Question: Problem Al-4A Journal entries for payroll transactions LO2, 3, 4 A company has three employees, each of whom has been employed since January 1, cams

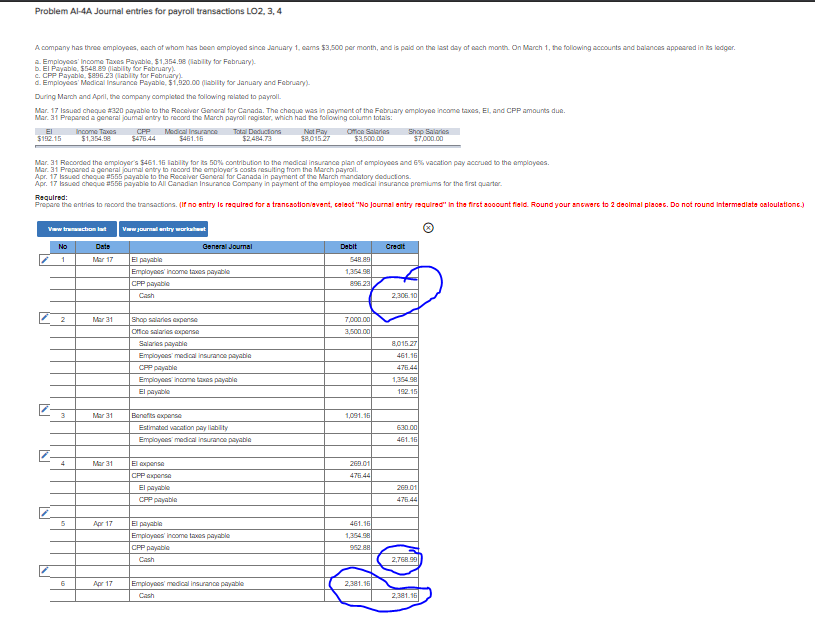

Problem Al-4A Journal entries for payroll transactions LO2, 3, 4 A company has three employees, each of whom has been employed since January 1, cams 53,500 per month, and is paid on the last day of each month On March 1, the following accounts and balances appeared in its lodger. Employees Income Taxos Payable $1,354.58 (lability for February b. El Payable $548.89 diability for February c. CPP Payable S06.23 (lability for February d. Employees' Medical Insurance Payable 51.620.00 ability for January and February During March and April, the company completed the following related to payroll Mar. 17 Issued cheque #320 payable to the Receiver General for Canada. The chaque was in payment of the February employee income taxes, El and CPP amounts due Mar 31 Prepared a general joumal entry to record the March payroll register, which had the following column totals: Income Taxes CPP Medical Insurance Total Deductions Not Pay Orice Salaries Shop Salaries $192.15 58.01527 S3500.00 Mar 31 P odgoneral Qums ry to record the Mar 31 Recorded the employer's 5461.16 labiry for contribution to the medical insurance plan of amployees and 6% vacation pay accrued to the employees Apr. 17 issued cheque #556 payable to the Receiver Generalfor Canada in payment of the March mandatory deducions Apr. 17 issued cheque #556 payable to All Canadian Insurance Company in payment of the employee medical insurance premiums for the first quarter. Required: Prepare the entries to record the transactions. (If no antry is required for a transation avant, calaot "No Journal entry required in the first account fald. Round your a ware to 2 daolmal place. Do not round Intermediate caloulationc. View trachomat Vww.journal entry workout Debit Credit No 1 Date Mar 17 General Journal El payable Employees' income taxes payable CPP payable 26231 2,306.10 Mar 31 7000.00 1.500.00 Shop salaries expense orice sales expense Salarios payable Employees medical insurance payable all Employees income taxes payable 1,3548 192.15 3 Mar 31 1.091 Benefits expense Estimated vacation payability Employees medical insurance payable 630.00 4 Mar 31 Expense CPP expense 26.01 EL AY 17 41.16 El payable Employees' income tax CPP payable payable 6 Apr 17 Employees medical insurance payable Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts