Question: Problem BIN-139D We are given a one-period binomial tree, where S is the price of a non-dividend-paying stock. and V is the price of Security

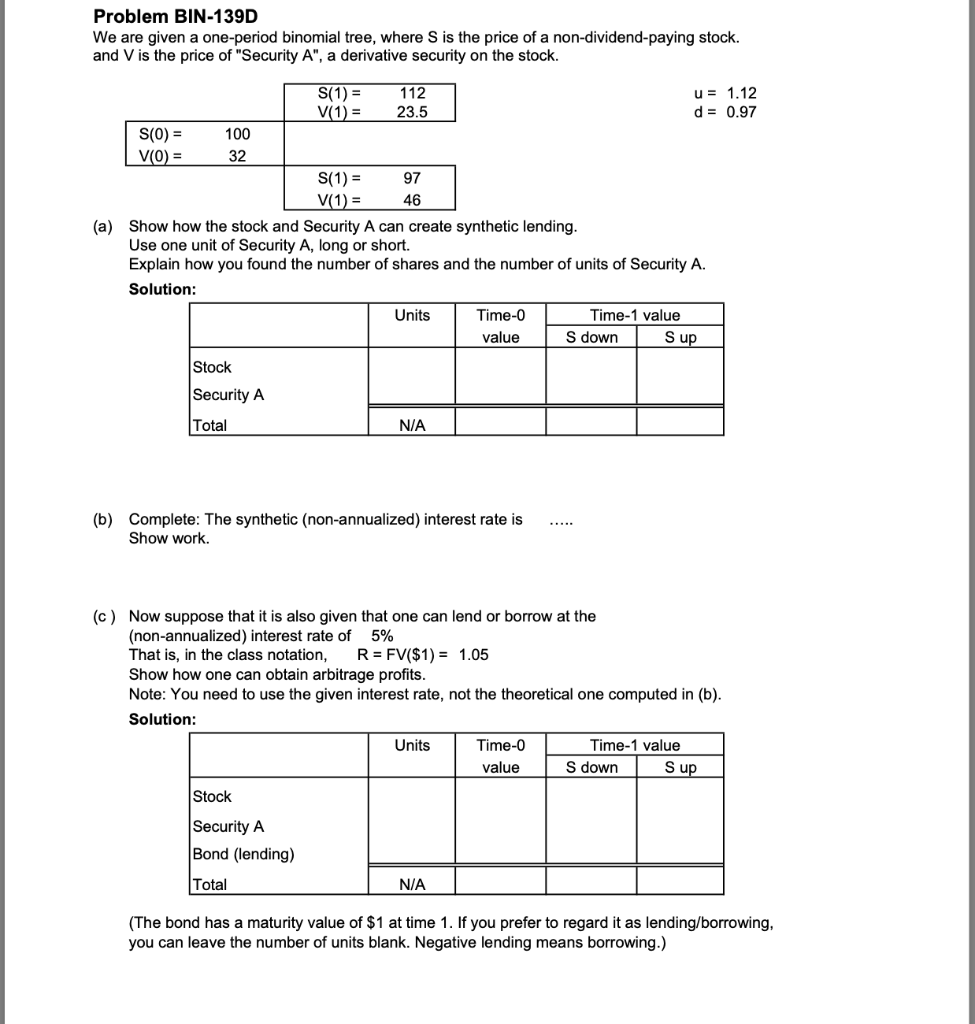

Problem BIN-139D We are given a one-period binomial tree, where S is the price of a non-dividend-paying stock. and V is the price of "Security A", a derivative security on the stock. S(1) = 112 u = 1.12 V(1) = 23.5 d = 0.97 S(0) = 100 V(O) = 32 S(1) = 97 V(1) = 46 (a) Show how the stock and Security A can create synthetic lending. Use one unit of Security A, long or short. Explain how you found the number of shares and the number of units of Security A. Solution: Units Time-o Time-1 value value S down S up Stock Security A Total N/A (b) Complete: The synthetic (non-annualized) interest rate is Show work. (c) Now suppose that it is also given that one can lend or borrow at the (non-annualized) interest rate of 5% That is, in the class notation, R = FV($1) = 1.05 Show how one can obtain arbitrage profits. Note: You need to use the given interest rate, not the theoretical one computed in (b). Solution: Units Time- Time-1 value value S down Sup Stock Security A Bond (lending) Total N/A (The bond has a maturity value of $1 at time 1. If you prefer to regard it as lending/borrowing, you can leave the number of units blank. Negative lending means borrowing.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts