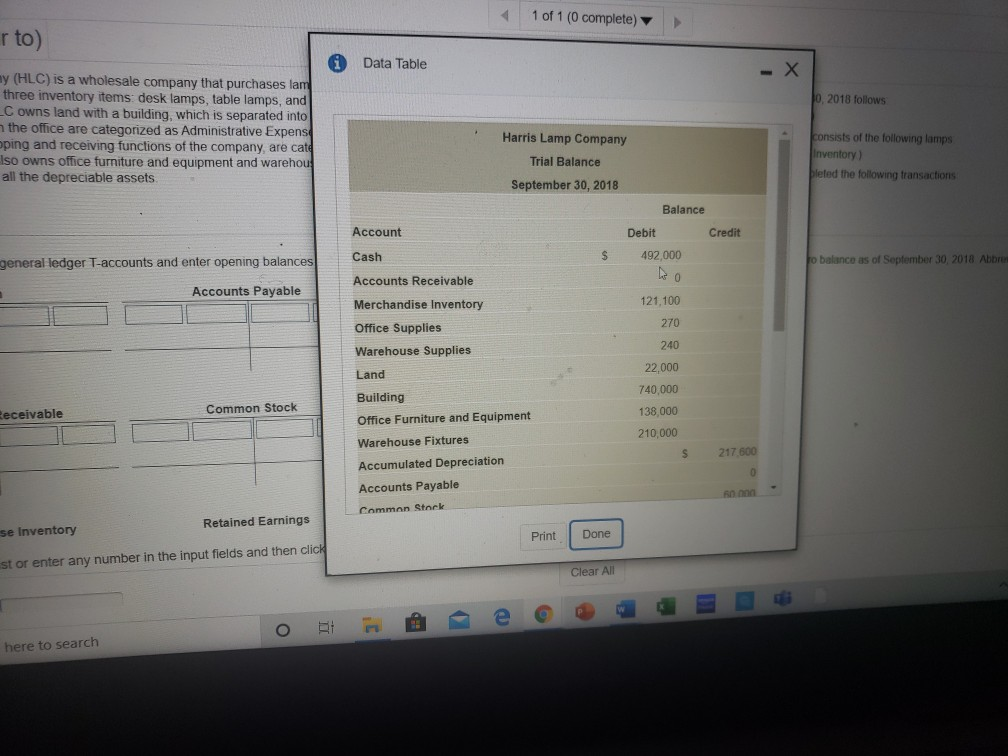

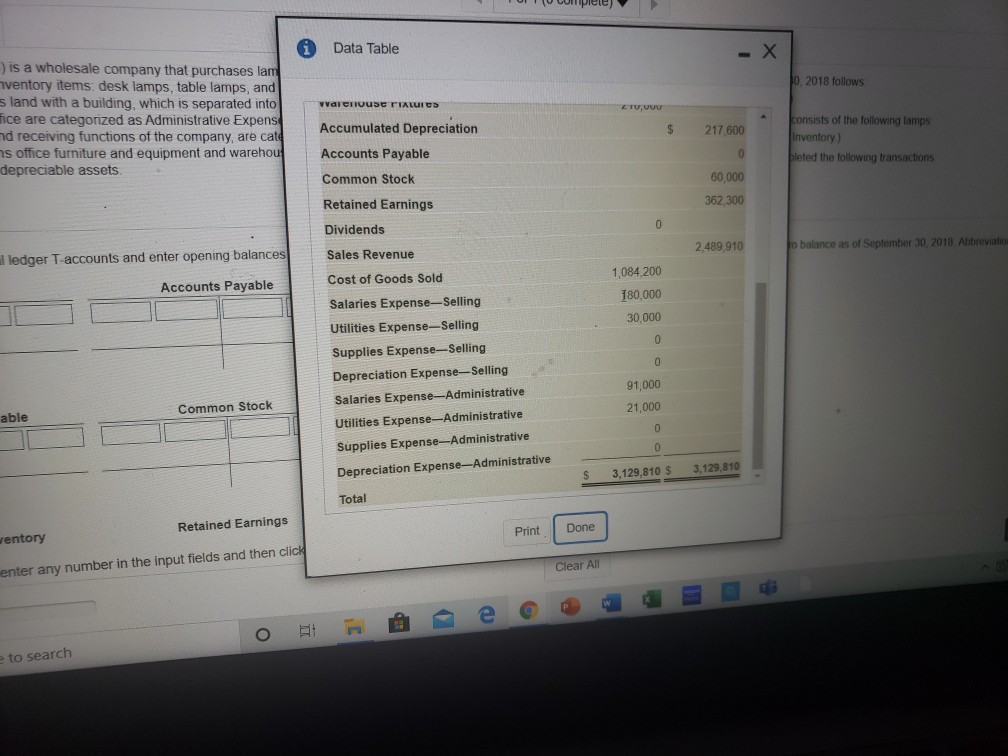

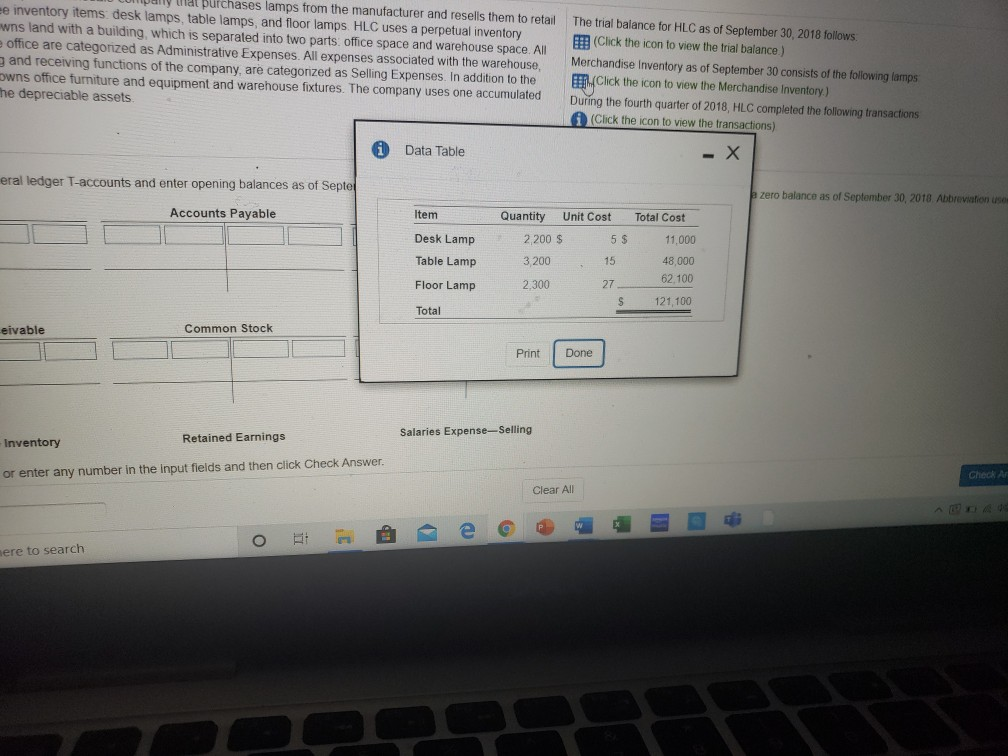

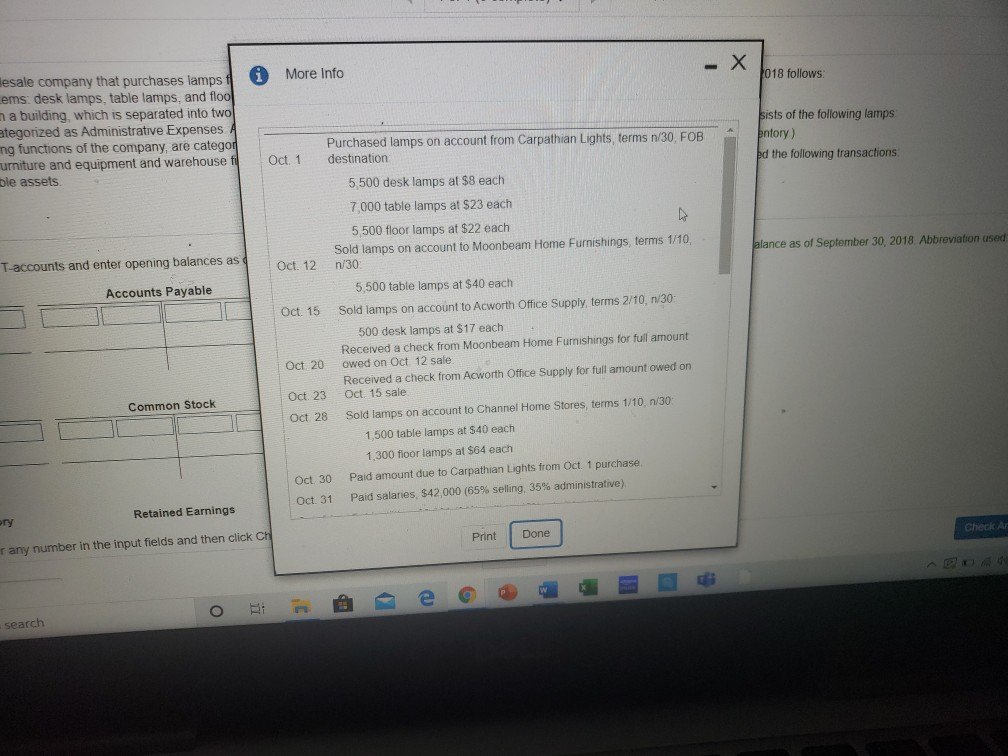

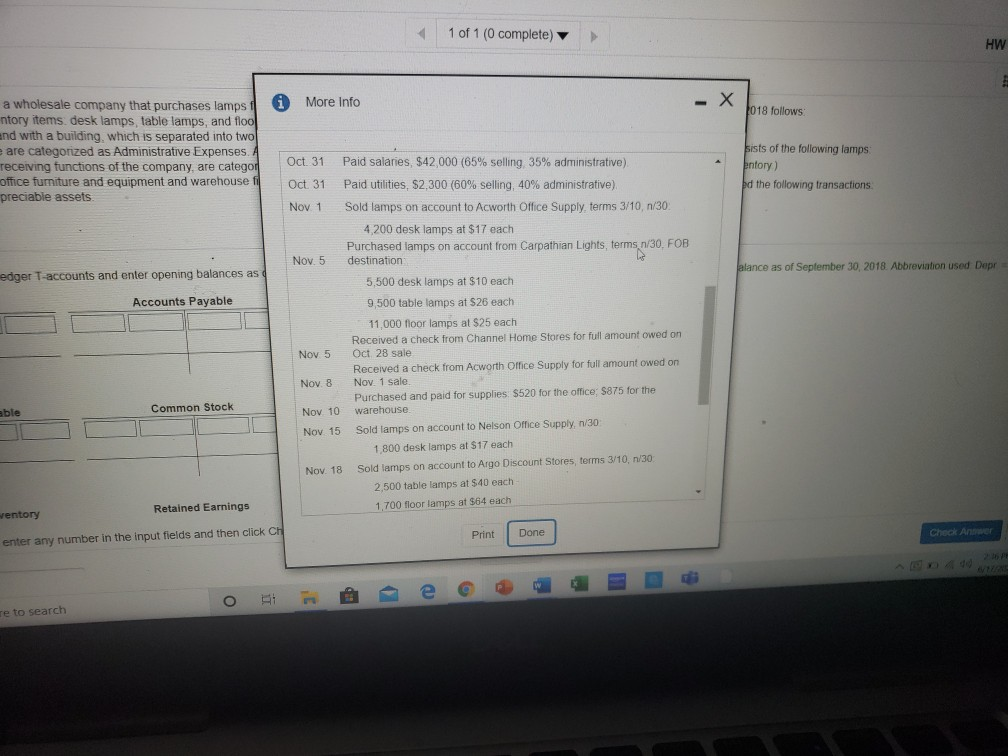

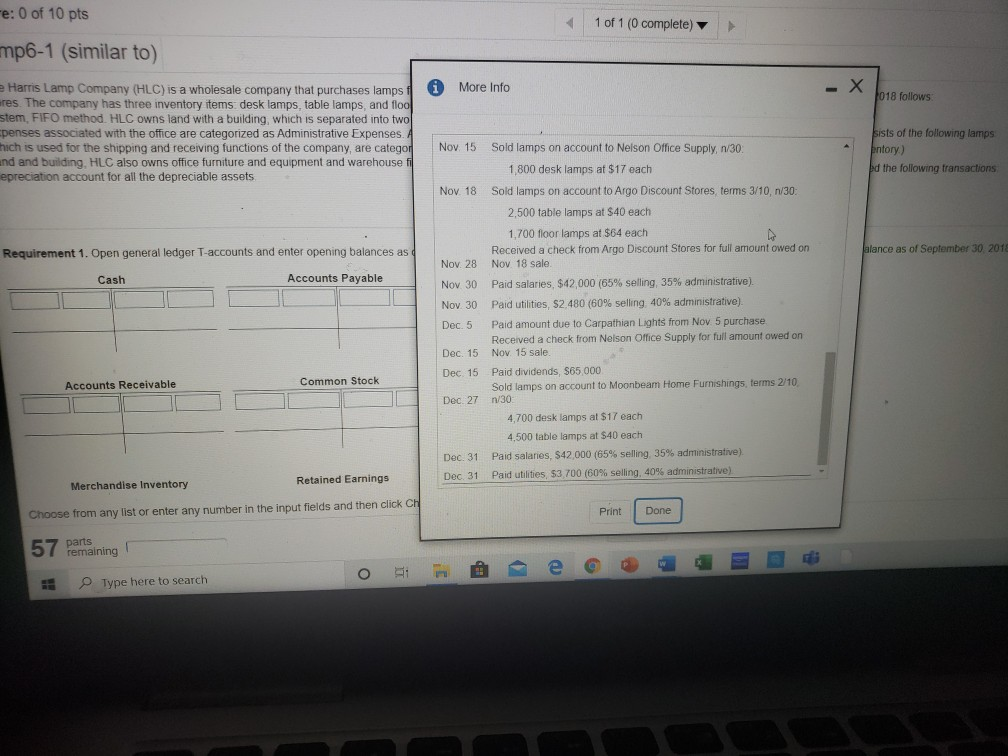

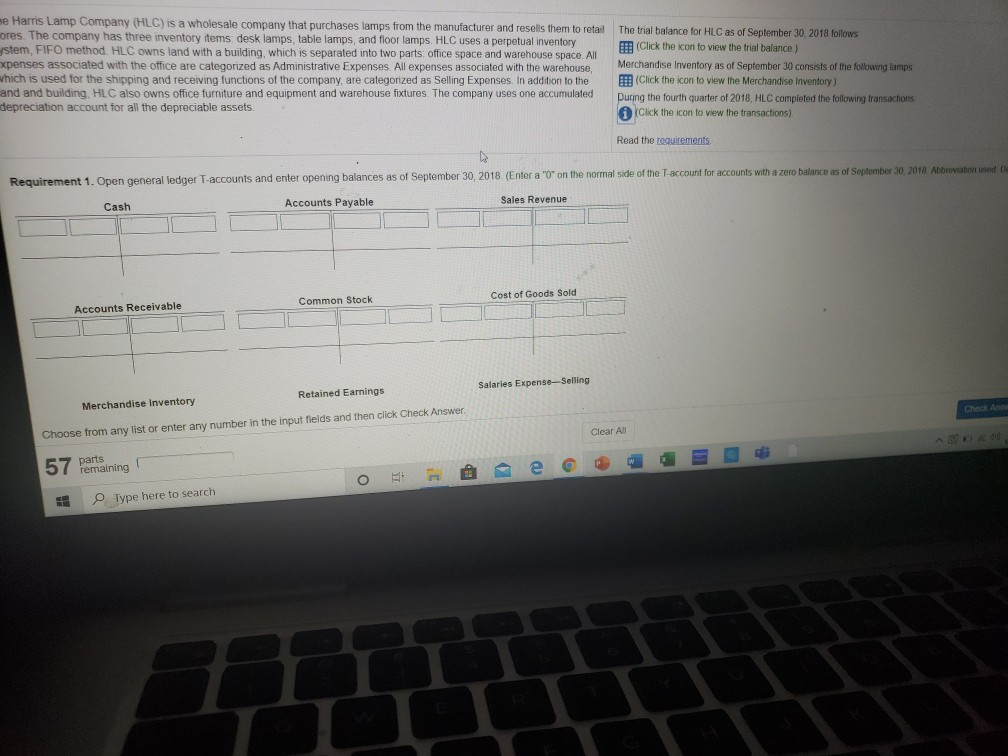

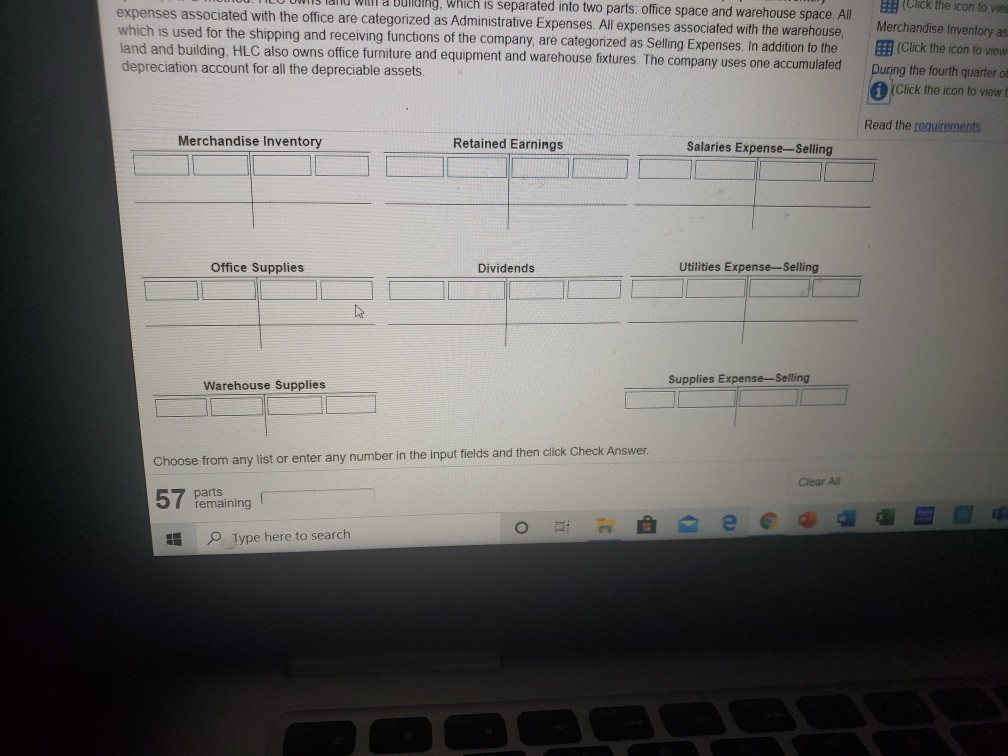

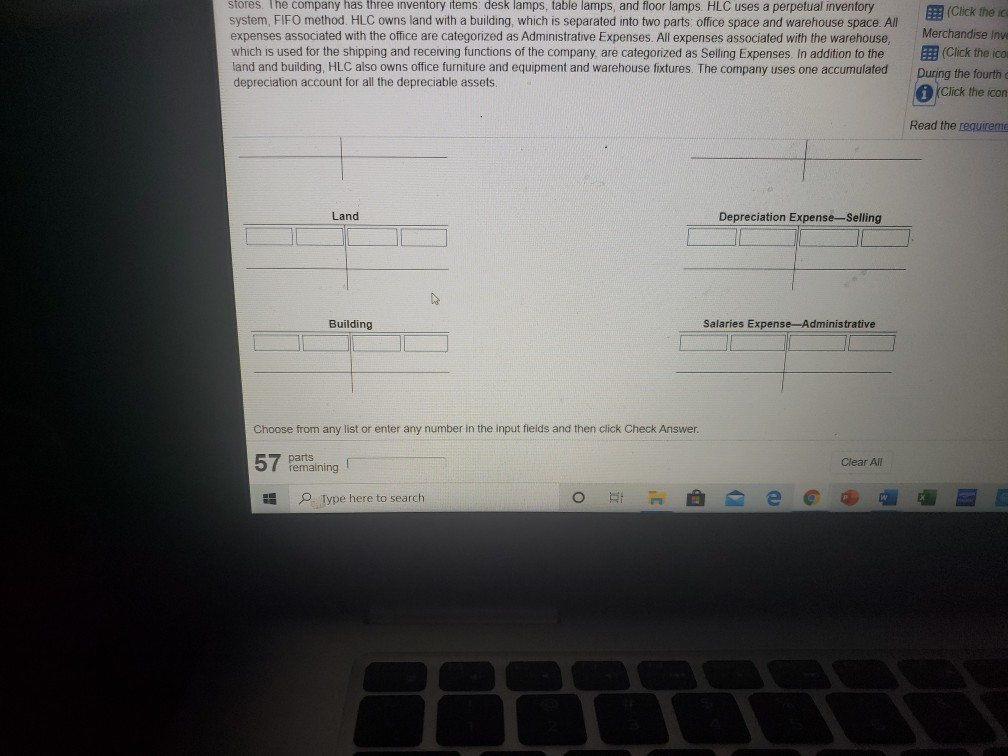

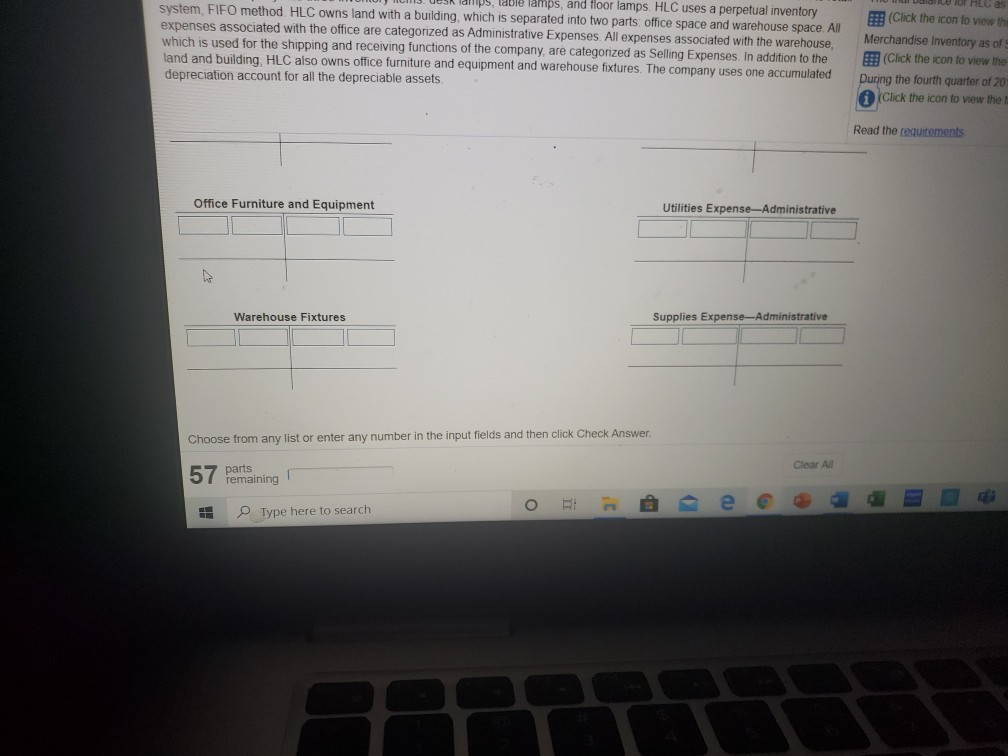

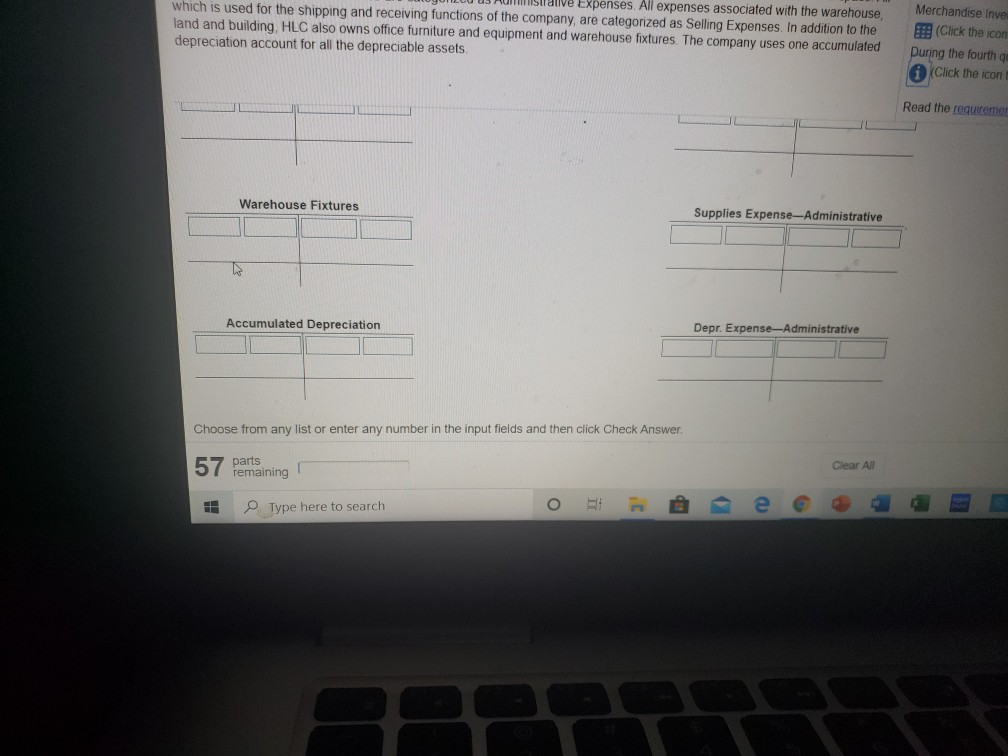

ACCT 2301 - SU2020 Homework: Comprehensive Problem 2 Score: 0 of 10 pts 1 of 1 (0 complete) Comp6-1 (similar to) The Harris Lamp Company (HLC) is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps HLC uses a perpetual inventory system, FIFO method. HLC owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets The trial balance for HLC as of September 30, 2018 follows: (Click the icon to view the trial balance.) Merchandise Inventory as of September 30 consists of the following lamps EE (Click the icon to view the Merchandise Inventory) During the fourth quarter of 2018, HLC completed the following transachons (Click the icon to view the transactions) Read the requirements Requirement 1. Open general ledger T-accounts and enter opening balances as of September 30, 2018. (Enter a "0" on the normal side of the T-account for accounts with a zero balance as of September 30, 2012 Cash Accounts Payable Sales Revenue Accounts Receivable Common Stock Cost of Goods Sold Merchandise Inventory Retained Earnings Salaries Expense-Selling Choose from any list or enter any number in the input fields and then click Check Answer Clear All 57 parts remaining Type here to search 1 of 1 (0 complete) rto) Data Table 0. 2018 follows ay (HLC) is a wholesale company that purchases lam three inventory items desk lamps, table lamps, and LC owns land with a building, which is separated into the office are categorized as Administrative Expense oping and receiving functions of the company, are cate Iso owns office furniture and equipment and warehou all the depreciable assets. Harris Lamp Company Trial Balance consists of the following lamps Inventory) pleted the following transactions September 30, 2018 Balance Debit Credit Account Cash S 492,000 general ledger T-accounts and enter opening balances to balance as of September 30, 2018 Abbre Accounts Payable Accounts Receivable Merchandise Inventory Office Supplies Warehouse Supplies 121,100 270 240 22,000 Land 740,000 Receivable Common Stock 138,000 210,000 Building Office Furniture and Equipment Warehouse Fixtures Accumulated Depreciation Accounts Payable Common Stock s 217 600 0 Retained Earnings se Inventory Print Done st or enter any number in the input fields and then click Clear All e o - C here to search plete Data Table -X 10. 2018 follows vvarruser LUIS TU; ) is a wholesale company that purchases lam ventory items: desk lamps, table lamps, and s land with a building, which is separated into fice are categorized as Administrative Expens nd receiving functions of the company, are cate s office furniture and equipment and warehou depreciable assets GA 217 600 Accumulated Depreciation Accounts Payable consists of the following lamps Inventory) bleted the following transactions 0 Common Stock 60,000 362,300 Retained Earnings Dividends 0 2,489,910 to balance as of September 30, 2018 Abbreviatio Sales Revenue al ledger T accounts and enter opening balances Accounts Payable 1,084 200 180.000 30,000 0 0 Cost of Goods Sold Salaries Expense-Selling Utilities Expense-Selling Supplies Expense-Selling Depreciation Expense-Selling Salaries Expense-Administrative Utilities Expense-Administrative Supplies Expense-Administrative Depreciation Expense-Administrative 91 000 Common Stock 21,000 able 0 0 S 3,129,810 3,129,810 Total Retained Earnings Print Done ventory Clear All enter any number in the input fields and then click to search de purchases lamps from the manufacturer and resells them to retail ee inventory items: desk lamps, table lamps and floor lamps. HLC uses a perpetual inventory wns land with a building, which is separated into two parts office space and warehouse space. All office are categorized as Administrative Expenses. All expenses associated with the warehouse, and receiving functions of the company, are categorized as Selling Expenses. In addition to the owns office furniture and equipment and warehouse fixtures. The company uses one accumulated the depreciable assets. The trial balance for HLC as of September 30, 2018 follows: (Click the icon to view the trial balance) Merchandise Inventory as of September 30 consists of the following lamps HEM Click the icon to view the Merchandise Inventory) During the fourth quarter of 2018, HLC completed the following transactions (Click the icon to view the transactions) Data Table eral ledger T-accounts and enter opening balances as of Septe a zero balance as of September 30, 2018 Abbreviations Accounts Payable Item Total Cost Desk Lamp Quantity Unit Cost 2 200 $ 5 $ 3 200 15 11,000 Table Lamp 48,000 62 100 Floor Lamp 2.300 27 S 121,100 Total eivable Common Stock Print Done Inventory Retained Earnings Salaries Expense-Selling or enter any number in the input fields and then click Check Answer. Check Ar Clear All nere to search - X i More Info 018 follows: Hesale company that purchases lamps ems: desk lamps, table lamps, and floo n a building, which is separated into two ategorized as Administrative Expenses ng functions of the company, are categor urniture and equipment and warehouse til ble assets Purchased lamps on account from Carpathian Lights, terms n/30, FOB destination sists of the following lamps entory) d the following transactions Oct 1 alance as of September 30, 2018 Abbreviation used T-accounts and enter opening balances as Oct 12 Accounts Payable Oct 15 5,500 desk lamps at $8 each 7,000 table lamps at $23 each 5,500 floor lamps at $22 each Sold lamps on account to Moonbeam Home Furnishings, terms 1/10, n/30 5,500 table lamps at $40 each Sold lamps on account to Acworth Office Supply terms 2/10, n/30 500 desk lamps at $17 each Received a check from Moonbeam Home Furnishings for full amount owed on Oct 12 sale Received a check from Acworth Office Supply for full amount owed on Oct 15 sale Sold lamps on account to Channel Home Stores terms 1/10, n/30 1,500 table lamps at $40 each 1,300 floor lamps at $64 each Paid amount due to Carpathian Lights from Oct 1 purchase Paid salaries, $42,000 (65% selling, 35% administrative) Oct 20 Oct. 23 Common Stock Oct 28 Oct 30 Oct 31 Retained Earnings ory Check Print Done rany number in the input fields and then click Ch e search 1 of 1 (0 complete) HW More Info 018 follows a wholesale company that purchases lamps ntory items: desk lamps, table lamps, and floo and with a building, which is separated into two are categorized as Administrative Expenses. A receiving functions of the company, are categor office furniture and equipment and warehouse fi preciable assets Oct 31 sists of the following lamps entory) d the following transactions Oct 31 Nov 1 Nov 5 alance as of September 30, 2018 Abbreviation used Depr edger T-accounts and enter opening balances as Accounts Payable Paid salaries, $42,000 (65% selling, 35% administrative) Paid utilities, $2,300 (60% selling, 40% administrative) Sold lamps on account to Acworth Office Supply, terms 3/10,n/30 4,200 desk lamps at $17 each Purchased lamps on account from Carpathian Lights, terms n/30, FOB destination 5,500 desk lamps at $10 each 9,500 table lamps at 26 each 11,000 floor lamps at $25 each Received a check from Channel Home Stores for full amount owed on Oct 28 sale Received a check from Acworth Office Supply for full amount owed on Nov. 1 sale Purchased and paid for supplies S520 for the office $875 for the warehouse Sold lamps on account to Nelson Office Supply, n/30 1 800 desk lamps at $17 each Sold lamps on account to Argo Discount Stores, terms 3/10, n/30 2.500 table lamps at $40 each 1.700 floor lamps at $64 each Nov 5 Nov. 8 able Common Stock Nov 10 Nov 15 Nov. 18 Retained Earnings wentory Print Done Check Answer enter any number in the input fields and then click CH e re to search Fe: 0 of 10 pts 1 of 1 (0 complete) mp6-1 (similar to) More Info - X 018 follows: e Harris Lamp Company (HLC) is a wholesale company that purchases lamps res. The company has three inventory items desk lamps, table lamps, and floo stem, FIFO method. HLC owns land with a building, which is separated into two penses associated with the office are categorized as Administrative Expenses hich is used for the shipping and receiving functions of the company, are categor and and building, HLC also owns office furniture and equipment and warehouse fi epreciation account for all the depreciable assets sists of the following lamps entory) bed the following transactions Requirement 1. Open general ledger T-accounts and enter opening balances as alance as of September 30 2018 Cash Accounts Payable Nov 15 Sold lamps on account to Nelson Office Supply, n/30 1.800 desk lamps af $17 each Nov. 18 Sold lamps on account to Argo Discount Stores terms 3/10, 1/30 2,500 table lamps at $40 each 1,700 floor lamps at $64 each Received a check from Argo Discount Stores for full amount owed on Nov. 28 Nov 18 sale Nov 30 Paid salaries, $42,000 (65% selling, 35% administrative) Nov. 30 Paid utilities, $2.480 (60% selling 40% administrative) Dec. 5 Paid amount due to Carpathian Lights from Nov 5 purchase Received a check from Nelson Office Supply for full amount owed on Dec. 15 Nov 15 sale. Dec. 15 Paid dividends, S65 000 Sold lamps on account to Moonbeam Home Furnishings, terms 2/10 Dec. 27 n/30 4.700 desk lamps at $17 each 4,500 table lamps at $40 each Dec 31 Paid salaries, S42,000 (65% selling, 35% administrative) Dec 31 Paid utilities, $3 700 (60% selling. 40% administrative) Accounts Receivable Common Stock Retained Earnings Merchandise Inventory Print Done Choose from any list or enter any number in the input fields and then click CH 57 parts remaining O Type here to search me Harris Lamp Company (HLC) is a wholesale company that purchases lamps from the manufacturer and resells them to retail ores. The company has three inventory items desk lamps, table lamps and floor lamps. HLC uses a perpetual inventory ystem, FIFO method. HLC owns land with a building, which is separated into two parts office space and warehouse space. All xpenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the and and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. The trial balance for HLC as of September 30, 2018 follows (Click the icon to view the trial balance ) Merchandise Inventory as of September 30 consists of the following lamps (Click the icon view the Merchandise Inventory) During the fourth quarter of 2018, HLC completed the following transactions Click the icon to view the transactions) Read the requirements Requirement 1. Open general ledger T accounts and enter opening balances as of September 30, 2018 (Enter a "0" on the normal side of the T-account for accounts with a zero balance as of September 30, 2018 Abreviated Cash Accounts Payable Sales Revenue Cost of Goods Sold Common Stock Accounts Receivable Salaries Expense-Selling Retained Earnings Merchandise Inventory Choose from any list or enter any number in the input fields and then click Check Answer Clear All 57 parts remaining O Type here to search Bullding, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets E: (Click the icon to vie Merchandise Inventory as (Click the icon to view During the fourth quarter of (Click the icon to view Read the requirements Merchandise Inventory Retained Earnings Salaries Expense-Selling Office Supplies Dividends Utilities Expense-Selling Warehouse Supplies Supplies Expense-Selling Choose from any list or enter any number in the input fields and then click Check Answer Clear All 57 parts remaining O HH Type here to search stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. HLC uses a perpetual inventory system, FIFO method. HLC owns land with a building, which is separated into two parts office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. E!! (Click the ic Merchandise Inve (Click the ico During the fourth Click the icon Read the requireme Land Depreciation Expense-Selling Building Salaries Expense-Administrative Choose from any list or enter any number in the input fields and then click Check Answer. 57 parts Clear All remaining Type here to search BE lamps, and floor lamps. HLC uses a perpetual inventory system FIFO method. HLC owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets for hlas :: (Click the icon to view the Merchandise Inventory as of E: (Click the icon view the During the fourth quarter of 20- Click the icon to view the Read the requirements Office Furniture and Equipment Utilities Expense-Administrative Warehouse Fixtures Supplies Expense-Administrative Choose from any list or enter any number in the input fields and then click Check Answer. Clear All 57 parts remaining RI IH Type here to search Expenses. All expenses associated with the warehouse which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. Merchandise Inves (Click the icon During the fourth qe (Click the icon Read the requiremen Warehouse Fixtures Supplies Expense-Administrative Accumulated Depreciation Depr. Expense-Administrative Choose from any list or enter any number in the input fields and then click Check Answer. 57 parts Clear All remaining HH Type here to search ACCT 2301 - SU2020 Homework: Comprehensive Problem 2 Score: 0 of 10 pts 1 of 1 (0 complete) Comp6-1 (similar to) The Harris Lamp Company (HLC) is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps HLC uses a perpetual inventory system, FIFO method. HLC owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets The trial balance for HLC as of September 30, 2018 follows: (Click the icon to view the trial balance.) Merchandise Inventory as of September 30 consists of the following lamps EE (Click the icon to view the Merchandise Inventory) During the fourth quarter of 2018, HLC completed the following transachons (Click the icon to view the transactions) Read the requirements Requirement 1. Open general ledger T-accounts and enter opening balances as of September 30, 2018. (Enter a "0" on the normal side of the T-account for accounts with a zero balance as of September 30, 2012 Cash Accounts Payable Sales Revenue Accounts Receivable Common Stock Cost of Goods Sold Merchandise Inventory Retained Earnings Salaries Expense-Selling Choose from any list or enter any number in the input fields and then click Check Answer Clear All 57 parts remaining Type here to search 1 of 1 (0 complete) rto) Data Table 0. 2018 follows ay (HLC) is a wholesale company that purchases lam three inventory items desk lamps, table lamps, and LC owns land with a building, which is separated into the office are categorized as Administrative Expense oping and receiving functions of the company, are cate Iso owns office furniture and equipment and warehou all the depreciable assets. Harris Lamp Company Trial Balance consists of the following lamps Inventory) pleted the following transactions September 30, 2018 Balance Debit Credit Account Cash S 492,000 general ledger T-accounts and enter opening balances to balance as of September 30, 2018 Abbre Accounts Payable Accounts Receivable Merchandise Inventory Office Supplies Warehouse Supplies 121,100 270 240 22,000 Land 740,000 Receivable Common Stock 138,000 210,000 Building Office Furniture and Equipment Warehouse Fixtures Accumulated Depreciation Accounts Payable Common Stock s 217 600 0 Retained Earnings se Inventory Print Done st or enter any number in the input fields and then click Clear All e o - C here to search plete Data Table -X 10. 2018 follows vvarruser LUIS TU; ) is a wholesale company that purchases lam ventory items: desk lamps, table lamps, and s land with a building, which is separated into fice are categorized as Administrative Expens nd receiving functions of the company, are cate s office furniture and equipment and warehou depreciable assets GA 217 600 Accumulated Depreciation Accounts Payable consists of the following lamps Inventory) bleted the following transactions 0 Common Stock 60,000 362,300 Retained Earnings Dividends 0 2,489,910 to balance as of September 30, 2018 Abbreviatio Sales Revenue al ledger T accounts and enter opening balances Accounts Payable 1,084 200 180.000 30,000 0 0 Cost of Goods Sold Salaries Expense-Selling Utilities Expense-Selling Supplies Expense-Selling Depreciation Expense-Selling Salaries Expense-Administrative Utilities Expense-Administrative Supplies Expense-Administrative Depreciation Expense-Administrative 91 000 Common Stock 21,000 able 0 0 S 3,129,810 3,129,810 Total Retained Earnings Print Done ventory Clear All enter any number in the input fields and then click to search de purchases lamps from the manufacturer and resells them to retail ee inventory items: desk lamps, table lamps and floor lamps. HLC uses a perpetual inventory wns land with a building, which is separated into two parts office space and warehouse space. All office are categorized as Administrative Expenses. All expenses associated with the warehouse, and receiving functions of the company, are categorized as Selling Expenses. In addition to the owns office furniture and equipment and warehouse fixtures. The company uses one accumulated the depreciable assets. The trial balance for HLC as of September 30, 2018 follows: (Click the icon to view the trial balance) Merchandise Inventory as of September 30 consists of the following lamps HEM Click the icon to view the Merchandise Inventory) During the fourth quarter of 2018, HLC completed the following transactions (Click the icon to view the transactions) Data Table eral ledger T-accounts and enter opening balances as of Septe a zero balance as of September 30, 2018 Abbreviations Accounts Payable Item Total Cost Desk Lamp Quantity Unit Cost 2 200 $ 5 $ 3 200 15 11,000 Table Lamp 48,000 62 100 Floor Lamp 2.300 27 S 121,100 Total eivable Common Stock Print Done Inventory Retained Earnings Salaries Expense-Selling or enter any number in the input fields and then click Check Answer. Check Ar Clear All nere to search - X i More Info 018 follows: Hesale company that purchases lamps ems: desk lamps, table lamps, and floo n a building, which is separated into two ategorized as Administrative Expenses ng functions of the company, are categor urniture and equipment and warehouse til ble assets Purchased lamps on account from Carpathian Lights, terms n/30, FOB destination sists of the following lamps entory) d the following transactions Oct 1 alance as of September 30, 2018 Abbreviation used T-accounts and enter opening balances as Oct 12 Accounts Payable Oct 15 5,500 desk lamps at $8 each 7,000 table lamps at $23 each 5,500 floor lamps at $22 each Sold lamps on account to Moonbeam Home Furnishings, terms 1/10, n/30 5,500 table lamps at $40 each Sold lamps on account to Acworth Office Supply terms 2/10, n/30 500 desk lamps at $17 each Received a check from Moonbeam Home Furnishings for full amount owed on Oct 12 sale Received a check from Acworth Office Supply for full amount owed on Oct 15 sale Sold lamps on account to Channel Home Stores terms 1/10, n/30 1,500 table lamps at $40 each 1,300 floor lamps at $64 each Paid amount due to Carpathian Lights from Oct 1 purchase Paid salaries, $42,000 (65% selling, 35% administrative) Oct 20 Oct. 23 Common Stock Oct 28 Oct 30 Oct 31 Retained Earnings ory Check Print Done rany number in the input fields and then click Ch e search 1 of 1 (0 complete) HW More Info 018 follows a wholesale company that purchases lamps ntory items: desk lamps, table lamps, and floo and with a building, which is separated into two are categorized as Administrative Expenses. A receiving functions of the company, are categor office furniture and equipment and warehouse fi preciable assets Oct 31 sists of the following lamps entory) d the following transactions Oct 31 Nov 1 Nov 5 alance as of September 30, 2018 Abbreviation used Depr edger T-accounts and enter opening balances as Accounts Payable Paid salaries, $42,000 (65% selling, 35% administrative) Paid utilities, $2,300 (60% selling, 40% administrative) Sold lamps on account to Acworth Office Supply, terms 3/10,n/30 4,200 desk lamps at $17 each Purchased lamps on account from Carpathian Lights, terms n/30, FOB destination 5,500 desk lamps at $10 each 9,500 table lamps at 26 each 11,000 floor lamps at $25 each Received a check from Channel Home Stores for full amount owed on Oct 28 sale Received a check from Acworth Office Supply for full amount owed on Nov. 1 sale Purchased and paid for supplies S520 for the office $875 for the warehouse Sold lamps on account to Nelson Office Supply, n/30 1 800 desk lamps at $17 each Sold lamps on account to Argo Discount Stores, terms 3/10, n/30 2.500 table lamps at $40 each 1.700 floor lamps at $64 each Nov 5 Nov. 8 able Common Stock Nov 10 Nov 15 Nov. 18 Retained Earnings wentory Print Done Check Answer enter any number in the input fields and then click CH e re to search Fe: 0 of 10 pts 1 of 1 (0 complete) mp6-1 (similar to) More Info - X 018 follows: e Harris Lamp Company (HLC) is a wholesale company that purchases lamps res. The company has three inventory items desk lamps, table lamps, and floo stem, FIFO method. HLC owns land with a building, which is separated into two penses associated with the office are categorized as Administrative Expenses hich is used for the shipping and receiving functions of the company, are categor and and building, HLC also owns office furniture and equipment and warehouse fi epreciation account for all the depreciable assets sists of the following lamps entory) bed the following transactions Requirement 1. Open general ledger T-accounts and enter opening balances as alance as of September 30 2018 Cash Accounts Payable Nov 15 Sold lamps on account to Nelson Office Supply, n/30 1.800 desk lamps af $17 each Nov. 18 Sold lamps on account to Argo Discount Stores terms 3/10, 1/30 2,500 table lamps at $40 each 1,700 floor lamps at $64 each Received a check from Argo Discount Stores for full amount owed on Nov. 28 Nov 18 sale Nov 30 Paid salaries, $42,000 (65% selling, 35% administrative) Nov. 30 Paid utilities, $2.480 (60% selling 40% administrative) Dec. 5 Paid amount due to Carpathian Lights from Nov 5 purchase Received a check from Nelson Office Supply for full amount owed on Dec. 15 Nov 15 sale. Dec. 15 Paid dividends, S65 000 Sold lamps on account to Moonbeam Home Furnishings, terms 2/10 Dec. 27 n/30 4.700 desk lamps at $17 each 4,500 table lamps at $40 each Dec 31 Paid salaries, S42,000 (65% selling, 35% administrative) Dec 31 Paid utilities, $3 700 (60% selling. 40% administrative) Accounts Receivable Common Stock Retained Earnings Merchandise Inventory Print Done Choose from any list or enter any number in the input fields and then click CH 57 parts remaining O Type here to search me Harris Lamp Company (HLC) is a wholesale company that purchases lamps from the manufacturer and resells them to retail ores. The company has three inventory items desk lamps, table lamps and floor lamps. HLC uses a perpetual inventory ystem, FIFO method. HLC owns land with a building, which is separated into two parts office space and warehouse space. All xpenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the and and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. The trial balance for HLC as of September 30, 2018 follows (Click the icon to view the trial balance ) Merchandise Inventory as of September 30 consists of the following lamps (Click the icon view the Merchandise Inventory) During the fourth quarter of 2018, HLC completed the following transactions Click the icon to view the transactions) Read the requirements Requirement 1. Open general ledger T accounts and enter opening balances as of September 30, 2018 (Enter a "0" on the normal side of the T-account for accounts with a zero balance as of September 30, 2018 Abreviated Cash Accounts Payable Sales Revenue Cost of Goods Sold Common Stock Accounts Receivable Salaries Expense-Selling Retained Earnings Merchandise Inventory Choose from any list or enter any number in the input fields and then click Check Answer Clear All 57 parts remaining O Type here to search Bullding, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets E: (Click the icon to vie Merchandise Inventory as (Click the icon to view During the fourth quarter of (Click the icon to view Read the requirements Merchandise Inventory Retained Earnings Salaries Expense-Selling Office Supplies Dividends Utilities Expense-Selling Warehouse Supplies Supplies Expense-Selling Choose from any list or enter any number in the input fields and then click Check Answer Clear All 57 parts remaining O HH Type here to search stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. HLC uses a perpetual inventory system, FIFO method. HLC owns land with a building, which is separated into two parts office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. E!! (Click the ic Merchandise Inve (Click the ico During the fourth Click the icon Read the requireme Land Depreciation Expense-Selling Building Salaries Expense-Administrative Choose from any list or enter any number in the input fields and then click Check Answer. 57 parts Clear All remaining Type here to search BE lamps, and floor lamps. HLC uses a perpetual inventory system FIFO method. HLC owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets for hlas :: (Click the icon to view the Merchandise Inventory as of E: (Click the icon view the During the fourth quarter of 20- Click the icon to view the Read the requirements Office Furniture and Equipment Utilities Expense-Administrative Warehouse Fixtures Supplies Expense-Administrative Choose from any list or enter any number in the input fields and then click Check Answer. Clear All 57 parts remaining RI IH Type here to search Expenses. All expenses associated with the warehouse which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, HLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. Merchandise Inves (Click the icon During the fourth qe (Click the icon Read the requiremen Warehouse Fixtures Supplies Expense-Administrative Accumulated Depreciation Depr. Expense-Administrative Choose from any list or enter any number in the input fields and then click Check Answer. 57 parts Clear All remaining HH Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts