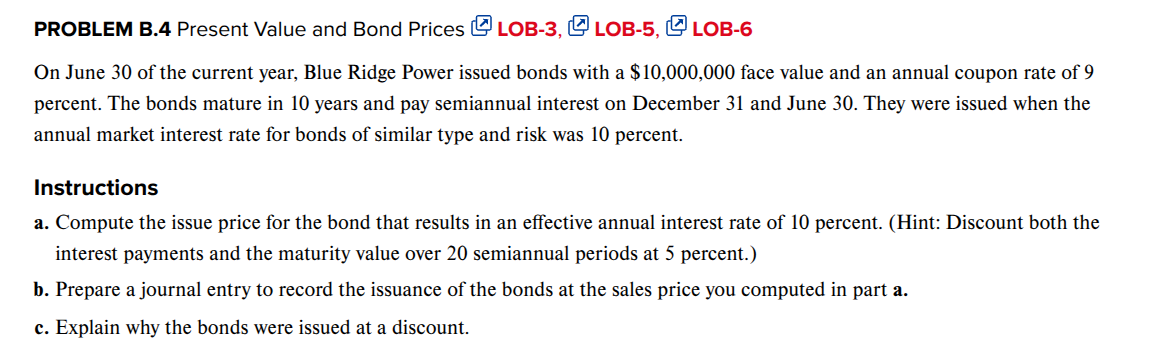

Question: PROBLEM B . 4 Present Value and Bond Prices LOB - 3 , ( sqrt { } ) LOB - 5 ,

PROBLEM B Present Value and Bond Prices LOBsqrt LOBsqrt LOB On June of the current year, Blue Ridge Power issued bonds with a $ face value and an annual coupon rate of percent. The bonds mature in years and pay semiannual interest on December and June They were issued when the annual market interest rate for bonds of similar type and risk was percent. Instructions a Compute the issue price for the bond that results in an effective annual interest rate of percent. Hint: Discount both the interest payments and the maturity value over semiannual periods at percent. b Prepare a journal entry to record the issuance of the bonds at the sales price you computed in part a c Explain why the bonds were issued at a discount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock