Question: PROBLEM B. Aldi Company is to be liquidated. The statement of financial position on June 30, 2018 is as follows: Cash P 5,000 Short term

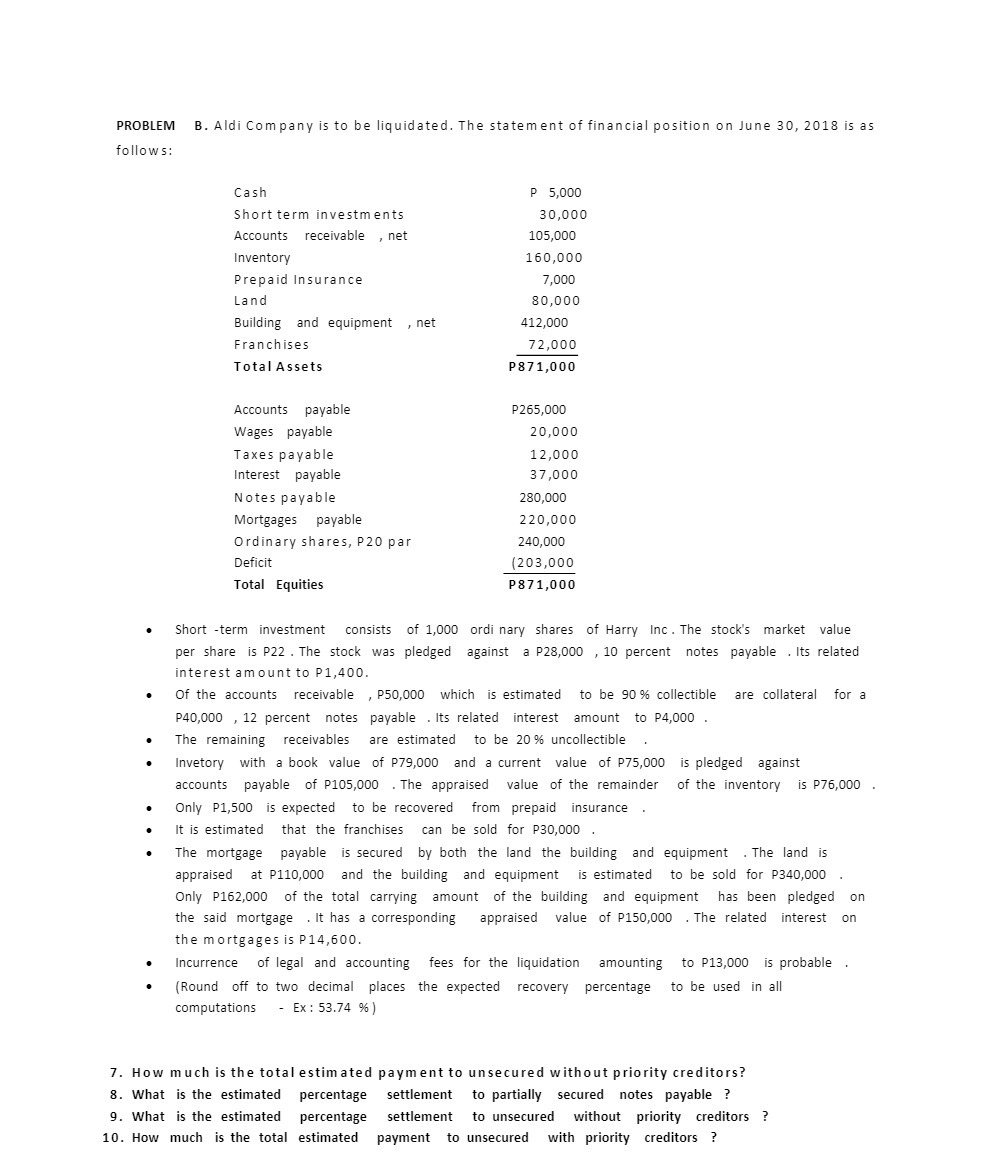

PROBLEM B. Aldi Company is to be liquidated. The statement of financial position on June 30, 2018 is as follows: Cash P 5,000 Short term investments 30,000 Accounts receivable , net 105,00 Inventory 160,000 Prepaid Insurance 7,000 Land 80,000 Building and equipment , net 412,000 Franchises 72,000 Total Assets P871,000 Accounts payable P265,000 Wages payable 20,000 Taxes payable 12,000 Interest payable 37,000 Notes payable 280,000 Mortgages payable 220,000 Ordinary shares, P20 par 240,000 Deficit (203,000 Total Equities P871,000 Short -term investment consists of 1,000 ordinary shares of Harry Inc . The stock's market value per share is P22 . The stock was pledged against a P28,000 , 10 percent notes payable . Its related interest amount to P1,400. Of the accounts receivable , P50,000 which is estimated to be 90 % collectible are collateral for a P40,000 , 12 percent notes payable . Its related interest amount to P4,000 . The remaining receivables are estimated to be 20 % uncollectible ry with a book value of P79,000 and a current value of P75,000 is pledged against accounts payable of P105,000 . The appraised value of the remainder of the inventory is P76,000 Only P1,500 is expected to be recovered from prepaid insurance It is estimated that the franchises can be sold for P30,000 . The mortgage payable is secured by both the land the building and equipment . The land is appraised at P110,000 and the building and equipment is is estimated to be sold for P340,000 Only P162,000 of the total carrying amount of the building and equipment has been pledged on the said mortgage . It has a corresponding appraised value of P150,000 . The related interest on the mortgages is P14,600. Incurrence of legal and accounting fees for the liquidation amounting to P13,000 is probable (Round off to two decimal places the expected recovery percentage to be used in all computations - Ex : 53.74 % ) 7. How much is the total estimated payment to unsecured without priority creditors? 8. What is the estimated percentage settlement to partially secured notes payable ? 9. What is the estimated percentage settlement to unsecured without priority creditors ? 10. How much is the total estimated payment to unsecured with priority creditors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts