Question: Problem are based on Americo Industries. Americo is a U.S.-based multinational manufacturing fimm with wholly owned subsidiaries in Brazil, Germany, and China, in addition to

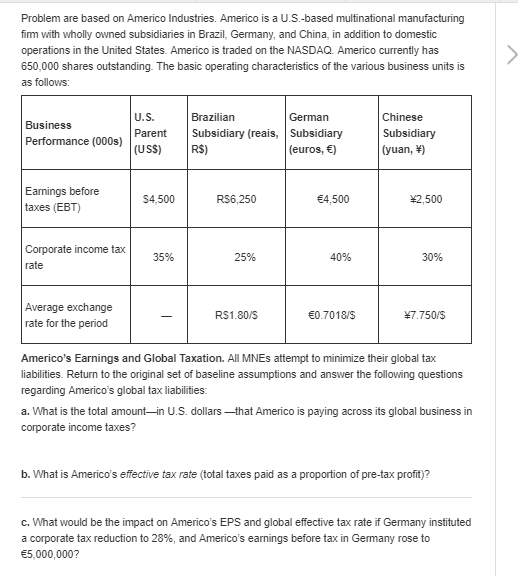

Problem are based on Americo Industries. Americo is a U.S.-based multinational manufacturing fimm with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has 650,000 shares outstanding. The basic operating characteristics of the various business units is as follows U.S. Parent Subsidiary (reais, Subsidiary uss) RS) Brazilian German Chinese Subsidiary (yuan, ) Business Performance (000s) (euros, ) Earnings before taxes (EBT) S4,500 RS6,250 4,500 2.500 Corporate income tax rate 35% 25% 40% 3096 Average exchange rate for the period R$1.80/S 0.7018S 7.750/5 Americo's Earnings and Global Taxation. All MNEs attempt to minimize their global tax liabilities. Return to the original set of baseline assumptions and answer the following questions regarding Americo's global tax liabilities a. What is the total amount-in U.S. dollars that Americo is paying across its global business in corporate income taxes? b. What is Americo's effective tax rate (total taxes paid as a proportion of pre-tax profit)? c. What would be the impact on Americo's EPS and global effective tax rate if Germany instituted a corporate tax reduction to 28%, and Americo's earnings before tax in Germany rose to 5,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts