Question: PROBLEM ANALYSIS: PRESENT VALUE, FUTURE VALUE & INVESTMENT Please go first through the case studies! QUESTION 1 Suppose you want to buy a news Honda

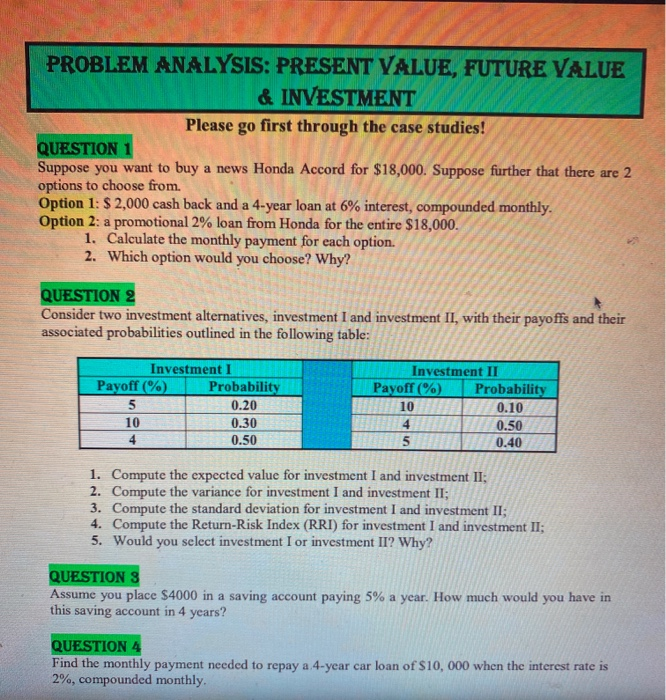

PROBLEM ANALYSIS: PRESENT VALUE, FUTURE VALUE & INVESTMENT Please go first through the case studies! QUESTION 1 Suppose you want to buy a news Honda Accord for $18,000. Suppose further that there are 2 options to choose from. Option 1: $ 2,000 cash back and a 4-year loan at 6% interest, compounded monthly. Option 2: a promotional 2% loan from Honda for the entire $18,000. 1. Calculate the monthly payment for each option. 2. Which option would you choose? Why? QUESTION 2 Consider two investment alternatives, investment I and investment II, with their payoffs and their associated probabilities outlined in the following table: Investment I Payoff (%) Probability 5 0.20 10 0.30 4 0.50 Investment II Payoff (% Probability 10 0.10 4 0.50 5 0.40 1. Compute the expected value for investment I and investment II; 2. Compute the variance for investment I and investment II; 3. Compute the standard deviation for investment I and investment II; 4. Compute the Return-Risk Index (RRI) for investment I and investment II; 5. Would you select investment I or investment II? Why? QUESTION 3 Assume you place $4000 in a saving account paying 5% a year. How much would you have in this saving account in 4 years? QUESTION 4 Find the monthly payment needed to repay a 4-year car loan of $10,000 when the interest rate is 2%, compounded monthly. QUESTIONS John expects to receive $4,000 in 2023. Calculate the present value of this cash flow assuming an interest rate of 5%, compounded annually. QUESTION 6 Brian invested S 2000 in Google paying 4% interest rate a year. Using the rule 72, how long will it take to double Brian's investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts