Question: Problem Assignment 1. Step into the role of Frank Brown, and conduct an ROI, payback period, and break-even volume and break-even on investment analysis of

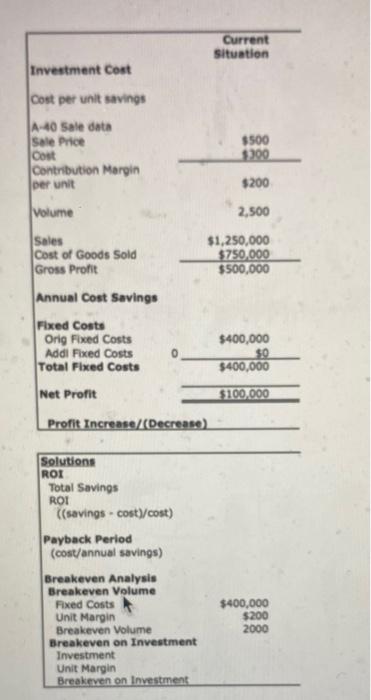

Problem Assignment 1. Step into the role of Frank Brown, and conduct an ROI, payback period, and break-even volume and break-even on investment analysis of New England Office Chair's alternatives. 2. Using the ROI, payback period, and break-even volume and break-even on investment results, provide a brief two-to three-sentence recommended course of action for the company and the reasons for this recommendation. Other Useful Information For purposes of this case, ignore any financing costs and assume the company has the cash to pay for either alternative (that is, do not assume any bank loan or imputed interest costs not specifically presented in the case). Assume that New England Office Chair's fixed costs associated with the A-40 chair are $400,000 per year. Assume a five-year time horizon. Problem Assignment 1. Step into the role of Frank Brown, and conduct an ROI, payback period, and break-even volume and break-even on investment analysis of New England Office Chair's alternatives. 2. Using the ROI, payback period, and break-even volume and break-even on investment results, provide a brief two-to three-sentence recommended course of action for the company and the reasons for this recommendation. Other Useful Information For purposes of this case, ignore any financing costs and assume the company has the cash to pay for either alternative (that is, do not assume any bank loan or imputed interest costs not specifically presented in the case). Assume that New England Office Chair's fixed costs associated with the A-40 chair are $400,000 per year. Assume a five-year time horizon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts