Question: PROBLEM Answer in the space provided. (40 Marks) On January 1, 2015, Parent Co. purchased 100% of the outstanding common shares of Child Ltd.

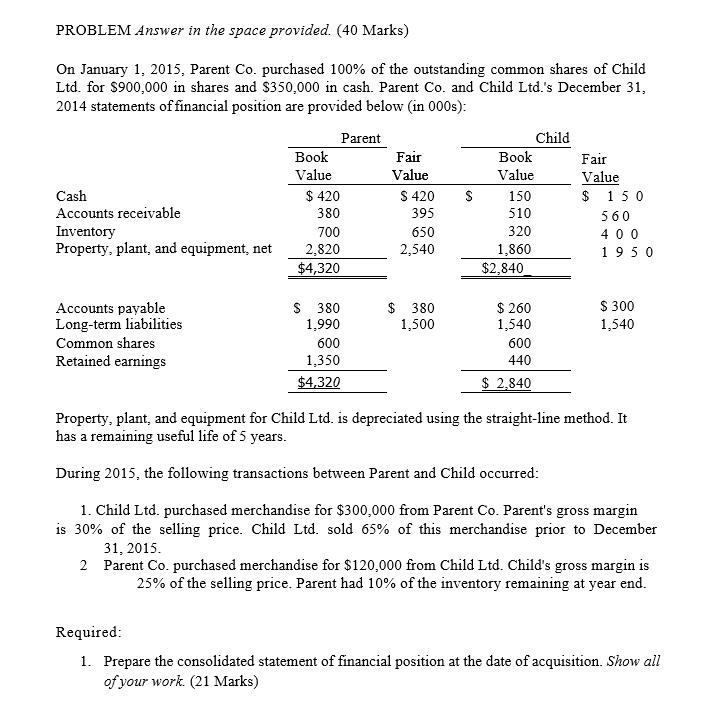

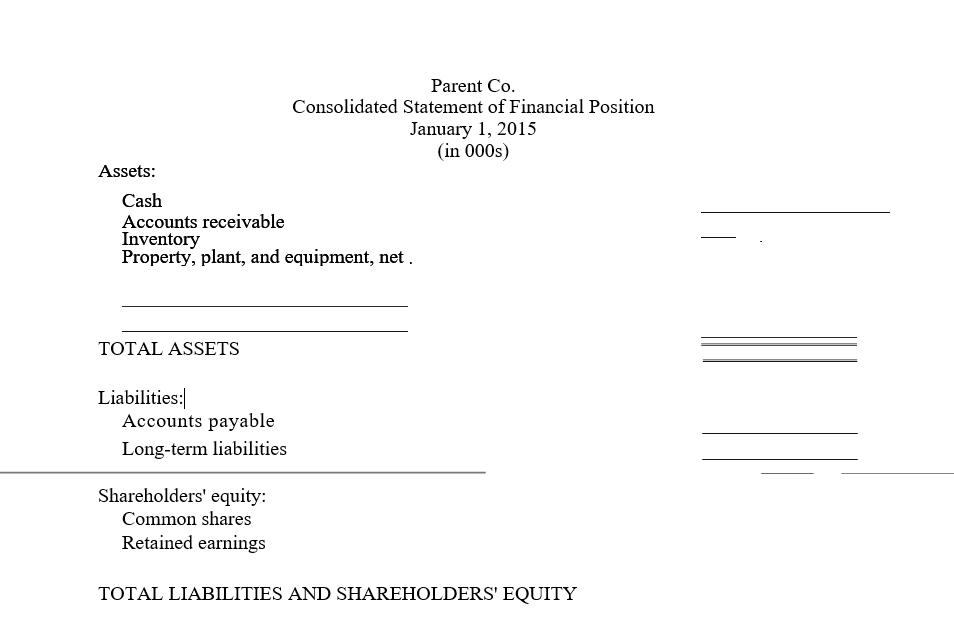

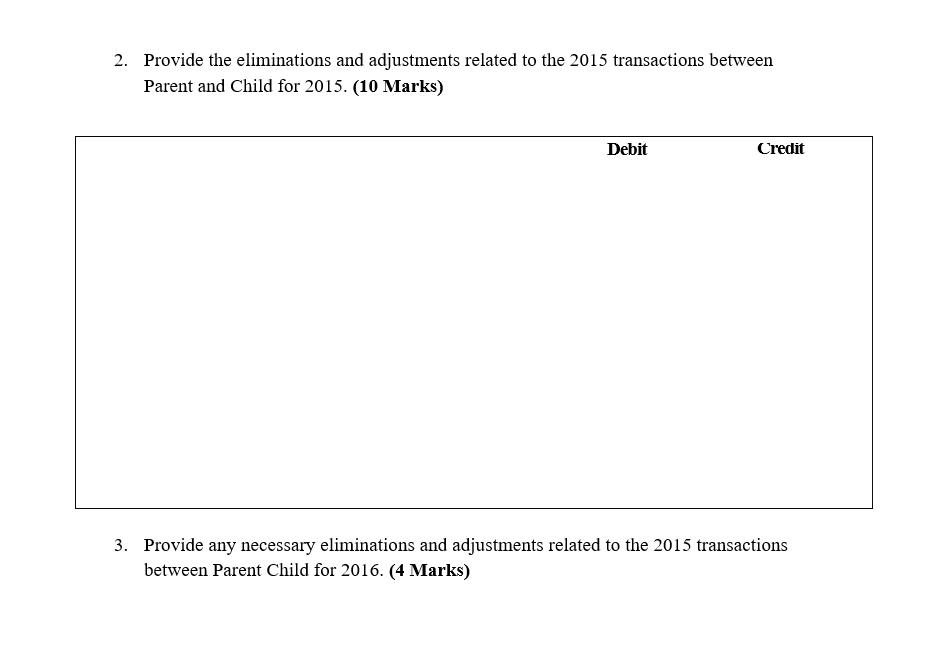

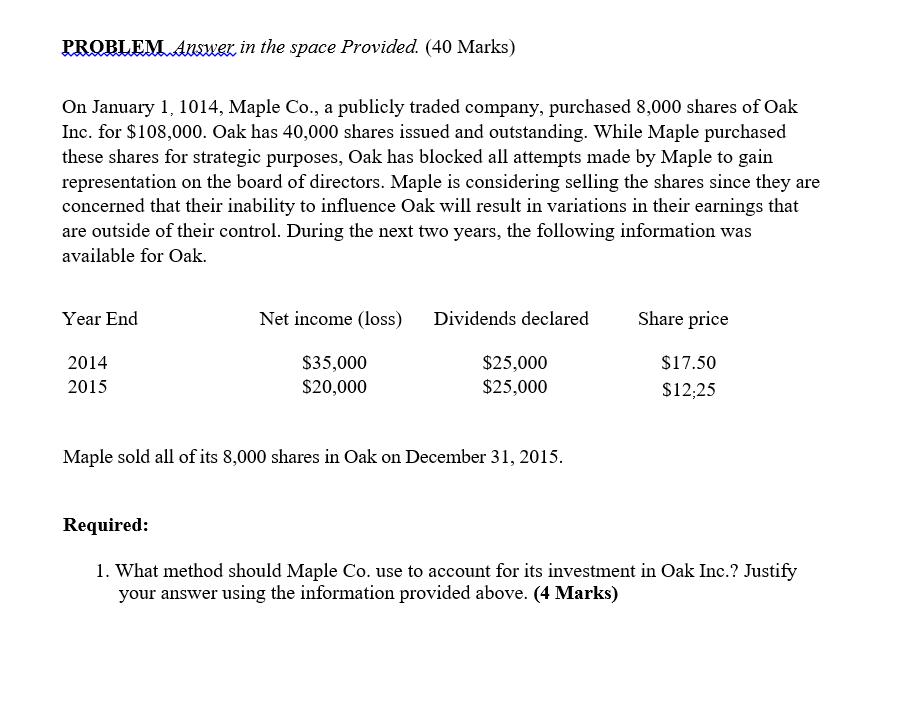

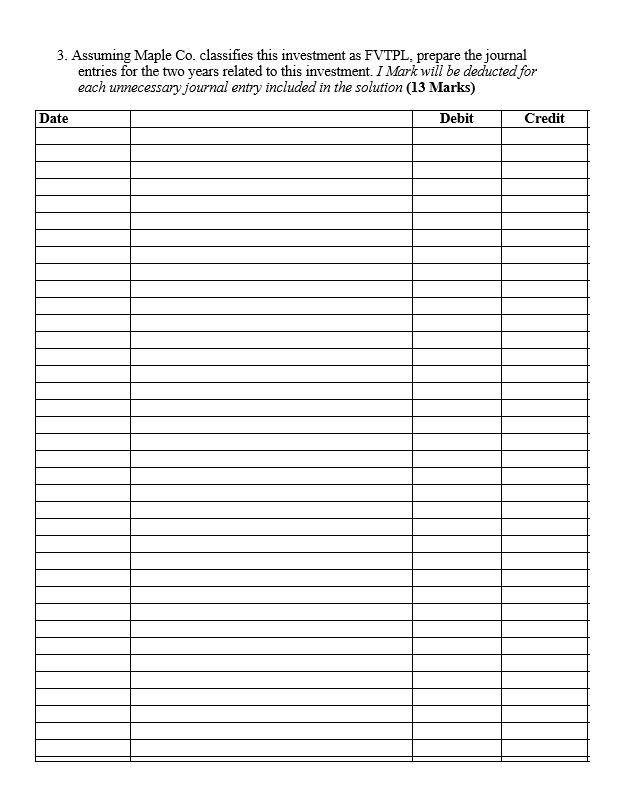

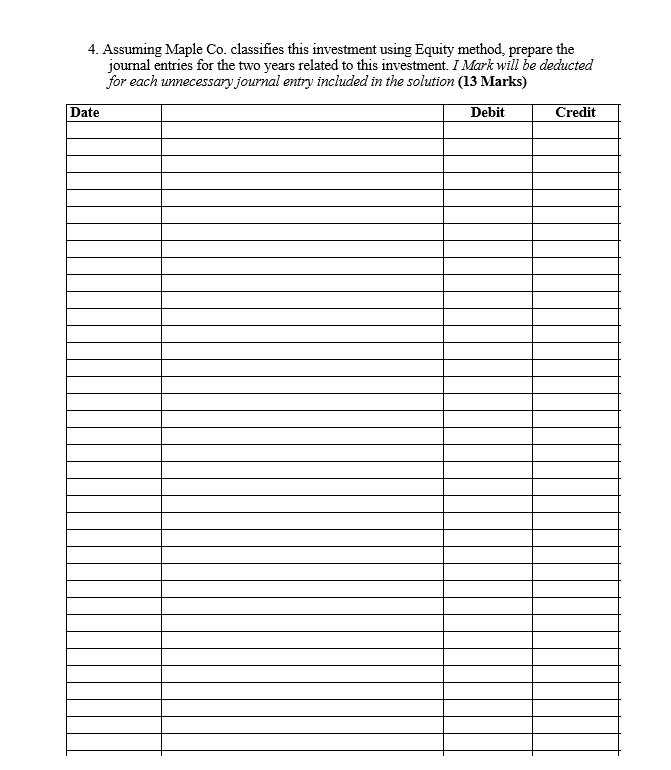

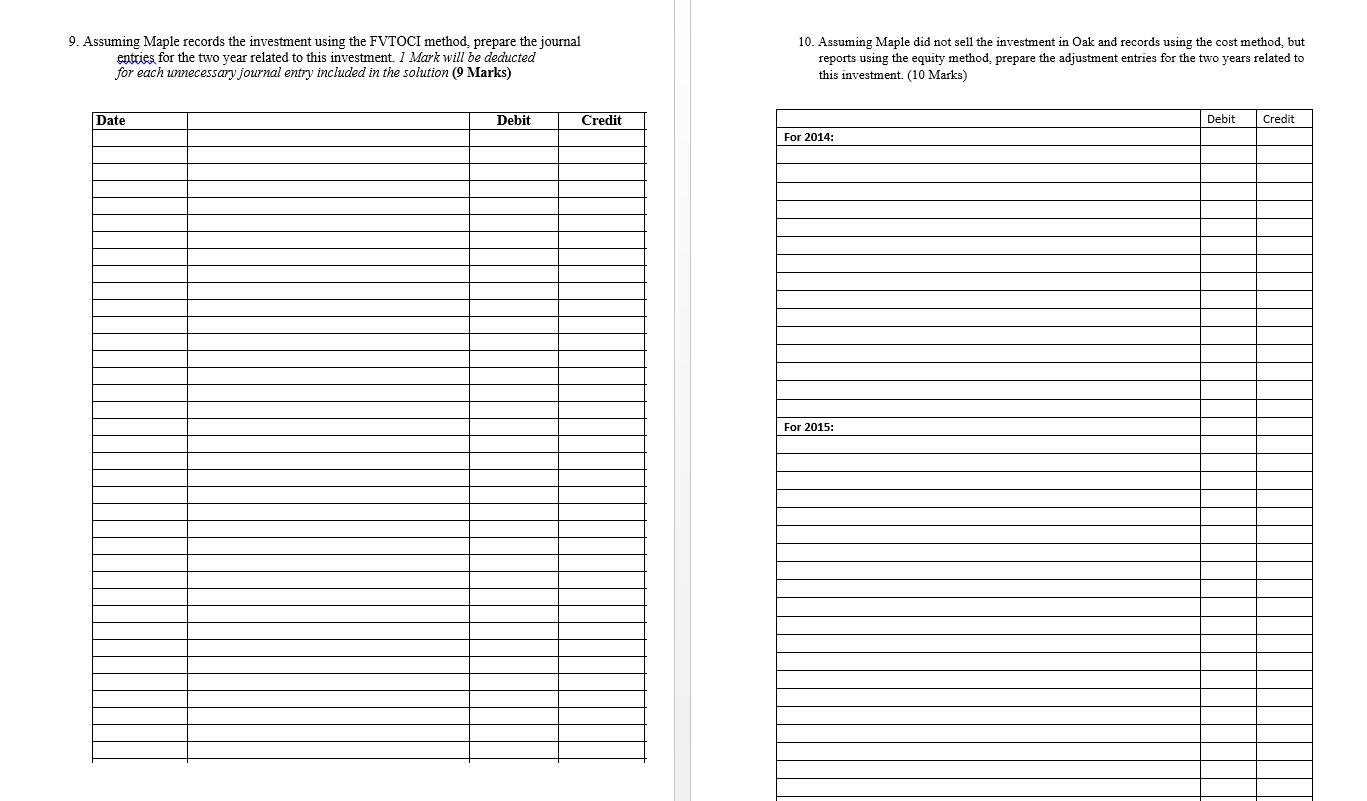

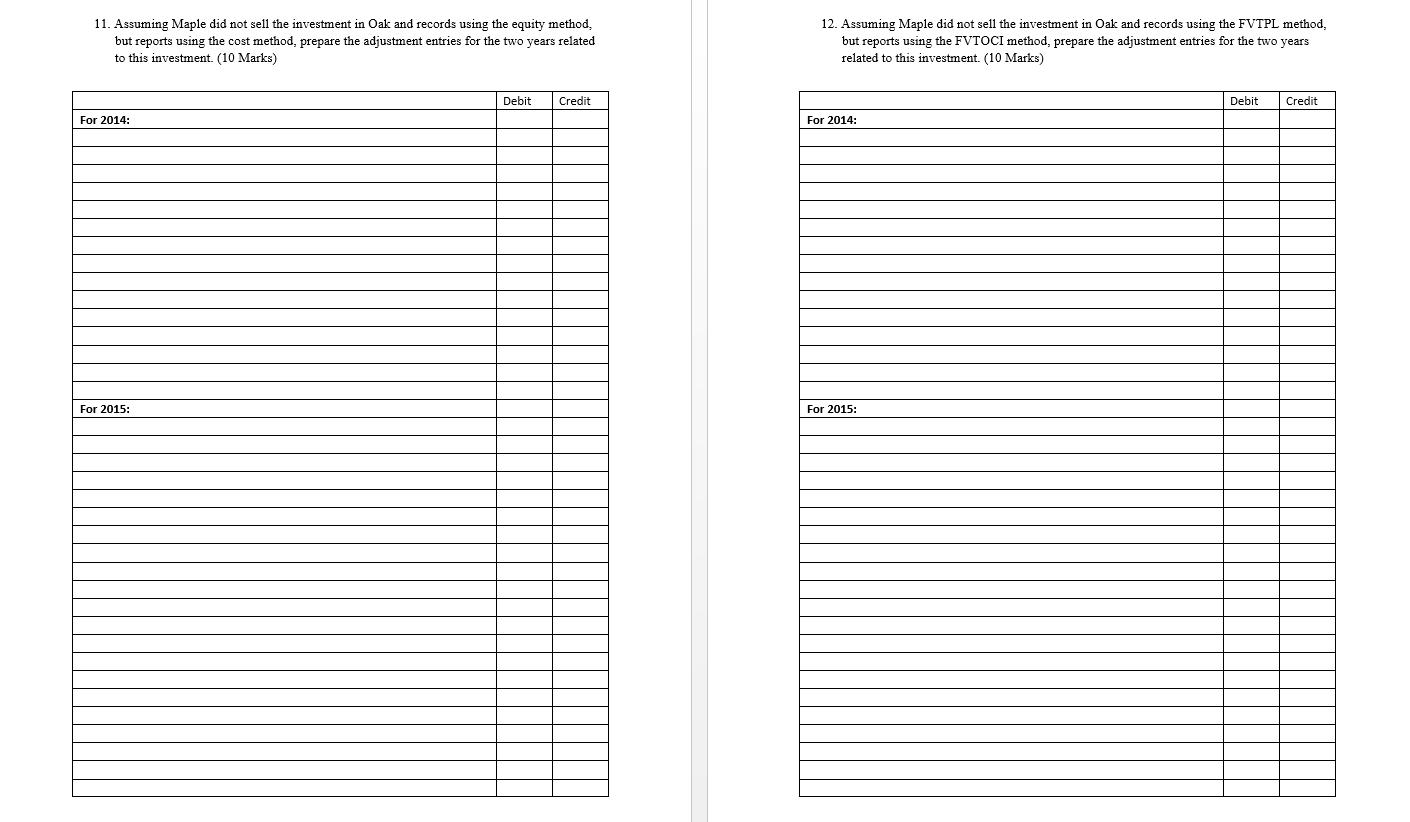

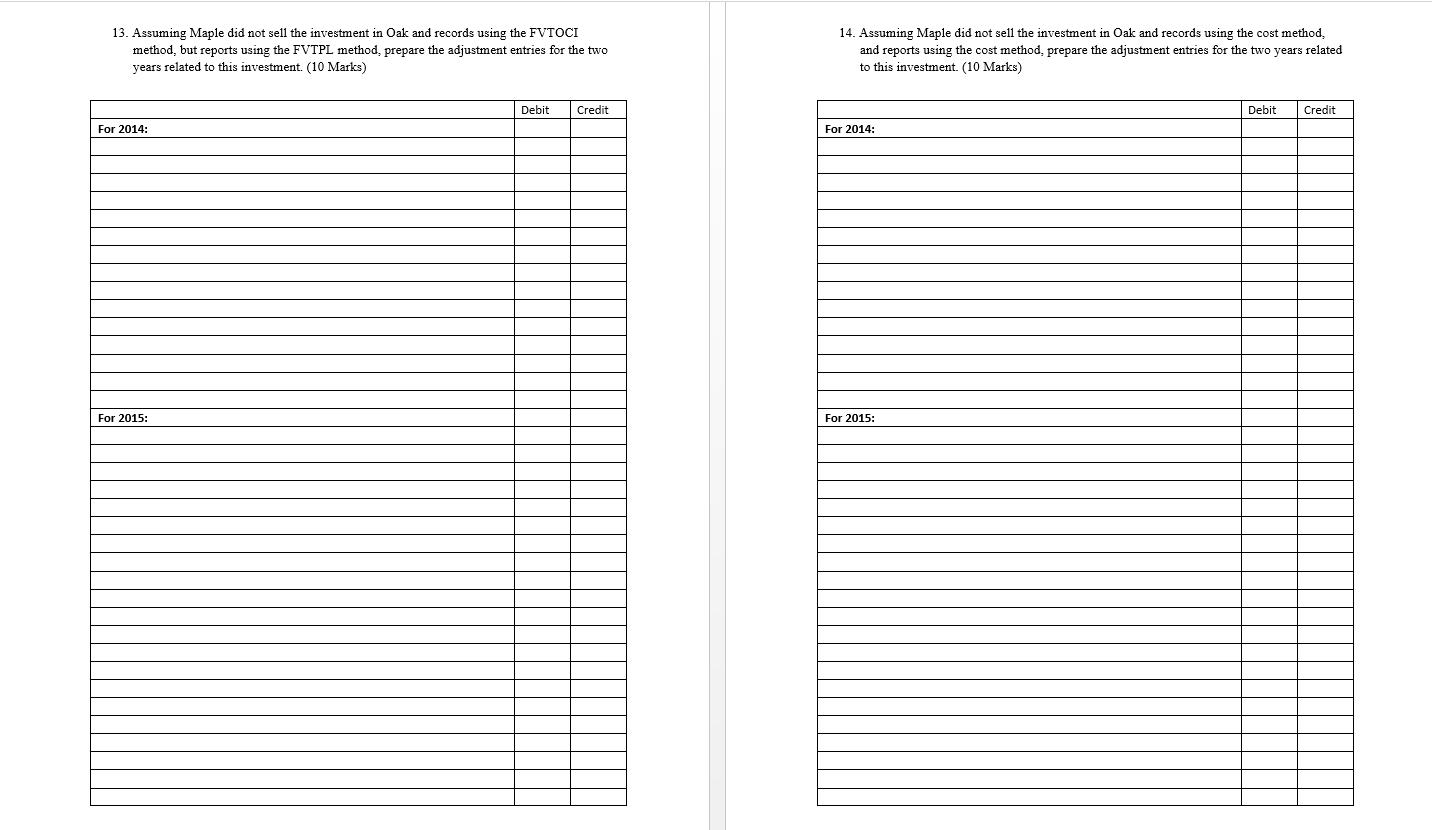

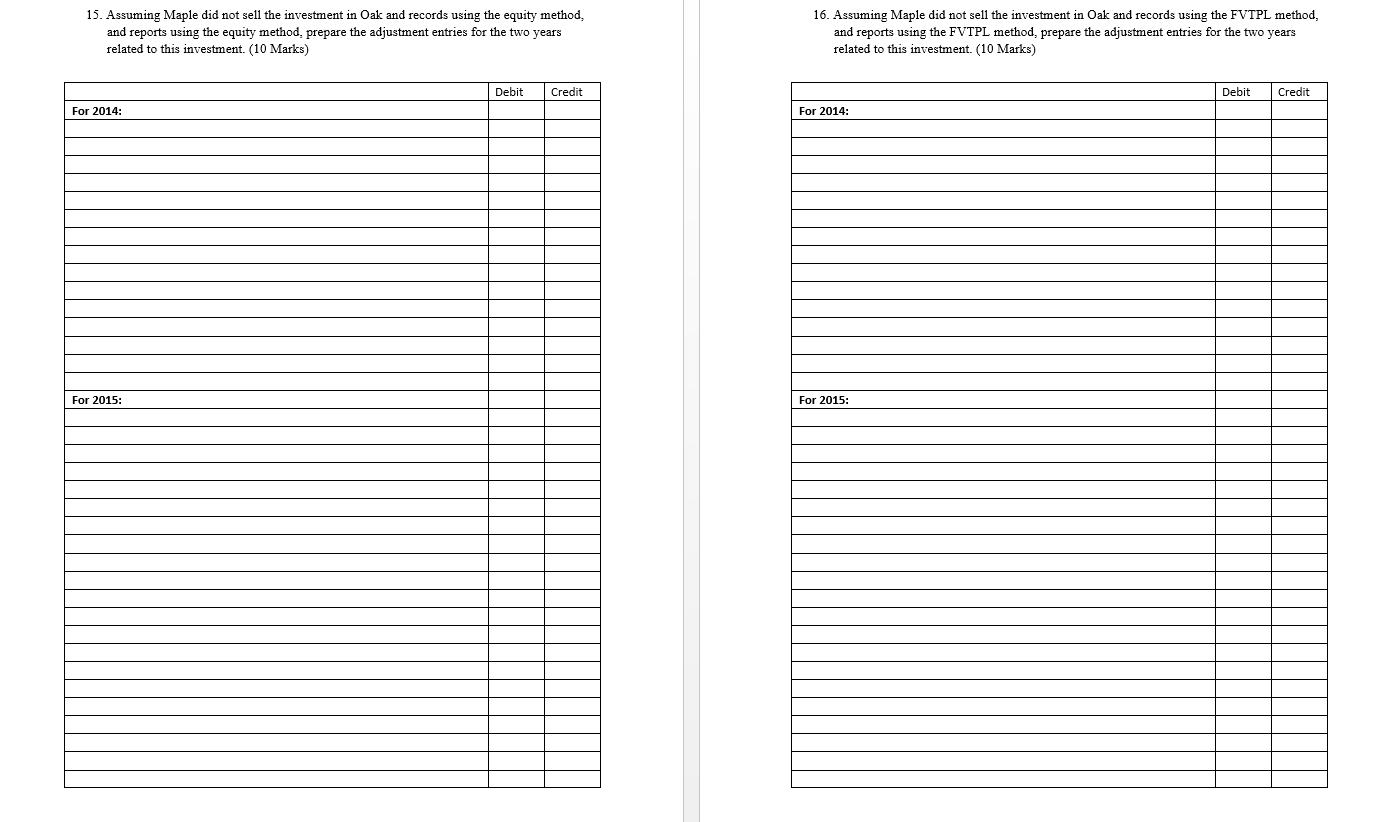

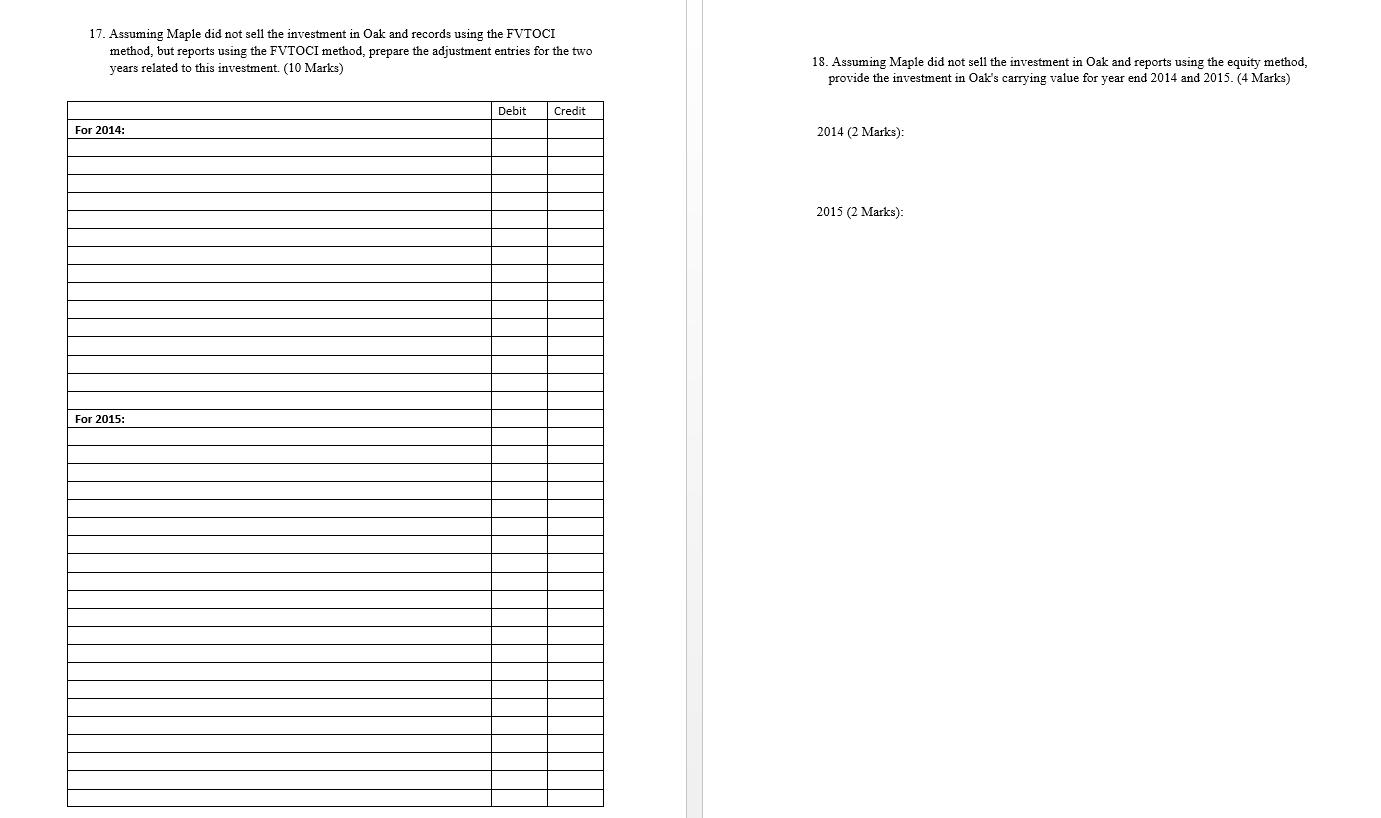

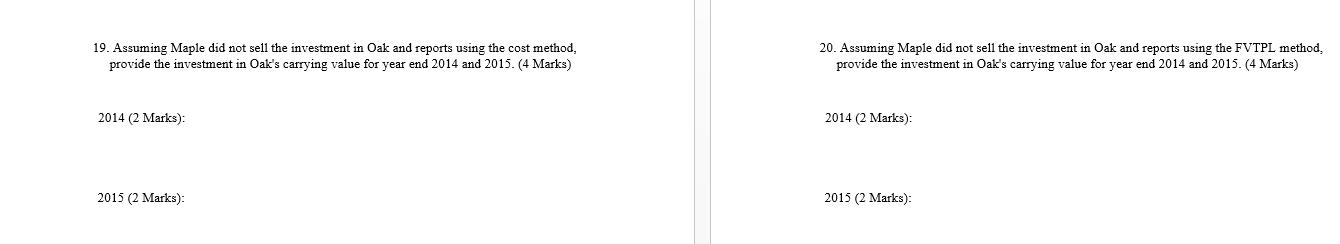

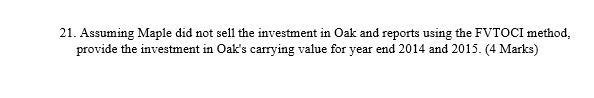

PROBLEM Answer in the space provided. (40 Marks) On January 1, 2015, Parent Co. purchased 100% of the outstanding common shares of Child Ltd. for $900,000 in shares and $350,000 in cash. Parent Co. and Child Ltd.'s December 31, 2014 statements of financial position are provided below (in 000s): Cash Accounts receivable Inventory Property, plant, and equipment, net Accounts payable Long-term liabilities Common shares Retained earnings Book Value Parent $ 420 380 700 2,820 $4,320 S 380 1,990 600 1,350 $4,320 Fair Value $ 420 395 650 2,540 $ 380 1,500 $ Book Value 150 510 320 1,860 $2,840 $ 260 1,540 600 440 $ 2,840 Child Fair Value $ 150 560 400 1950 $ 300 1,540 Property, plant, and equipment for Child Ltd. is depreciated using the straight-line method. It has a remaining useful life of 5 years. During 2015, the following transactions between Parent and Child occurred: 1. Child Ltd. purchased merchandise for $300,000 from Parent Co. Parent's gross margin is 30% of the selling price. Child Ltd. sold 65% of this merchandise prior to December 31, 2015. 2 Parent Co. purchased merchandise for $120,000 from Child Ltd. Child's gross margin is 25% of the selling price. Parent had 10% of the inventory remaining at year end. Required: 1. Prepare the consolidated statement of financial position at the date of acquisition. Show all of your work. (21 Marks) Assets: Cash Accounts receivable Inventory Property, plant, and equipment, net. TOTAL ASSETS Liabilities: Accounts payable Long-term liabilities Parent Co. Consolidated Statement of Financial Position January 1, 2015 (in 000s) Shareholders' equity: Common shares Retained earnings TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 2. Provide the eliminations and adjustments related to the 2015 transactions between Parent and Child for 2015. (10 Marks) Debit Credit 3. Provide any necessary eliminations and adjustments related to the 2015 transactions between Parent Child for 2016. (4 Marks) Debit Credit 4. Prepare the amortization table for 2015. (5 Marks) PROBLEM Answer in the space Provided. (40 Marks) On January 1, 1014, Maple Co., a publicly traded company, purchased 8,000 shares of Oak Inc. for $108,000. Oak has 40,000 shares issued and outstanding. While Maple purchased these shares for strategic purposes, Oak has blocked all attempts made by Maple to gain representation on the board of directors. Maple is considering selling the shares since they are concerned that their inability to influence Oak will result in variations in their earnings that are outside of their control. During the next two years, the following information was available for Oak. Year End 2014 2015 Net income (loss) Dividends declared $35,000 $20,000 $25,000 $25,000 Maple sold all of its 8,000 shares in Oak on December 31, 2015. Share price $17.50 $12,25 Required: 1. What method should Maple Co. use to account for its investment in Oak Inc.? Justify your answer using the information provided above. (4 Marks) 3. Assuming Maple Co. classifies this investment as FVTPL, prepare the journal entries for the two years related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (13 Marks) Debit Date Credit 4. Assuming Maple Co. classifies this investment using Equity method, prepare the journal entries for the two years related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (13 Marks) Debit Date Credit 5. Assuming Maple Co. classifies this investment using Cost method, prepare the journal entries for the two years related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (13 Marks) Date Debit Credit 6. Assuming Maple records the investment using the cost method, prepare the journal entries for the two year related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (9 Marks) Date Debit Credit 6. Assuming Maple records the investment using the cost method, prepare the journal entries for the two year related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (9 Marks) Date Debit Credit 7. Assuming Maple records the investment using the equity method, prepare the journal entries for the two year related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (9 Marks) Date Debit Credit 8. Assuming Maple records the investment using the FVTPL method, prepare the journal entries for the two year related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (9 Marks) Date Debit Credit 9. Assuming Maple records the investment using the FVTOCI method, prepare the journal entries for the two year related to this investment. I Mark will be deducted for each unnecessary journal entry included in the solution (9 Marks) Date Debit Credit 10. Assuming Maple did not sell the investment in Oak and records using the cost method, but reports using the equity method, prepare the adjustment entries for the two years related to this investment. (10 Marks) For 2014: For 2015: Debit Credit 11. Assuming Maple did not sell the investment in Oak and records using the equity method, but reports using the cost method, prepare the adjustment entries for the two years related to this investment. (10 Marks) For 2014: For 2015: Debit Credit 12. Assuming Maple did not sell the investment in Oak and records using the FVTPL method, but reports using the FVTOCI method, prepare the adjustment entries for the two years related to this investment. (10 Marks) For 2014: For 2015: Debit Credit 13. Assuming Maple did not sell the investment in Oak and records using the FVTOCI method, but reports using the FVTPL method, prepare the adjustment entries for the two years related to this investment. (10 Marks) For 2014: For 2015: Debit Credit 14. Assuming Maple did not sell the investment in Oak and records using the cost method, and reports using the cost method, prepare the adjustment entries for the two years related to this investment. (10 Marks) For 2014: For 2015: Debit Credit 15. Assuming Maple did not sell the investment in Oak and records using the equity method, and reports using the equity method, prepare the adjustment entries for the two years related this investment. (10 Marks) For 2014: For 2015: Debit Credit 16. Assuming Maple did not sell the investment in Oak and records using the FVTPL method, and reports using the FVTPL method, prepare the adjustment entries for the two years related to this investment. (10 Marks) For 2014: For 2015: Debit Credit 17. Assuming Maple did not sell the investment in Oak and records using the FVTOCI method, but reports using the FVTOCI method, prepare the adjustment entries for the two years related to this investment. (10 Marks) For 2014: For 2015: Debit Credit 18. Assuming Maple did not sell the investment in Oak and reports using the equity method, provide the investment in Oak's carrying value for year end 2014 and 2015. (4 Marks) 2014 (2 Marks): 2015 (2 Marks): 19. Assuming Maple did not sell the investment in Oak and reports using the cost method, provide the investment in Oak's carrying value for year end 2014 and 2015. (4 Marks) 2014 (2 Marks): 2015 (2 Marks): 20. Assuming Maple did not sell the investment in Oak and reports using the FVTPL method, provide the investment in Oak's carrying value for year end 2014 and 2015. (4 Marks) 2014 (2 Marks): 2015 (2 Marks): 21. Assuming Maple did not sell the investment in Oak and reports using the FVTOCI method, provide the investment in Oak's carrying value for year end 2014 and 2015. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

The provided text contains several accounting problems related to the preparation of financial state... View full answer

Get step-by-step solutions from verified subject matter experts