Question: Problem B (5 points) April sold several properties and made several withdrawals as follow in 2019: Sale of inherited stock (fair market value when inherited

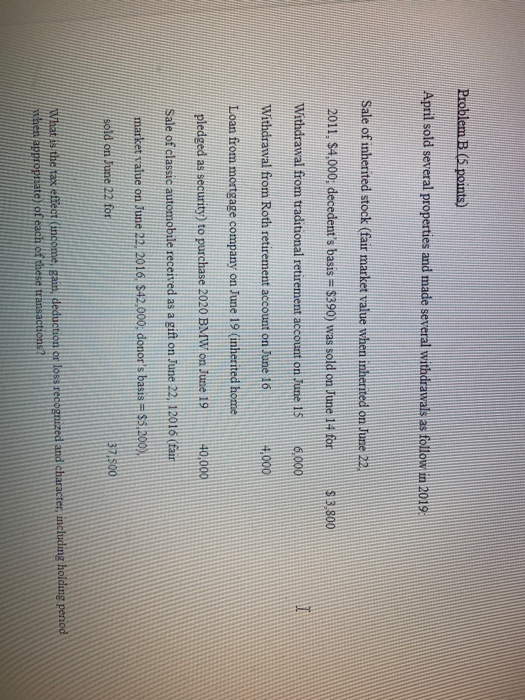

Problem B (5 points) April sold several properties and made several withdrawals as follow in 2019: Sale of inherited stock (fair market value when inherited on June 22. 2011. $4,000. decedent's basis = $390) was sold on June 14 for $ 3.800 Withdrawal from traditional retirement account on June 15 6,000 I Withdrawal from Roth retirement account on June 16 4,000 Loan from mortgage company on June 19 inherited home pledged as security) to purchase 2020 BMW on June 19 40,000 Sale of classic automobile received as a gift on June 22, 12016 (fair market value on June 22, 2016. $42.000, donor's basis = $5,200), sold on June 22 for 371500 What is the tax effect (income, gain, deduction or loss recognized and character, including holding period when appropriate) of each of these transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts